Bitcoin Price Dips Below $118K as $961M in Crypto Liquidations Hit the Market

Bitcoin (BTC) recently fell from $124,000 to under $118,000, triggering $961 million in liquidations, with $821 million wiped from leveraged long positions. This suggests that bullish traders chasing a breakout were caught off guard, resulting in pressure on price action.

At the time of writing, BTC is trading near $115,000, following a 2% intraday dip. Liquidity clusters have started forming again — indicating possible future volatility.

Market Rotation Signals Shift Back to BTC

The broader crypto market also pulled back. The TOTAL2 index, which tracks altcoin market cap excluding BTC, dropped 3.84%. This indicates that capital is flowing out of altcoins and rotating back into Bitcoin.

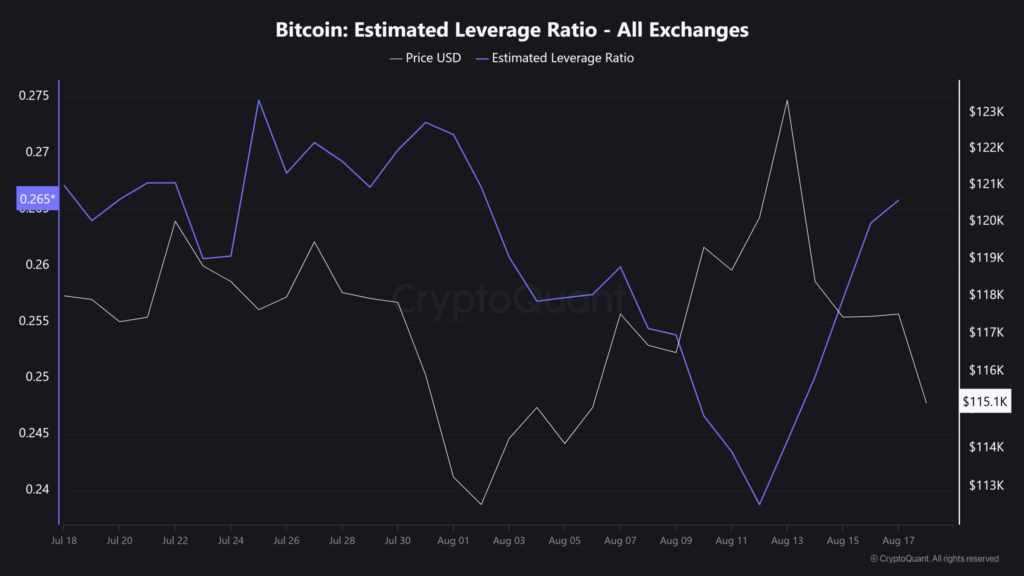

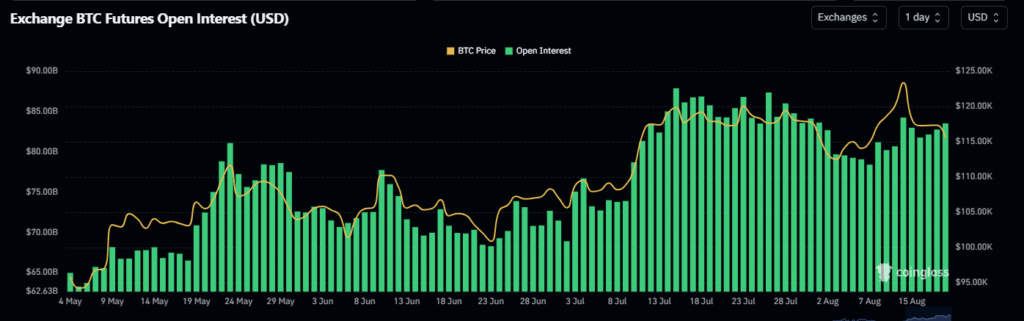

Bitcoin dominance (BTC.D) has held steady around 59%, with a small 0.40% intraday gain. Meanwhile, BTC Open Interest (OI) rose by $380 million in under 48 hours. The Estimated Leverage Ratio (ELR) is also rising, pointing to increasing speculative behavior.

Is Another $1 Billion Liquidation on the Horizon?

In the last 24 hours alone, $563 million in crypto positions were liquidated, with 85% from leveraged longs. Despite BTC falling nearly 8% from its all-time high, OI remains above $80 billion—a notable divergence from past cycles where OI typically dropped with price.

This suggests the market hasn’t fully deleveraged yet, and traders remain heavily positioned in longs—especially on Binance’s BTC/USDT pair, where long bias exceeds 60%.

Comments are closed.