Featured News Headlines

Consolidation or Decline? XRP Shows Signs of Recovery

Although XRP is now trading much below its peak, a number of patterns suggest that support is strengthening. However, this reversal might be setting the stage for a recovery. Three major elements could influence the token’s next recovery phase: early treasury adoption, ETF momentum, and whale accumulation. The first indications of real-world treasury acceptance, a regulatory pathway that is finally opening for ETFs, and stealthy accumulation by whales are all indicated by market signals. These three factors taken together imply that XRP’s dip may be more about consolidation before the next move rather than a decline.

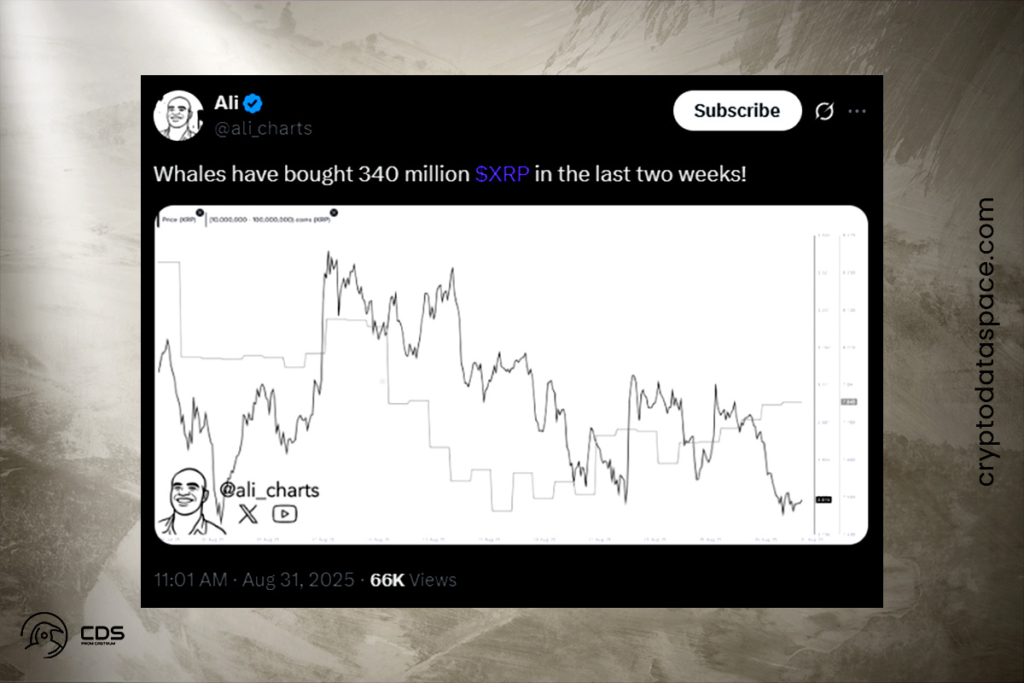

XRP Whale Activity Hits New Highs

Santiment data shows that the number of wallets with at least one million XRP has increased to 2,743 addresses, which hold a total of 47.32 billion XRP. About 80% of the entire circulating supply is made up of this. The two trends of more whales and more tokens owned are highly encouraging for XRP’s future growth. According to the reports, whales collectively bought almost 340 million XRP worth $962 million during the last two weeks of the correction, even though stock market outflows increased by $268 million. This is a blatant indication of covert strategic buildup.

XRP Spot ETF Hopes Rise With Consistent Positive Market Sentiment

Although there aren’t any authorized spot XRP ETFs, things are moving swiftly forward. ETF specialist Nate Geraci echoed the high expectations for quick regulatory approval by pointing out that investors’ demand for spot XRP and Solana ETFs is being significantly underestimated. Positive sentiment is increased by consistent positive engagement. A number of companies have made updates to their Solana and XRP ETF files, including Grayscale, Franklin Templeton, VanEck, and Canary/Marinade. These reports usually show active progress in the review process and favorable back-and-forth with the SEC.

XRP Adoption Grows Beyond Investors

Demand for XRP in the real world is also growing. As previously reported by crypto.news, SBI Holdings-backed Tokyo-listed gaming company Gumi has confirmed plans to buy about $17 million worth of XRP. As part of a dual-asset plan that pairs Bitcoin and XRP, the purchase will be made gradually between September 2025 and February 2026. The argument for long-term growth is strengthened by this move, which shows that XRP is becoming more well-known among investors as well as a corporate treasury asset.

For more up-to-date crypto news, you can follow Crypto Data Space.

[…] then, Bitwise, 21Shares, and CoinShares have all introduced XRP ETFs, contributing to a wave of new products hitting the market following the end of the U.S. government […]