Major Ethereum Trader Exits Leveraged Bet With $6.6M Loss

Recent on-chain data suggests a potential shift in Ethereum market sentiment, following a large whale’s decision to exit a major leveraged position. The address 0x89Da, known for active trading in Ethereum derivatives, has closed a long position of 21,683 ETH, worth around $93 million.

$6.6M Loss Signals Risk-Off Approach

This move wasn’t without cost. The trade reportedly ended with a realized loss of $6.6 million, indicating that even experienced traders are opting to reduce exposure. After closing the position, the whale withdrew 9.6 million USDC from Hyperliquid—a platform widely used for leveraged Ethereum trades.

This full withdrawal may reflect a lack of short-term confidence, and it could affect market liquidity if similar actions are taken by other large players.

Leverage Pullback Near Cycle Peaks

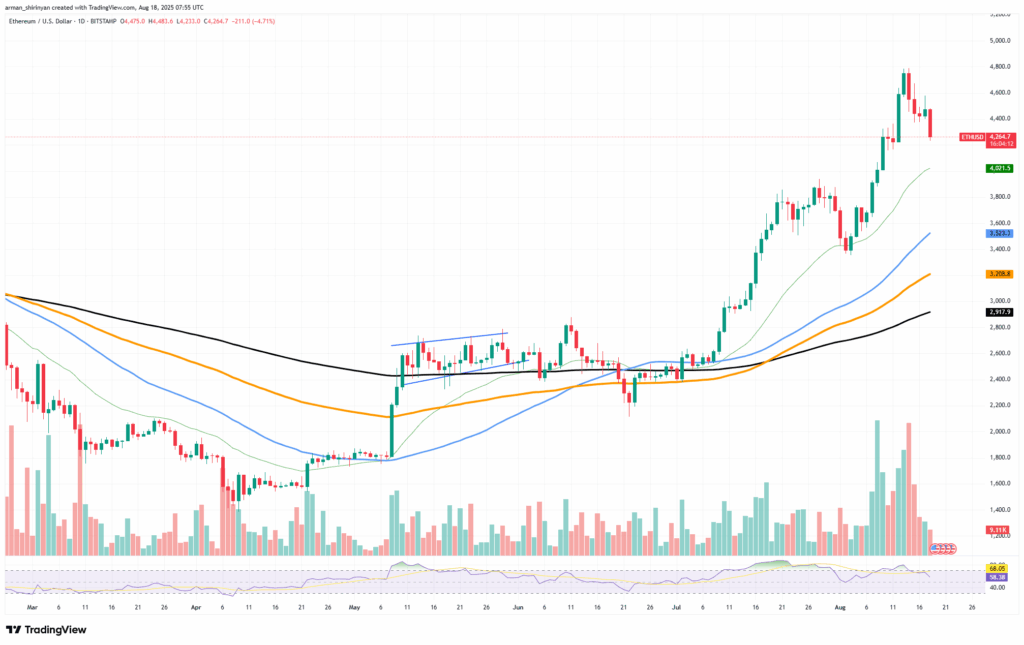

Historically, Ethereum derivatives activity tends to cool as the asset nears potential cycle highs. With ETH currently consolidating below $4,500, some large traders are choosing to de-risk—especially as funding rates for perpetual futures remain elevated.

Whale 0x89Da’s exit aligns with this trend, suggesting a broader pattern of reduced leverage and profit-taking. If more whales follow suit, we could see a decline in open interest, potentially slowing momentum in the near term.

While Ethereum remains close to its yearly high, large-scale position closures like this may indicate increased caution. Traders and investors should monitor derivatives data and on-chain activity closely, as further de-risking could influence short-term price action and overall market sentiment.

Comments are closed.