Featured News Headlines

Crypto Market on Edge Ahead of Powell’s Jackson Hole Speech

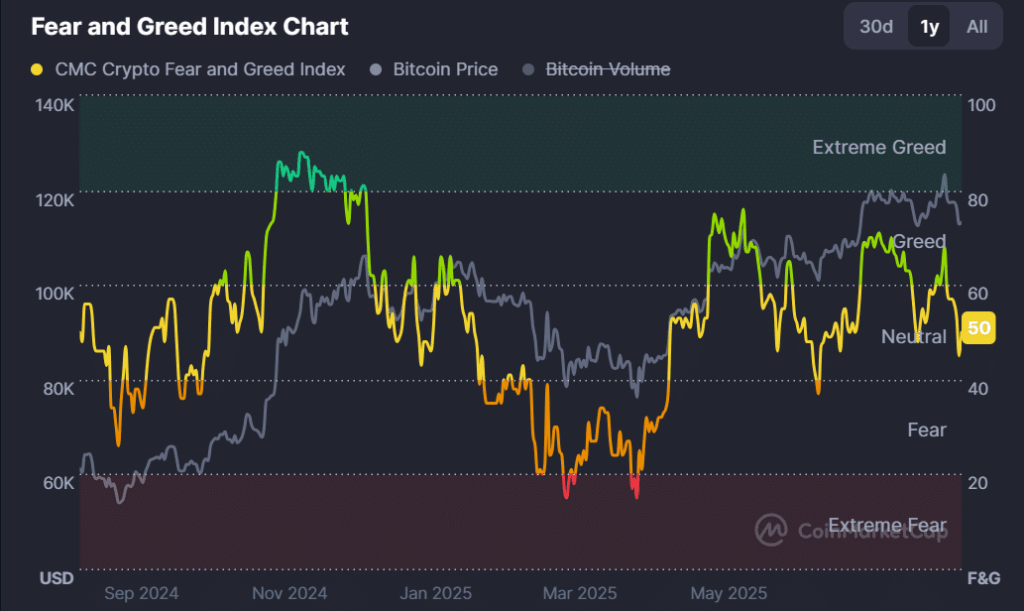

The crypto market experienced another pullback this week, with investors turning cautious ahead of Fed Chair Jerome Powell’s speech at the Jackson Hole Symposium on August 22. On Wednesday, the Crypto Fear and Greed Index dropped to 45 (“fear”) before recovering to a neutral 50, signaling ongoing uncertainty.

Bitcoin Cools After Rally to $124K

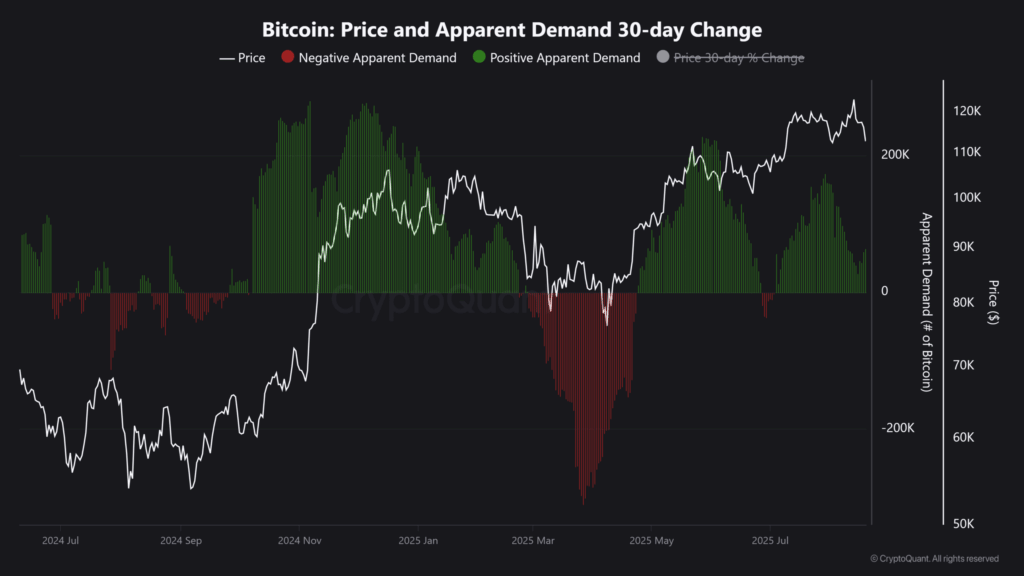

Bitcoin recently hit $124,000 in Q3, before retreating by nearly 10% amid macroeconomic pressure and profit-taking. ETF inflows and treasury demand have also slowed down, suggesting that investors are trimming exposure ahead of Powell’s upcoming remarks, which may hint at the Fed’s stance on a possible September rate cut.

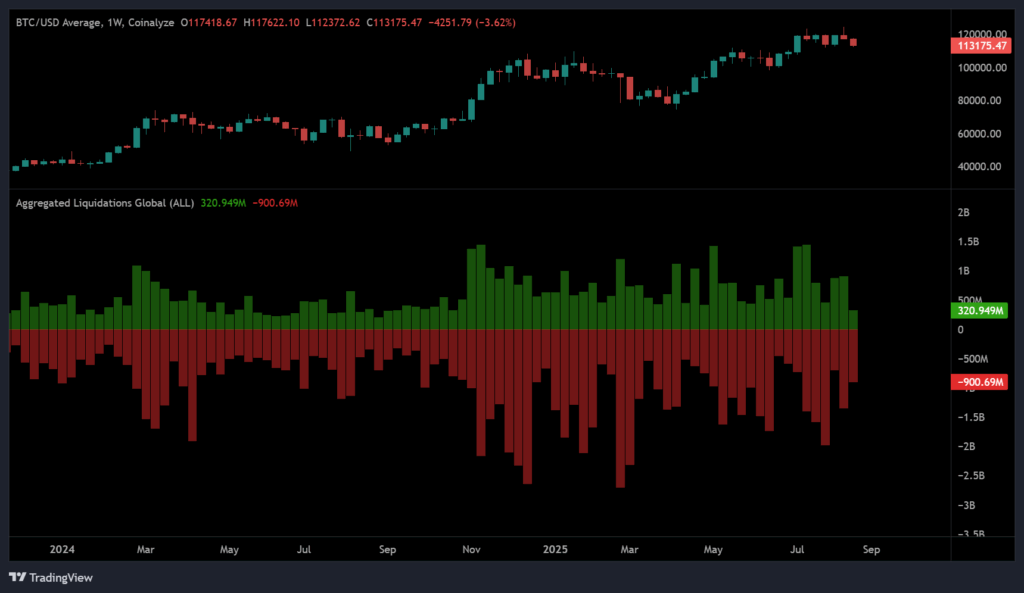

Liquidations Hit $1B, But Are Prices Stabilizing?

In the last three weeks, market liquidations surpassed $1 billion, pointing to high volatility and trader discomfort. However, some analysts, including Wall Street’s Tom Lee, believe the worst could be over. According to Lee, both Bitcoin and Ethereum may have already bottomed out, potentially setting the stage for a recovery.

ETH recently bounced from $4,000 with a 6% gain, while BTC found support at $112,300. Derivatives data supports this view, with 25 Delta Skew still favoring call options over puts — a bullish signal.

Outlook: Recovery or More Pain?

Despite the recent dip, short-term sentiment is showing signs of improvement. Options traders are increasingly betting on a rebound toward $124K–$130K. Still, Powell’s tone on Friday could be a deciding factor. A hawkish stance may pressure markets further, making his speech a key event to watch.

Comments are closed.