Featured News Headlines

Bitcoin’s 1% Drop Triggers $536M in Crypto Liquidations

A slight pullback in Bitcoin’s price has led to significant volatility across the crypto market. According to WhaleWire CEO “King,” a 1% drop in Bitcoin triggered more than $360 million in liquidations within 24 hours. Over $100 million was wiped out in just the last few hours.

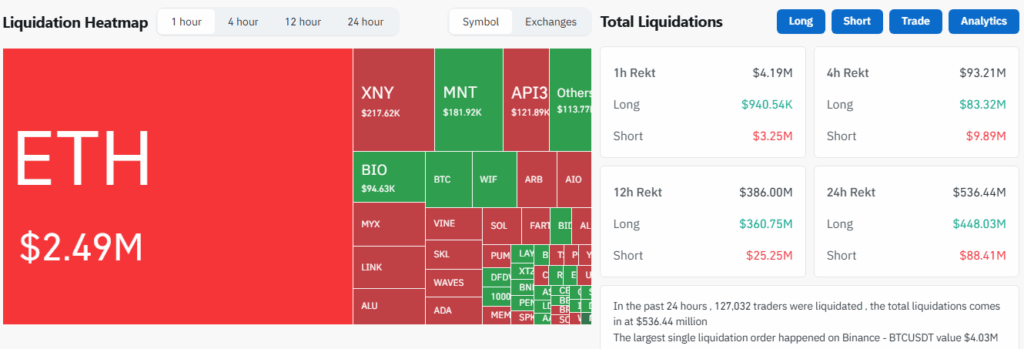

Market Sees $536M in Daily Losses

Recent data shows that total market liquidations have now climbed to over $536 million, indicating a highly leveraged market. Long positions took the biggest hit, accounting for around $254 million, while short positions saw liquidations of approximately $111 million.

This highlights a growing risk for traders using high leverage as Bitcoin continues to correct from its recent all-time high.

Bitcoin Falls After Reaching ATH of $124K

On August 14, Bitcoin reached a new all-time high of $124,457. Since then, the price has dropped to the $115,000 range, marking a 7.14% decline. At the time of writing, Bitcoin trades around $115,569.

While some analysts view this pullback as a healthy correction after a strong rally, others are raising red flags.

Analyst Warns of Deeper Crash Ahead

Jacob, an analyst at WhaleWire, warns that the market remains dangerously overleveraged. He suggests that if a minor dip can cause hundreds of millions in liquidations, a larger crash could be far more damaging. He believes a “catastrophic” sell-off could occur if panic selling spreads.

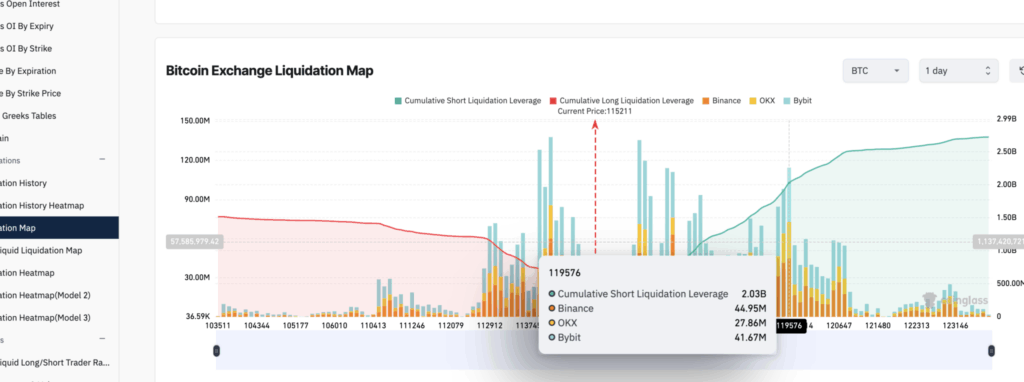

According to CoinGlass, further drops could worsen liquidations. A dip to $114,000 might wipe out an additional $597 million in long positions. On the flip side, a bounce to $120,000 could trigger $2.23 billion in short liquidations.

Comments are closed.