Crypto Shockwave: Pantera Seeks Big Capital for Solana Co.

According to a report from The Information, Pantera Capital is seeking to raise up to $1.25 billion in order to create a Solana treasury firm that is listed in the United States. A publicly traded firm will be converted into a Solana treasury company, temporarily known as Solana Co., by the digital asset fund manager. In order to achieve this, it plans to first fund $500 million and then issue warrants to raise an additional $750 million.

Pantera and Partners Target Billions in Holdings

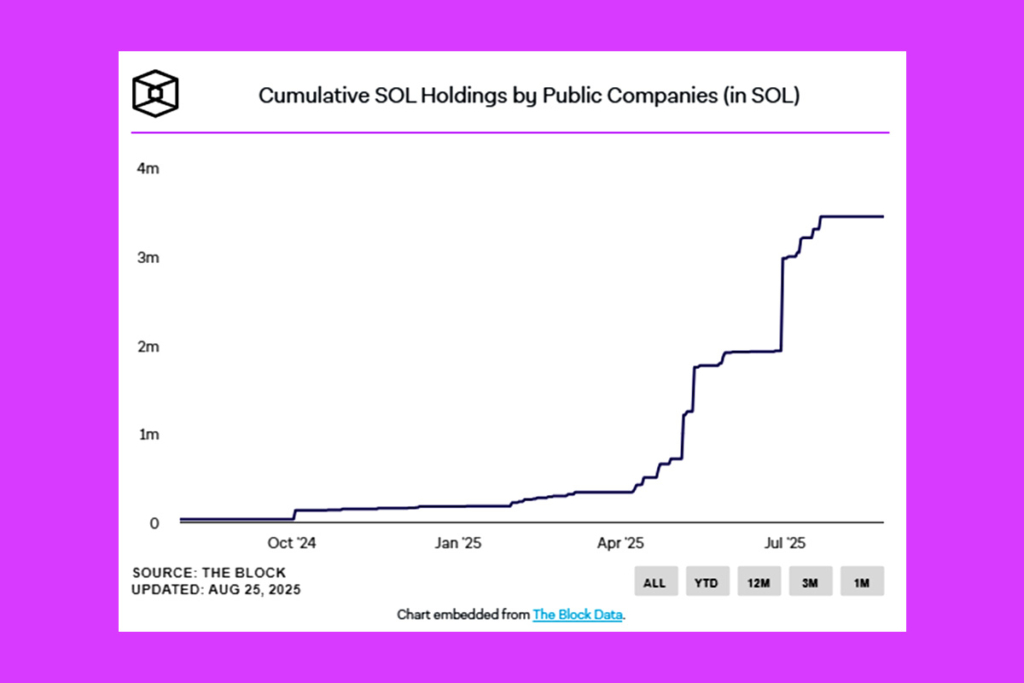

This has the potential to establish the world’s largest corporate Solana treasury. Currently, public corporations own over $650 million, equivalent to approximately 3.44 million SOL. Additionally, yesterday’s Bloomberg news on Galaxy Digital, Jump Crypto, and Multicoin Capital’s current endeavor aligns with Pantera’s most recent initiative. In order to jointly acquire Solana, they are seeking to fund $1 billion to create a digital asset treasury company. This is indicative of a bigger trend in which digital asset treasuries are starting to deploy significant cash from larger, more established firms, rather than just the early movers.

Pantera Pumps $300M Into Crypto Treasury Projects Across Multiple Blockchains

A few hundred million dollars were recently invested in crypto treasury projects by Pantera. Earlier this month, the company reported that it had invested over $300 million into digital asset treasury (DAT) startups. Several tokens, such as Bitcoin, Ethereum, Solana, BNB, Toncoin, Hyperliquid, Sui, and Ethena treasury corporations spread across multiple nations, are included in Pantera’s DAT portfolio.

DATs can generate yield to grow net asset value per share, resulting in more underlying token ownership over time than just holding spot. Therefore, owning a DAT could offer higher return potential compared to holding tokens directly or through an ETF.

Pantera

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.