Crypto Market Sheds $20B as Bitcoin Dominance Drops

The cryptocurrency market witnessed significant turbulence over a 72-hour period, with total market capitalization dropping nearly $20 billion. Bitcoin accounted for approximately half of these losses at $10 billion, demonstrating its continued influence on overall market sentiment.

Bitcoin dominance retreated to multi-month lows of 57%, while the TOTAL2 index, which excludes Bitcoin from market capitalization calculations, declined correspondingly. Market analysts observed minimal rotational flows between assets, indicating widespread risk-averse behavior among traders.

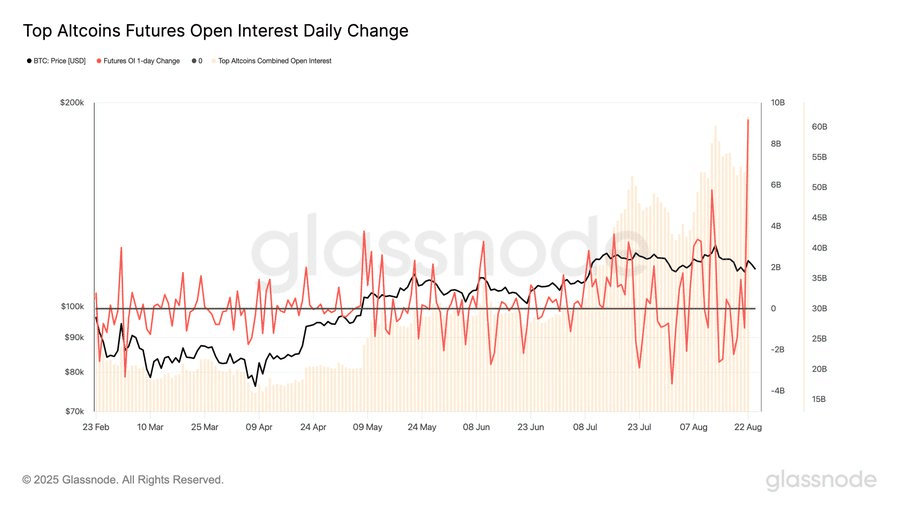

Altcoin Futures Activity Reaches Record Levels

Despite subdued market conditions, altcoin futures open interest experienced dramatic growth on Friday, August 22, surging by $9.2 billion in a single day. This activity pushed total altcoin open interest to an unprecedented $61.7 billion, suggesting increased leveraged positions across alternative cryptocurrencies.

The data reveals a sustained upward trend in altcoin derivatives activity, climbing from $20 billion in March to $60 billion by late August. This $40 billion increase outpaced Bitcoin’s $30 billion open interest growth during the same timeframe.

Market observers note that while open interest spikes typically correlate with Bitcoin price movements, altcoins have established an independent trajectory in derivatives markets.

Leverage Amplifies Market Volatility

The elevated leverage levels intensified recent price corrections across altcoin markets. Ethereum, the largest altcoin by market capitalization, recorded a 4% decline in open interest alongside a 3% price drop over 24 hours. In comparison, Bitcoin contained its decline to 2.68%.

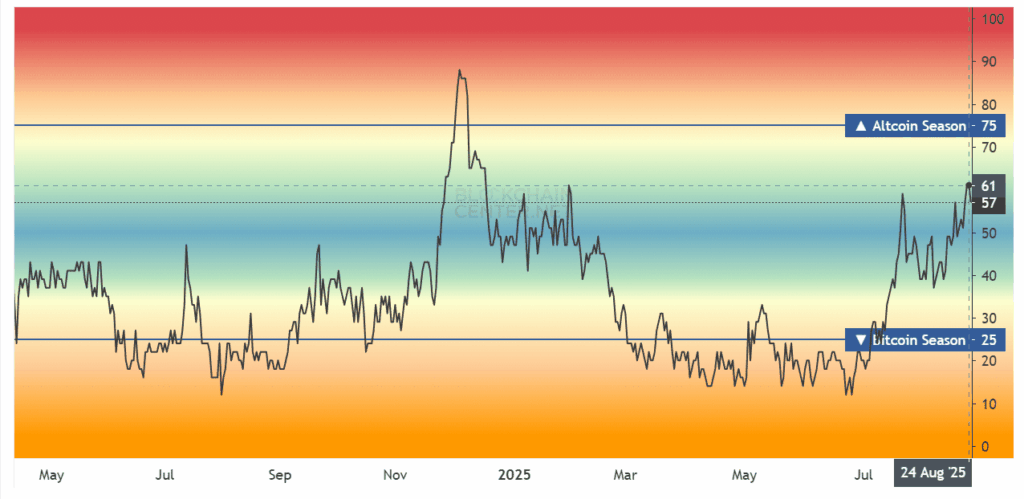

The Altcoin Season Index dropped from 61 to 56 within a single day, reflecting the disproportionate impact on alternative cryptocurrencies. This metric measures the relative performance of altcoins against Bitcoin over specific timeframes.

Historical precedent from late January and early February shows similar market conditions preceded previous altcoin season interruptions. During that period, the index reached 61 before Bitcoin’s 18% monthly decline drove it down to 20 by quarter’s end, with Ethereum falling to monthly lows of $1,440.

Comments are closed.