Featured News Headlines

Centrifuge Smashes $1 Billion TVL Barrier, Joins Elite RWA Tokenization Club

Centrifuge – The real-world asset (RWA) tokenization space just witnessed another major milestone as Centrifuge officially crossed the $1.1 billion TVL threshold, cementing its position among the industry’s heavy hitters alongside Securitize ($3.1B) and Ondo Finance ($1.3B).

JAAA Fund Drives Massive Growth

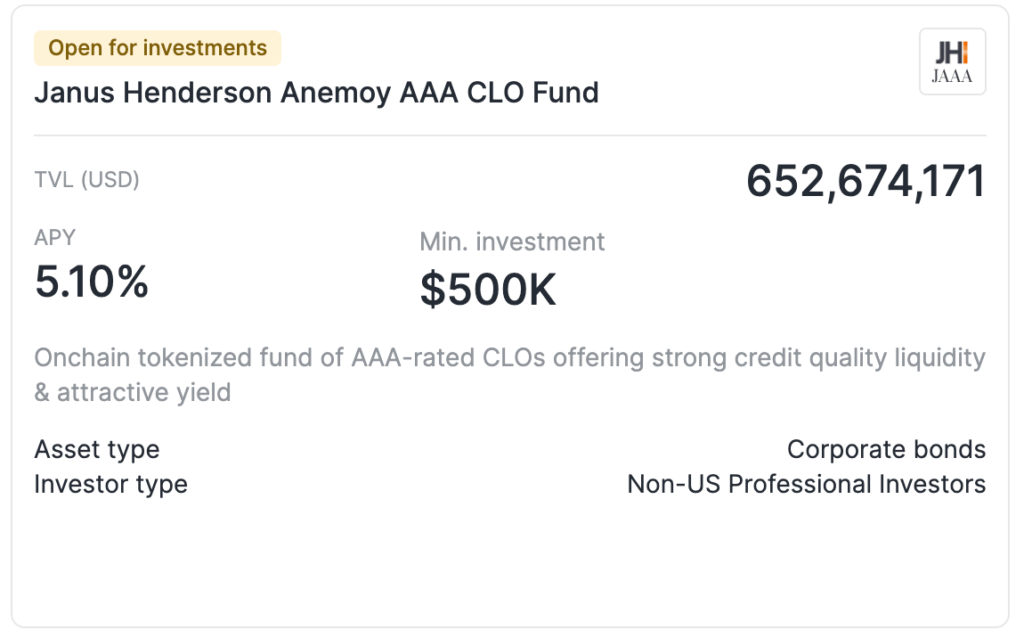

The surge in Centrifuge’s total value locked has been primarily fueled by overwhelming demand for its Janus Henderson Anemoy AAA CLO Fund (JAAA). This innovative tokenized investment vehicle has attracted more than $653 million in on-chain assets, offering investors exposure to AAA-rated collateralized loan obligations with an attractive annual yield of approximately 5.10%.

The JAAA fund operates as a professional investment vehicle domiciled in the British Virgin Islands, targeting non-U.S. professional investors with a substantial minimum investment requirement of $500,000. This structure allows sophisticated investors to access corporate loan-backed securities while maintaining both strong credit quality and enhanced liquidity through blockchain technology.

Diversified Treasury Offerings Boost Platform Appeal

Beyond its flagship CLO product, Centrifuge has also gained significant traction with its Janus Henderson Anemoy Treasury Fund, which focuses on short-term U.S. government bills. This more conservative offering has successfully attracted over $392 million in assets, demonstrating the platform’s ability to cater to diverse risk appetites and investment strategies.

Strategic Platform Evolution

The $1 billion milestone comes on the heels of several strategic developments for Centrifuge. In early July, the platform launched a tokenized S&P 500 fund in partnership with S&P Dow Jones Indices, expanding its traditional finance integration capabilities.

Perhaps more significantly, Centrifuge completed a major infrastructure overhaul on July 24 with the launch of Centrifuge V3. This upgrade marked the platform’s migration from Polkadot to Ethereum, transforming it into a multichain, EVM-native protocol that significantly enhances DeFi composability and strengthens integration across its expanding suite of tokenized real-world assets.

Comments are closed.