PENGU Price Falls, Yet Bullish Patterns Suggest Recovery Ahead

Pudgy Penguins [PENGU] has taken a sharp hit, dropping over 9% in the past 24 hours and trimming its monthly gains to 23% as of press time. The sudden downturn was largely triggered by a steep liquidity outflow across the broader crypto market, yet technical indicators and on-chain data suggest the decline may be short-lived.

The recent price dip correlates closely with a sharp reduction in available capital. According to CoinGlass, the market saw roughly $70 million in outflows in a single day, while Open Interest dropped to $332.66 million. This decline indicates a general retreat from both long and short positions, with liquidations more prominent among long traders.

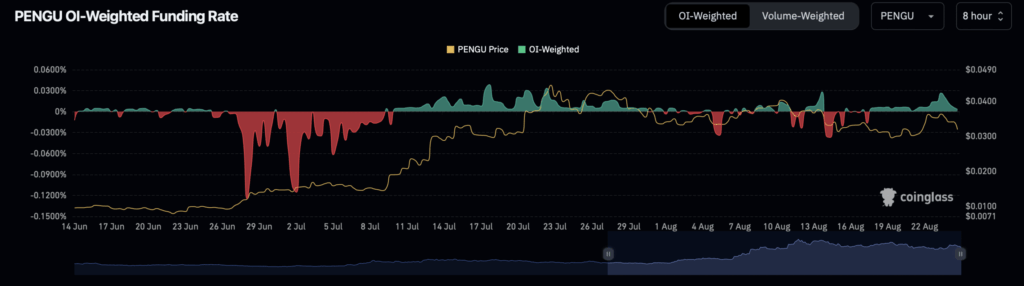

Additionally, the OI-Weighted Funding Rate dropped significantly—from 0.0265% to 0.0063%—suggesting waning confidence from long-position holders. Still, it remained in positive territory, a sign that bullish sentiment hasn’t completely vanished.

Buy-Side Activity Provides a Buffer

Despite the outflows, data from CoinGlass’s Spot Exchange Netflow showed continued buying interest. Over the past 72 hours, more than $14.5 million worth of PENGU was moved from exchanges to private wallets. This suggests holders are reducing sell-side pressure, decreasing circulating supply.

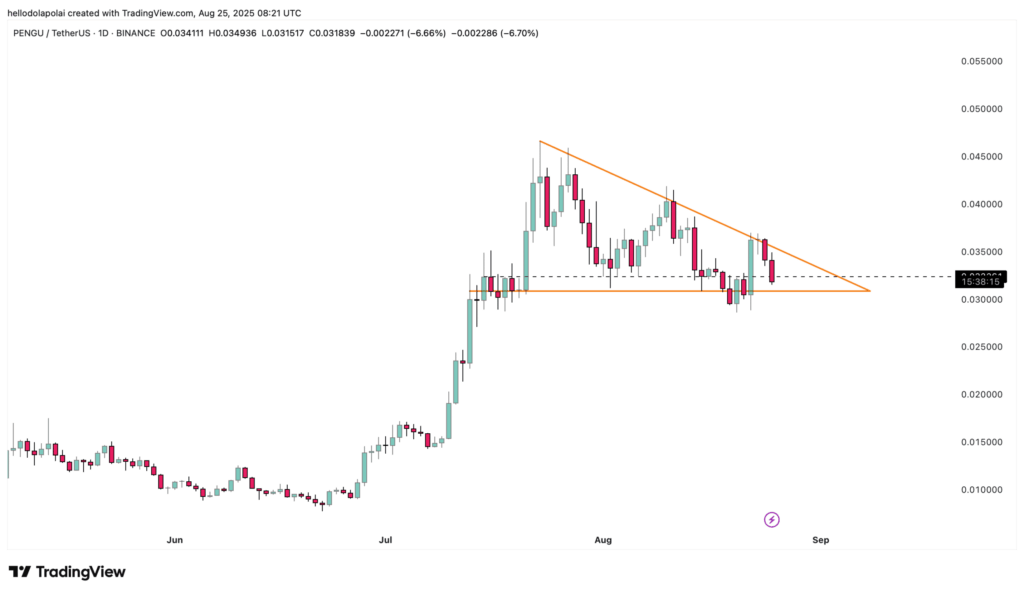

Price action on the charts showed PENGU nearing a critical support level within a bullish triangle pattern, often a precursor to a rebound.

Momentum Indicators Point to Reversal

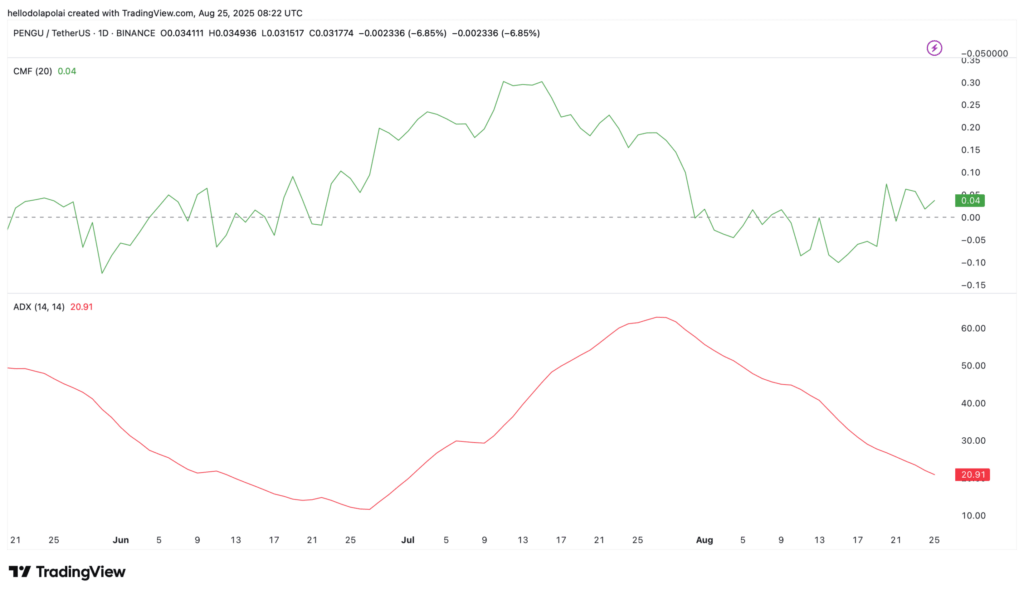

The Chaikin Money Flow (CMF) rose to 0.04, signaling a growing inflow of capital into PENGU. Simultaneously, the Average Directional Index (ADX) dropped to 20.91, implying weakening bearish momentum.

With bullish divergence forming across technical indicators, analysts suggest PENGU may be setting up for a rebound—despite short-term volatility driven by liquidity shifts.

Comments are closed.