XRP’s Breakout Fails: Is a Bigger Drop Coming Next?

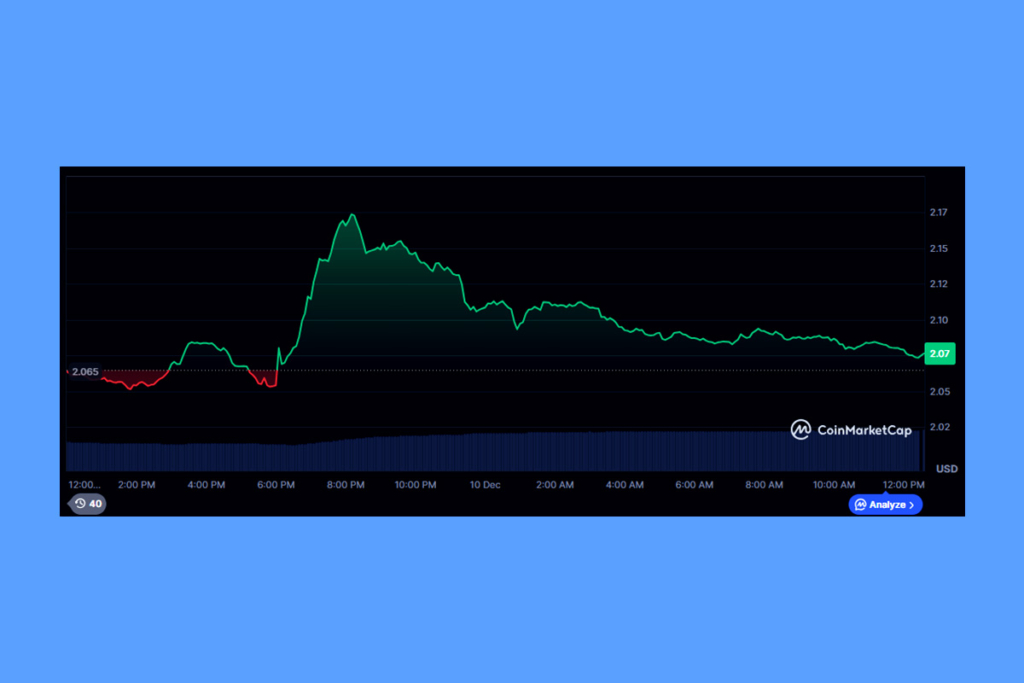

Following a brief rise above the $2.12 resistance, XRP found it difficult to sustain its recent climb. Strong institutional interest was demonstrated by rising trading activity. However, the token was unable to turn this momentum into a long-term breakout. Heavy supply was indicated by the denial at $2.17, indicating that sellers are still active at higher levels. Because of this, XRP is currently trading within a narrowing range as investors assess whether the coin may move into deeper decline territory or recover an important barrier.

XRP Rally Stalls as Whales Use Liquidity Spikes to Exit Positions

The trading volume of XRP surged, surpassing weekly averages by about 38%. Growing institutional demand is typically indicated by this kind of behavior. The price activity, however, conveyed a different message. The token touched $2.17 after momentarily breaking through the $2.12 resistance. But sellers pulled it back down right away. The response suggests that rather than accumulating, significant holders might be leveraging liquidity surges to lower exposure. The breakout failure limits short-term bullish continuation by confirming that the $2.12–$2.17 zone is still a heavy supply area.

There is currently compression in the market structure between $2.083 and $2.17. Although higher lows provide some support, the bias remains skewed toward neutral to bearish conditions due to the failure to maintain upside momentum. Although there is some variance in momentum indicators, declining volume on recoveries indicates that buyers are not convinced.

Heavy Supply Threatens XRP Rally as Tactical Selling Rises

XRP’s short-term trajectory will be determined by price movement around $2.09. A clear breakdown from this level leads to bigger liquidity pockets at $2.05 and $2.00. Upside validation requires that XRP recover $2.12 and then break over $2.17 with significant volume. Any upward movements run the risk of becoming further distribution phases without confirmation.

Order-book behavior lends credence to this warning. Offer-side liquidity is still high, and institutional involvement seems to be tactical rather than cumulative. XRP might keep trailing more successful market performers like BTC and SOL until supply overhead is eliminated.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.