Bold Bet on Ethena: UAE M2 Holdings Diversifies Portfolio

UAE M2 Holdings’ private investment division, UAE M2 Capital Limited, has made a major move to diversify its holdings of digital assets. It accomplished this by investing $20 million in Ethena ($ENA), the Ethena protocol’s governance token. M2 Capital’s strategic dedication to incorporating cutting-edge blockchain solutions into regulated investment offerings is demonstrated by this step, especially for the expanding Middle East and North Africa (MENA) region.

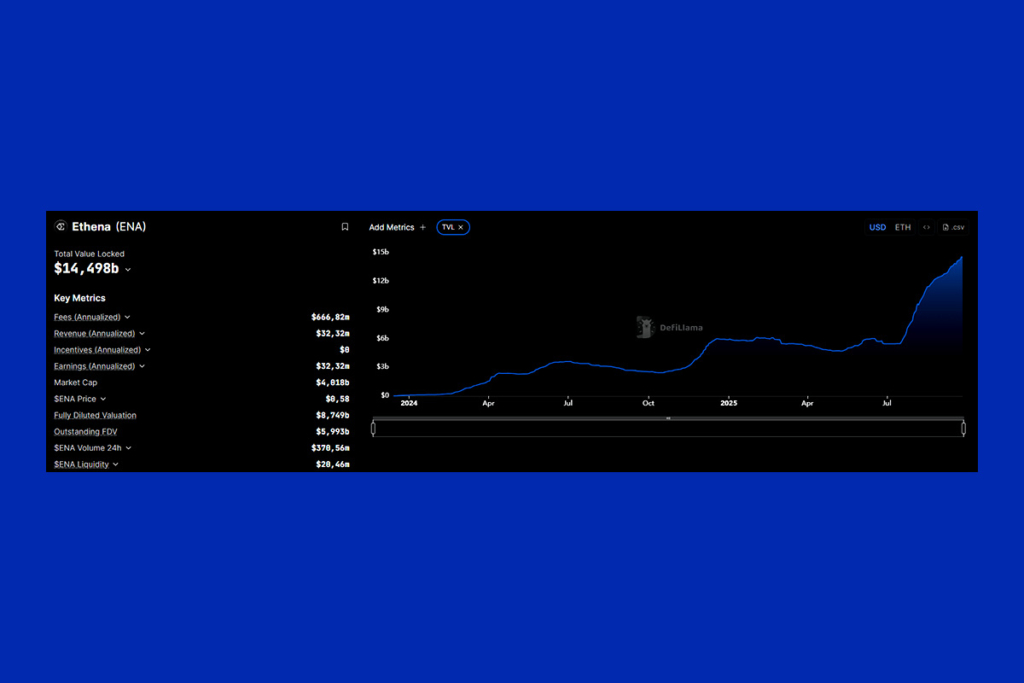

Ethena Surpasses $14B TVL, Redefining Synthetic Stablecoins

Ethena is unique in the cryptocurrency realm since it powers both the reward-bearing USDe and the crypto-native synthetic dollar, sUSDe. With a Total Value Locked (TVL) of over $14 billion to date, Ethena has demonstrated its potential as a yield-producing, stability-driven asset. The protocol offers stability and performance by combining delta-neutral hedging with crypto-backed collateral, which is uncommon in the ecosystem of synthetic stablecoins.

The Managing Director and Head of Treasury at M2 Holdings, Kim Wong, stressed that this transaction gives investors in sophisticated digital assets exclusive access to regulated crypto-native merchandise. In the MENA area, institutional and high-net-worth investors who are looking for stability and innovation are finding such regulated solutions more and more alluring.

UAE’s Progressive Crypto Rules Boost Ethena’s Growth Potential

Digital asset innovation has flourished in the UAE, and Ethena‘s arrival fits nicely with the country’s progressive regulatory approach. Ethena has a strategic niche as a result of UAE central bank restrictions that permit the acquisition of virtual assets using synthetic stablecoins, even if they only permit AED fiat-backed stablecoins as legal tender. Stablecoins are one of the most promising digital currencies, according to Conor Ryder, Head of Research at Ethena.

Stablecoins providing a crypto-native synthetic dollar are not only the largest challenge in the space but the largest opportunity,

Ryder

M2 Capital‘s goal of creating a diverse digital assets portfolio that combines strong growth potential and regulatory compliance to meet the demands of MENA investors is ideally aligned with this. UAE M2 Capital expands its presence in the quickly changing cryptocurrency market, while Ethena is well-positioned to grow faster with this $20 million investment.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.