UNIfication Proposal Aims to Rebalance Incentives Across Uniswap

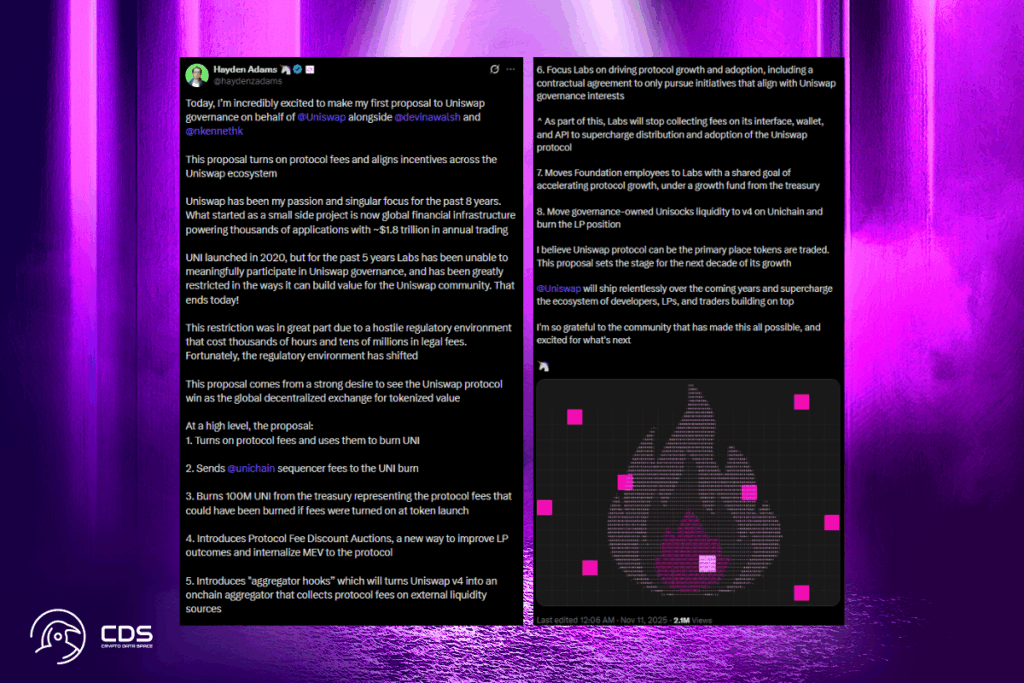

Hayden Adams, the founder of Uniswap, has presented “UNIfication,” the protocol’s first-ever governance proposal. The proposal aims to rebalance incentives throughout the ecosystem, implement a UNI-burning mechanism, and activate protocol fees. Investor confidence was increased by the announcement. The native token of Uniswap, UNI, shot to a two-month high after Adams’ announcement.

Major Ethereum v3 pools and Uniswap v2 will be subject to fees at launch. Liquidity providers (LPs) will receive 0.25% per trade in v2, while the protocol will receive 0.05%. Depending on the fee tier, governance will get either one-fourth or one-sixth of the liquidity provider fees for v3. The plan asks for a retroactive burn of 100 million UNI from the Uniswap treasury. This is the amount that could have been burned if fees had been in place from the beginning of the protocol.

Unichain launched just 9 months ago, and is already processing ~$100 billion in annualized DEX volume and ~$7.5 million annualized sequencer fees. This proposal directs all Unichain sequencer fees, after L1 data costs and the 15% to Optimism, into the burn mechanism,

the proposal

UNIfication Proposal Aims to Boost Liquidity Provider Rewards

Users and liquidity providers can now bid for fee-free trading times due to the introduction of Protocol Fee Discount Auctions. The goal of this innovation is to optimize protocol value and assist liquidity providers. Uniswap v4 will be able to function as an on-chain aggregator and receive protocol fees from outside liquidity sources due to aggregator hooks.

The UNIfication proposal modifies Uniswap‘s structure in addition to fee activation and burning. Fees for Uniswap Labs’ app, wallet, and API will no longer be collected. Instead, the money will be used to support the expansion and uptake of the protocol. Additionally, the idea transfers Foundation staff to Labs under a Treasury-backed growth fund. The goal of this action is to accelerate protocol expansion and unify the ecosystem. The liquidity position of governance-owned Unisocks will be burnt after it transfers to v4 on Unichain.

UNI Community to Vote on Major UNIfication Proposal

Before any changes are made, the Uniswap community must still approve the request. With a 7-day discussion period, a 5-day snapshot vote, and a 10-day on-chain execution window, the governance process will take about 22 days. In his statement on X, Adams stressed the significance of the proposition. He emphasized the regulatory obstacles Uniswap Labs had to overcome, pointing out the expensive legal fees. This change in governance is now supported by the recent evolution of the regulatory environment.

UNI launched in 2020, but for the past 5 years Labs has been unable to meaningfully participate in Uniswap governance, and has been greatly restricted in the ways it can build value for the Uniswap community. That ends today!

Adams

For more up-to-date crypto news, you can follow Crypto Data Space.

[…] cryptocurrency executives expressed privacy worries as well. Hayden Adams, the founder of Uniswap, was adamantly opposed to the new […]