Solana Maintains Revenue Lead for 22 Weeks with Rising dApp Activity

Despite a 6% drop in the last 24 hours, Solana (SOL) has maintained solid weekly gains and steady real-world adoption. Over the past week, more than $400 million flowed into Solana-based products and bridged assets, showing resilience as the overall crypto market cap declined by about 3.5%.

Institutional Interest and Bridging Drive Growth

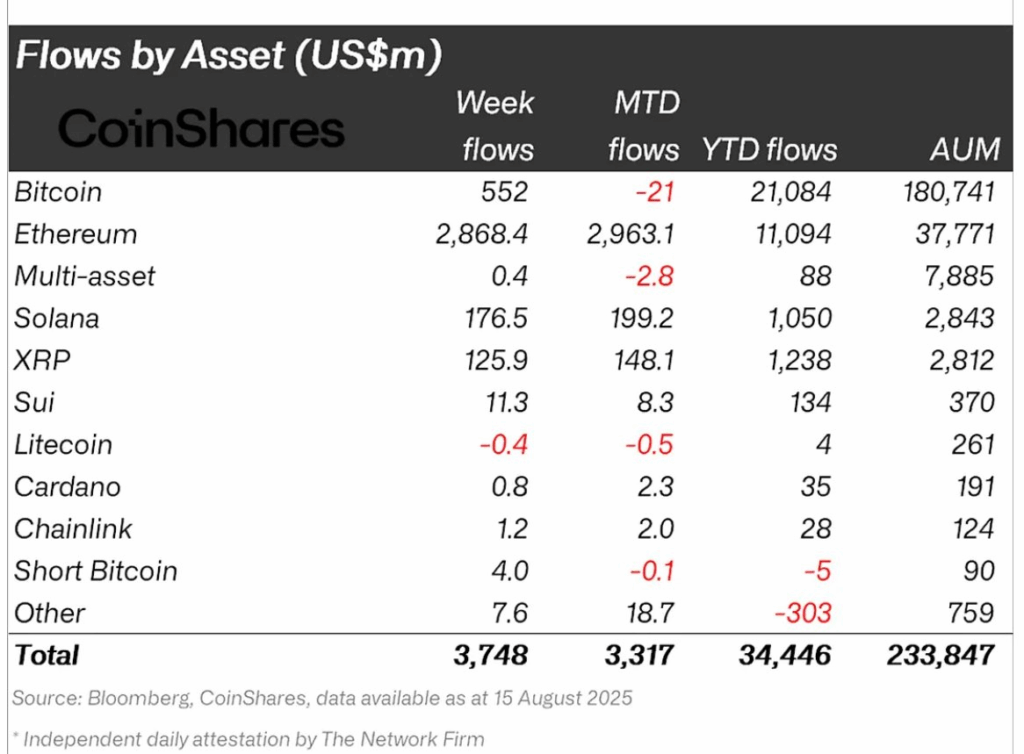

A major part of these inflows came from institutions and Solana investment products like ETFs and ETPs. Notably, REX-Osprey (SSK) alone attracted $166.7 million recently. The total monthly inflow reached nearly $200 million, and year-to-date, Solana has seen over $1 billion in capital injections.

Only Ethereum and Bitcoin recorded higher weekly inflows at $2.87 billion and $552 million, respectively. Solana’s total assets under management now stand at approximately $2.84 billion.

