Featured News Headlines

Bitcoin Price Jumps Above $117K After Fed Chair Signals Rate Cut Plans

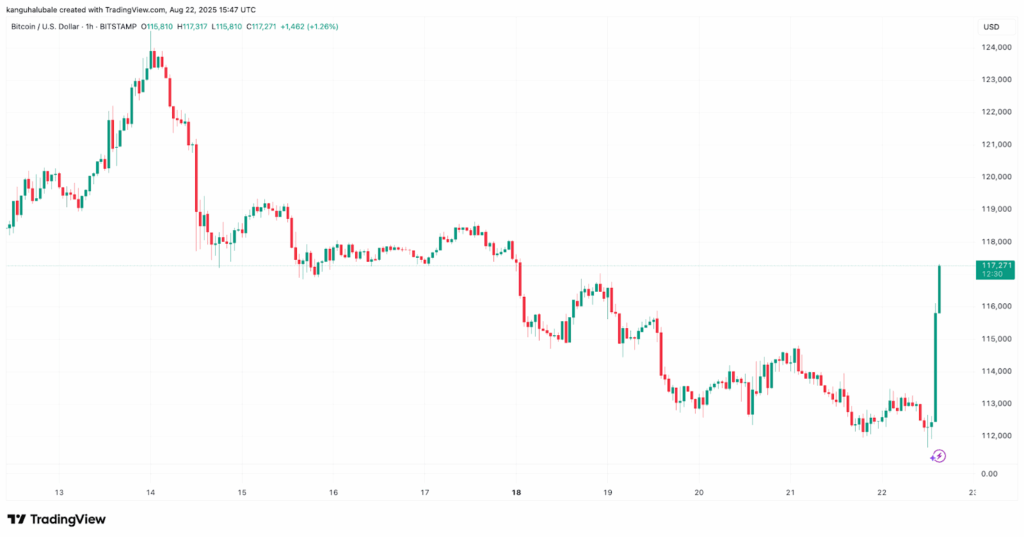

Bitcoin experienced a dramatic surge on Friday, climbing over 4% to reach an intraday high of $117,300 on Bitstamp after Federal Reserve Chair Jerome Powell hinted at potential interest rate cuts during his Jackson Hole symposium speech.

Massive Short Liquidations Rock Crypto Market

The sudden price movement triggered massive liquidations across the cryptocurrency market. According to CoinGlass data, short positions worth $379.88 million were liquidated, with Ethereum accounting for the largest portion at $193 million as ETH soared nearly 15% to $4,760.

Bitcoin followed with $56.4 million in short liquidations, contributing to a total market liquidation of $629.48 million across both short and long positions. The rapid market recovery caught 150,217 traders off guard as sentiment quickly shifted to bullish.

Liquidity Zones Cleared Above $117K

The Bitcoin liquidation heatmap revealed significant liquidity clearing above the $117,000 level, with more than $259.5 million in ask orders positioned between $117,000 and $118,000. This sweep of liquidity levels demonstrates the strength of the current move.

Analysts Declare “Uptrend is Back”

MN Capital Founder Michael van de Poppe had previously warned his followers to watch for a sweep below the August 3 low of $111,900 as an accumulation opportunity. Following Friday’s action, van de Poppe declared the “uptrend is back” after witnessing the immediate massive upward movement.

Fellow analyst Jelle acknowledged that Bitcoin might experience some retracement following the pump, but emphasized that “the market wants higher”.

Ambitious Price Targets Remain in Play

Several industry participants maintain bullish long-term outlooks. Analyst BitQuant continues to target $145,000 for Bitcoin throughout 2025, while Bitwise’s head of European research André Dragosch suggested that President Donald Trump’s potential move to allow crypto in 401(k) retirement plans could push Bitcoin toward $200,000 by year-end.

The cryptocurrency’s recovery from six-week lows near $111,600 demonstrates the market’s resilience and continued institutional interest in digital assets.

Comments are closed.