Featured News Headlines

ETH Bulls Take Charge: 4 Altcoins Are Poised to Rally

With Ethereum gaining pace around the $2,700 mark following an 8% climb, the cryptocurrency market is beginning to show signs of a shift. Despite the erratic price movements, one analyst claims that ETH has found strong support. Bitcoin may pave the way for Ethereum and other cryptocurrencies to rise next if it remains stable or rises higher. The researcher has identified 4 altcoins that might follow Ethereum’s example when market sentiment improves.

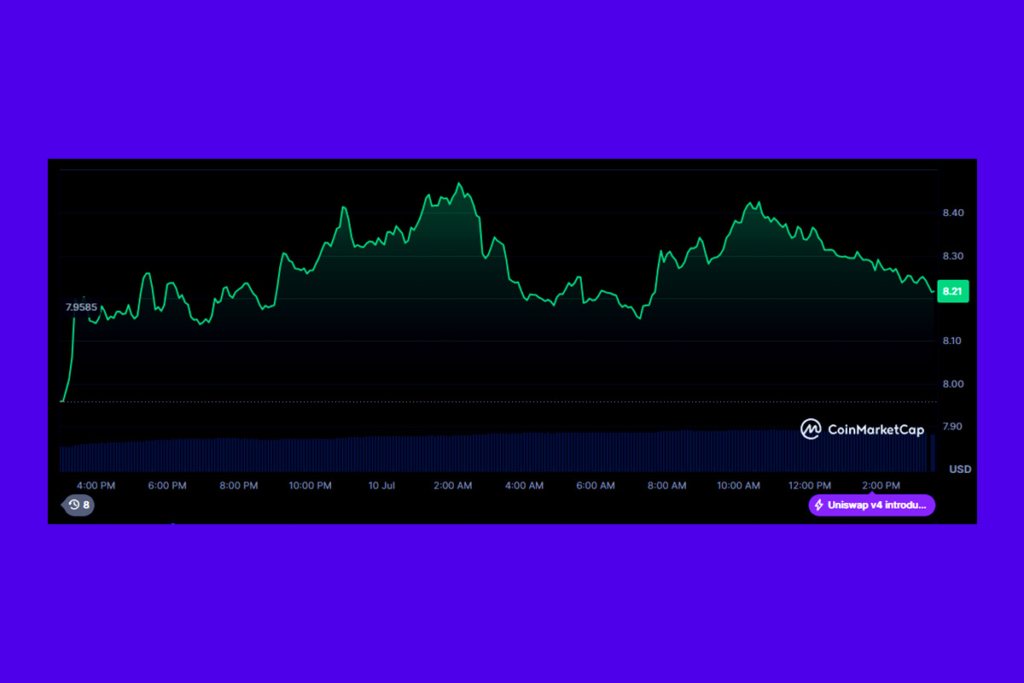

Uniswap (UNI)’s Performance Shines as Ethereum and DeFi Momentum Grow

One of the most well-known tokens associated with Ethereum is Uniswap (UNI). Although Uniswap’s price often follows Ethereum’s path, it frequently increases even more quickly when the market becomes positive. For instance, Uniswap may increase by 15% or more if Ethereum rises by 10%. Over the past year, this pattern has shown up numerous times.

Because of its close relationship to Ethereum, Uniswap is a desirable option for investors hoping to profit from rising prices in the larger cryptocurrency market. Uniswap’s position as a major decentralized exchange enhances its development potential as decentralized finance (DeFi) continues to gain traction. UNI continues to be one of the best-performing DeFi tokens, providing both long-term value and short-term upside during rallies driven by Ethereum, thanks to rising trading volumes and a growing user base.