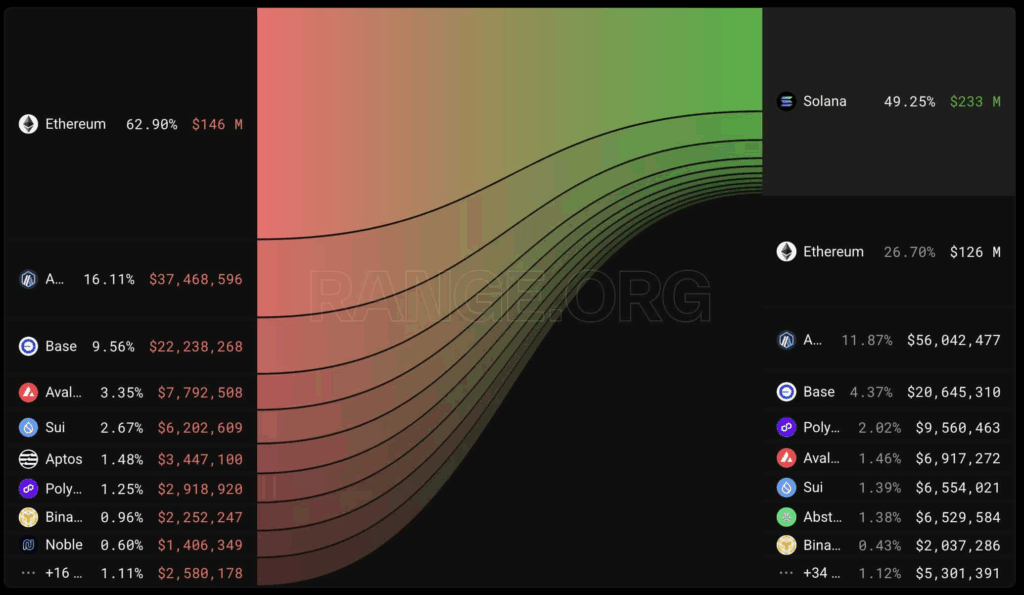

Bridging activity also played a key role, with about 62% of new capital coming from the Ethereum network—roughly $126 million out of $230 million total. Other contributors included Arbitrum One and Base chain, while chains like Polygon, Avalanche, and Sui added smaller amounts.

Revenue Growth Highlights Active Ecosystem

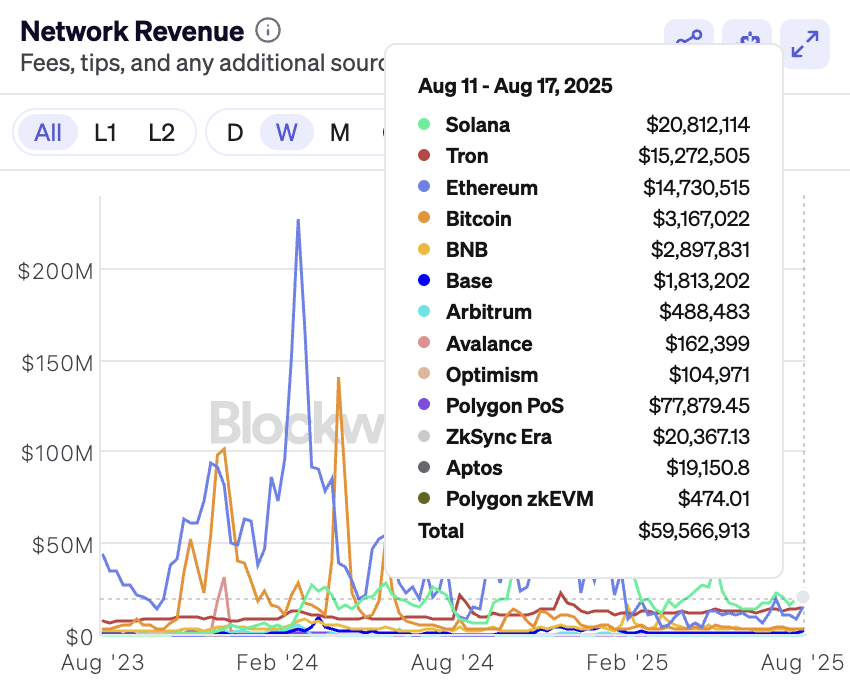

Increased activity on Solana platforms such as Jupiter, Raydium, LetsBONKfun, and Pump.fun has led to rising revenues. Pump.fun generated $10 million in the last week, helping push total dApp revenues on Solana to $35 million.

Solana has led all chains in revenue generation for 22 weeks straight, followed by Tron, Ethereum, and Bitcoin.

Despite these positive signs, Solana faces criticism over heavy venture capital involvement. Some inflows may be driven by short-term traders, which could lead to volatility.

However, the ongoing capital inflows and growing ecosystem activity suggest that Solana remains a key player with potential for future price gains.

Comments are closed.