The Liquidity Trigger: Does China Hold the Key to the Next Altseason?

By cutting interest rates or allowing special lending terms, central banks effectively increase the money supply and spur economic growth. This phenomenon is advantageous for riskier assets like equities and cryptocurrency. In this regard, the next action by the Chinese central bank may or may not offer the liquidity boost that propels altcoins past their prior all-time highs, traders are now wondering.

As of right now, Porkopolis Economics estimates that the US M0 monetary base is $5.8 trillion, followed by the eurozone ($5.4 trillion), China ($5.2 trillion), and Japan ($4.4 trillion). Even when headlines focus on the US Federal Reserve, China’s monetary policy actions are still important because they account for 19.5% of the world’s GDP.

Rising Jobless Rate Pressures China to Act on Monetary Stimulus

China announced on Thursday that its July retail sales were down 0.1% from the previous month. According to Goldman Sachs estimates, fixed asset investments had the biggest decline since March 2020 in July alone, falling 5.3% year over year. In contrast, industrial production increased by a meager 0.4% during the course of the month. In addition, China’s survey-based urban jobless rate increased from 5% in June to 5.2% in July.

Chang Shu and Eric Zhu, analysts at Bloomberg Economics, pointed out that the People’s Bank of China (PBOC) might start implementing stimulus plans as early as September. In a similar vein, economists from Commerzbank and Nomura contend that more robust assistance measures will soon be implemented. However, cryptocurrency investors would be hesitant if concerns about a global recession worsen, even if the PBOC takes a more expansionist approach.

China’s Stimulus May Spark Risk Appetite, Sending Altcoins Higher

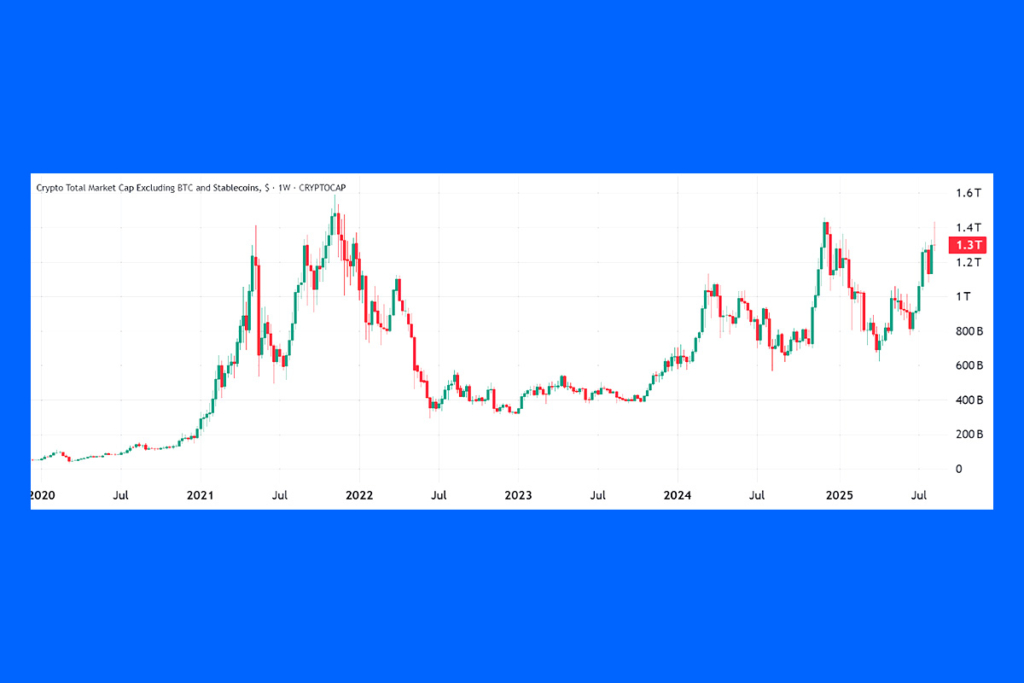

Investors are usually able to accept lower returns when recession fears mount because of the increased demand for US government-backed assets. The yield on the 5-year Treasury fell to 3.83% on Friday after falling to 3.74% on Aug. 4, the lowest level in over three months. The action shows that traders are becoming less risk-averse, which creates room for altcoin market capitalization to rise. A widespread shift towards riskier assets may be sparked by the additional liquidity provided by China’s implementation of more robust stimulus. Cryptocurrencies might reach new all-time highs in such a situation due to the PBOC’s efforts.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.