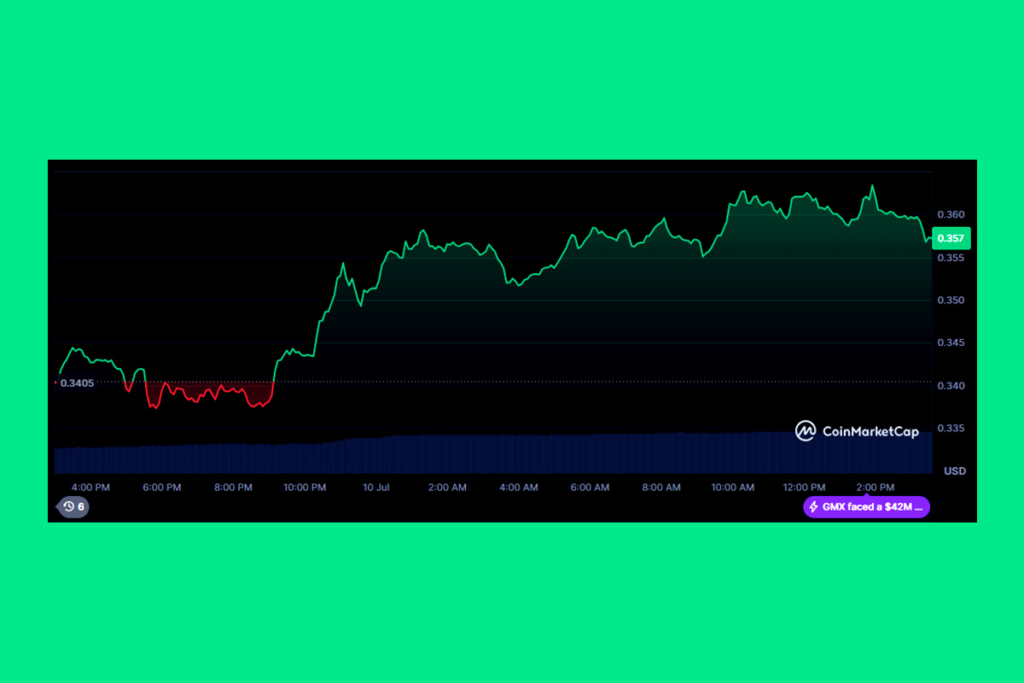

Arbitrum (ARB)’s Volatility Could Mean Big Profits in the Next Crypto Rally

Arbitrum (ARB) is one of Ethereum’s top Layer-2 solutions. Although Ethereum has recently outperformed Arbitrum, historical evidence indicates that ARB can make a sharp surge when altcoins begin to rally. According to the expert, during a brief cryptocurrency boom in November of last year, Ethereum gained almost 30%, while ARB soared over 50%. Because of this, when the market begins to pump, Arbitrum is a higher-risk, higher-reward choice.

Investors looking for higher profits during bullish cycles will find Arbitrum‘s tremendous potential as a leveraged play on Ethereum’s growth enticing. The ecosystem of Arbitrum keeps growing as more users and projects switch to Layer-2 solutions in order to avoid Ethereum’s expensive fees and congestion, enhancing its long-term value proposition. ARB presents a strong chance for traders who are prepared to accept its increased volatility to profit on cryptocurrency rallies while taking advantage of the Ethereum network’s scalability and security.

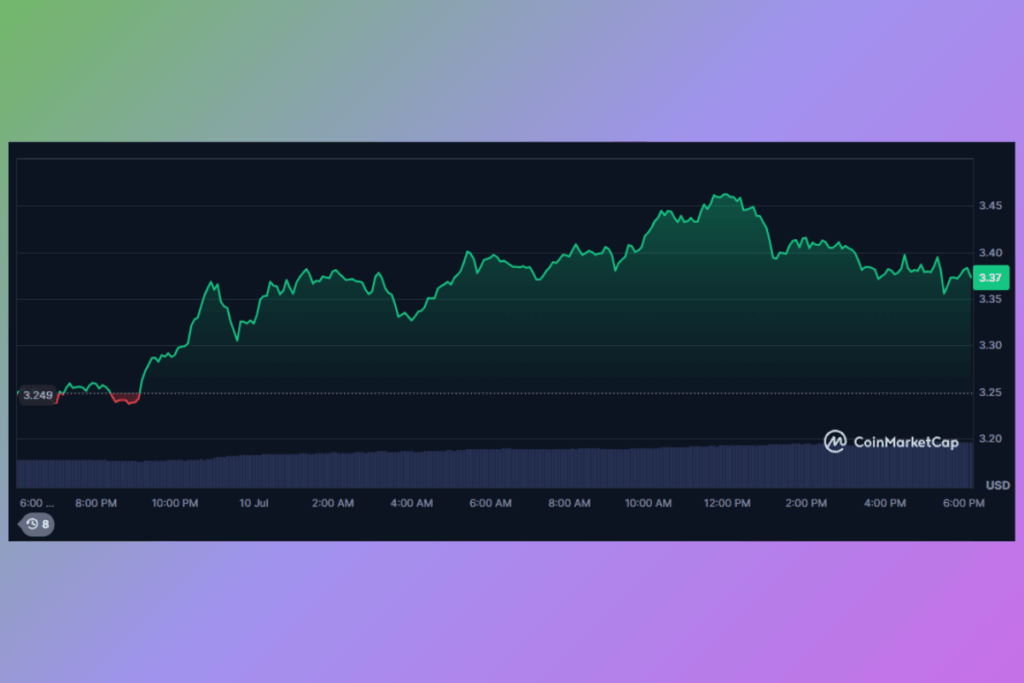

As Ethereum Rallies, Is Render (RNDR) Ready to Catch Up?

