XRP Faces Harsh Correction: What’s Behind the Crash?

XRP has fallen by almost 10% in the last few days after posting its highest daily and weekly close above $3.45 last week. On Wednesday, XRP had its largest daily fall since April 6, with a 10.33% decline. XRP futures open interest (OI) also fell precipitously as a result of the downturn, from $10.94 billion to $9.10 billion, a 16.8% decrease since Tuesday. As a result, there may be a short-term decline in speculative confidence as leveraged traders may be liquidating their holdings.

Whale Moves and Long Liquidations Trigger XRP Crash

A spike in long liquidations and bearish whale activity seems to have contributed to XRP’s recent decline. Crypto analyst Darkfost saw significant XRP outflows from a wallet linked to Chris Larsen, a co-founder of Ripple. Over 50 million XRP reportedly changed, with $140 million going to exchanges. Although it is still behind the 84 million XRP withdrawn last Friday, the pace has increased dramatically since July 15. On Thursday, 42 million XRP were withdrawn. About $86 million was lost in a matter of hours as a result of the dramatic price change, which set off the third-largest XRP long liquidation event on Binance this year.

Cointelegraph has highlighted whale accumulation despite the price fluctuation, pointing out that 2,743 wallets already have over a million XRP each, totaling 47.32 billion tokens, or 4.4% of the supply in circulation. But perhaps the tide is turning. The 90-day whale flow average for XRP has gone negative, according to data from CryptoQuant, which raises the possibility that big holdings are now dumping. Significantly, this indicator turned positive in early May, just prior to XRP’s powerful rally, and its recent reversal may be a precursor to a local peak.

XRP Holds Bullish Structure Despite 10% Drop

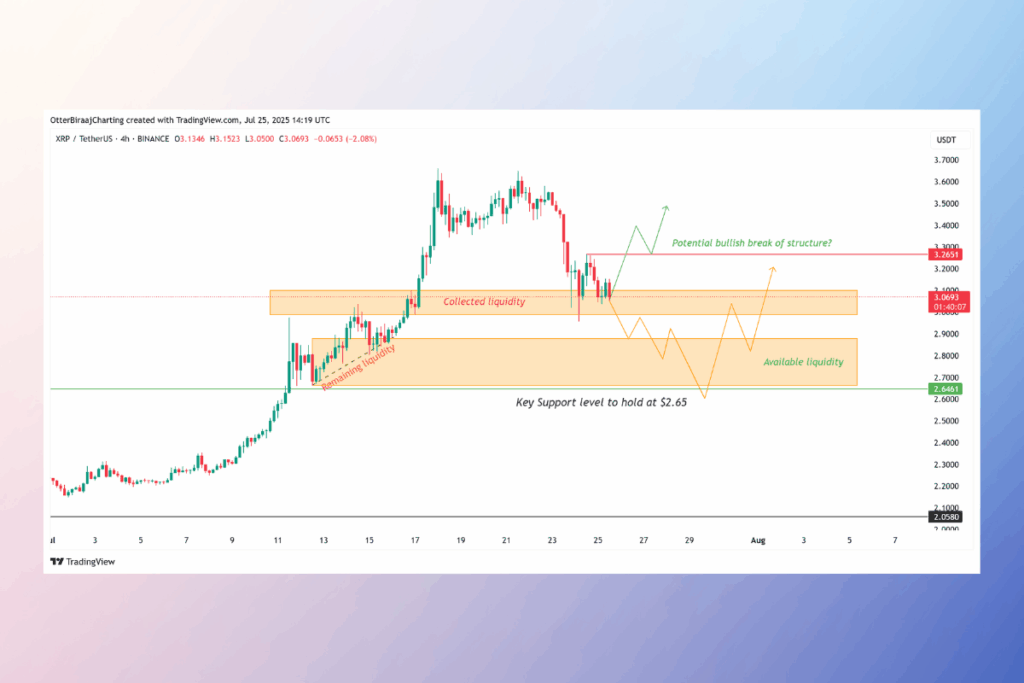

The longer-term market structure of XRP is unaffected by the current volatility. Even with this week’s 10% decline, the multimonth high from last week confirmed the current positive trend. The immediate area of interest on the four-hour chart is located just above the psychological level of $3.

A positive market structure shift on the lower time frames would be confirmed if the price broke over $3.25, possibly establishing $2.95 as a local bottom. On the other hand, XRP might aim for the following liquidity cluster between $2.66 and $2.86 if selling pressure persists.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.