UNI Price Dips Below $10 After a Month-Long Hold

Uniswap’s [UNI] price fell below the $10 mark this week, closing at $9.35, marking a notable shift after holding above that level throughout August. While past crypto market cycles typically show weakness during August, this year saw an anomaly, with mixed sentiment spilling into September.

Traders now speculate that this dip could mirror past pre-Q4 rallies—setting up for a potential bounce later in the month.

Whale Activity Signals Accumulation

Data from OnchainLens shows that whale wallets have begun accumulating UNI again after a phase of profit-taking. One notable transaction involved a 153,975 UNI purchase worth $1.5 million via CoW Protocol. This whale also accumulated Maker (MKR) and Spark (SPK), later moving the assets to liquidity pools.

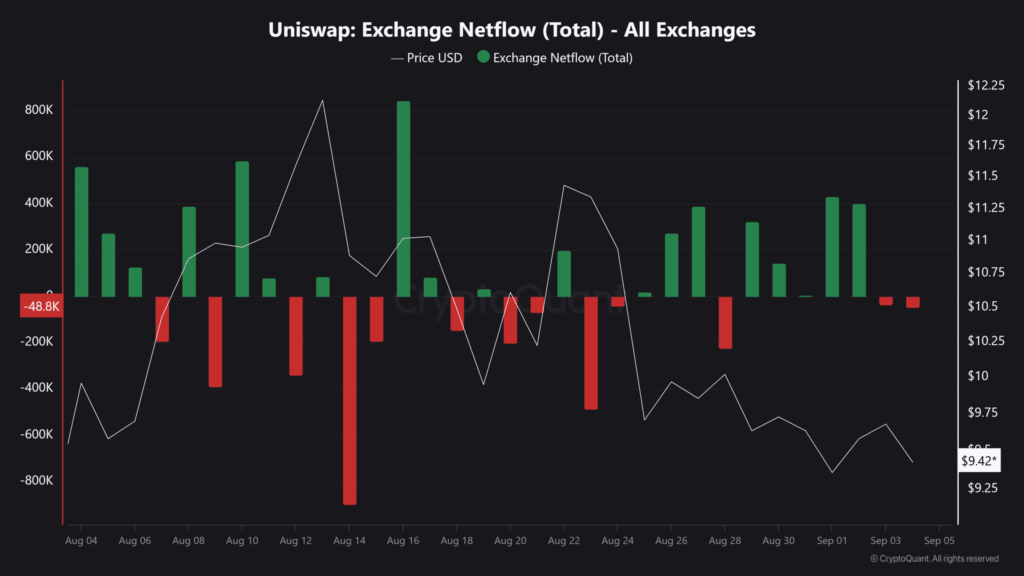

UNI’s exchange netflows turned negative, with over 55,000 tokens withdrawn, 18,000 more than the previous day. This followed a 400K UNI inflow on September 1st, which had coincided with the price dip—suggesting whales may now be accumulating again.

Large outflows from exchanges typically indicate a shift from selling pressure to accumulation.

Price Nears Key Support Zone Around $8.74

UNI is now approaching a historically significant support zone at $8.74, which last triggered a 40% rally. During that rally, UNI briefly broke above $11 but was quickly rejected at $12.25—a failed breakout.

Analysts believe $8.74 to $9.74 could act as an ideal accumulation zone. However, a drop below $8.74 may invalidate this bullish setup.

Meanwhile, Ethereum Layer-2 volumes surpassed $50 billion, with Unichain, Arbitrum (ARB), and Base leading. Unichain Labs recently partnered with Wormhole to enable multichain token swaps, potentially boosting UNI’s long-term use case.

Comments are closed.