Another Ethereum-based currency called Render (RNDR) is dedicated to decentralized GPU-based rendering for 3D graphics and artificial intelligence applications. Its price hasn’t kept up with Ethereum in recent months, despite its high long-term potential. However, given that the market has turned bullish, there is a potential that it might catch up because it often moves in the same direction as ETH.

Render’s distinct functionality makes it a formidable challenger in the upcoming wave of crypto innovation, given the increasing demand for AI-driven visuals and metaverse applications. RNDR might profit from a resurgence of investor interest in projects with practical applications as Ethereum spearheads the market’s revival. Render is one to keep an eye on in the upcoming months due to its strong association with ETH and its function in enabling decentralized rendering services, which might lead to a notable price bounce if optimistic sentiment continues.

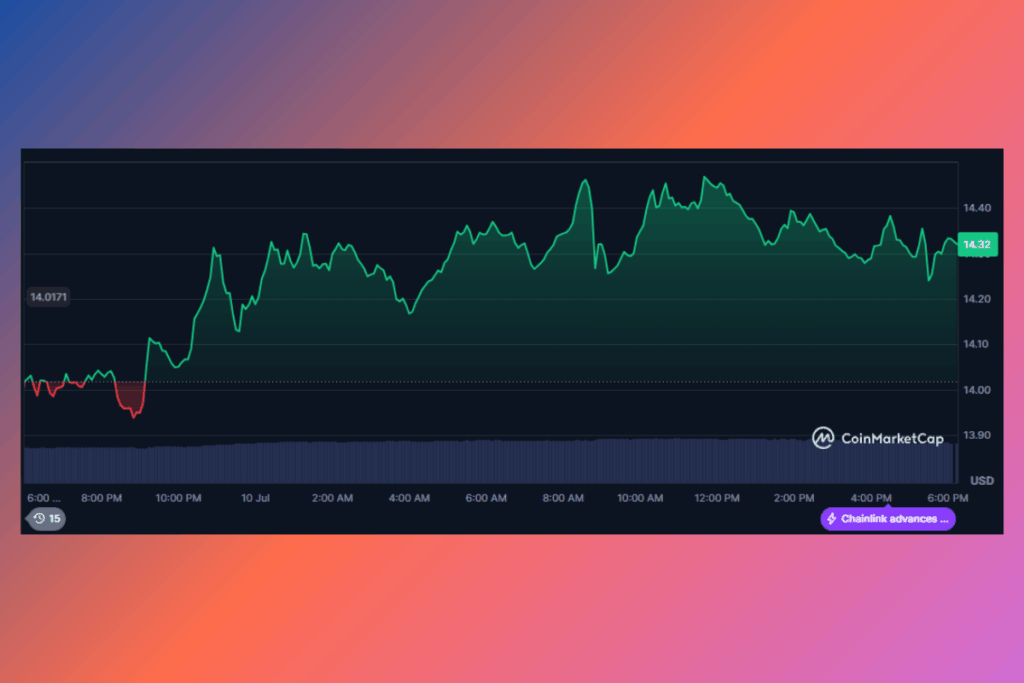

Chainlink (LINK)’s Real-World Utility Positions LINK as a Long-Term Winner

One of the most dependable and popular altcoins is Chainlink (LINK). It links real-time data, such as stock prices, sports results, and weather, to blockchain smart contracts. Chainlink has performed better than Ethereum and a number of other altcoins during the last 12 months. The expert believes that LINK is one of the safest investments for the upcoming cryptocurrency boom because of its strong use case and expanding collaborations with businesses.

It is anticipated that the need for dependable oracle networks like Chainlink will increase rapidly as decentralized applications continue to develop. LINK is in a strong position to increase its market share in the Web3 arena because of its track record of securely transmitting real-world data to blockchains. Its position as a provider of key infrastructure is further cemented by ongoing integrations with significant corporations and DeFi protocols. Chainlink’s utility-driven growth and solid fundamentals make it an appealing option for investors looking for stability and long-term growth as the next cryptocurrency bull market draws near.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.