Crypto News– The daily trading volume on South Korea’s largest cryptocurrency exchange has plunged by 75% from this year’s peak, indicating that the frenzied trading in alternative cryptocurrencies (altcoins) has subsided and digital assets other than the market leaders bitcoin (BTC) and ether (ETH) may struggle to maintain their high valuations.

The trading volume on Upbit, South Korea’s prominent cryptocurrency exchange, has plummeted by 75%

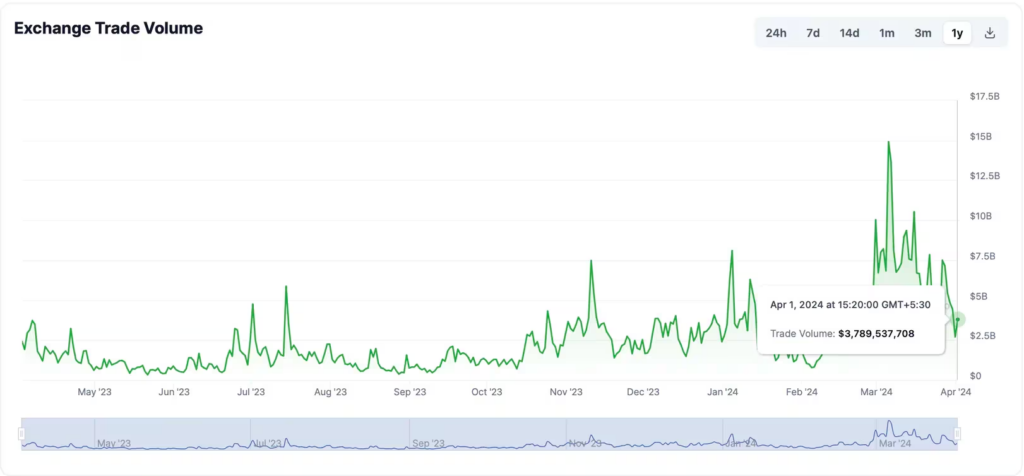

Upbit, which lists 192 cryptocurrencies and offers trading in 309 pairs, recorded only $3.79 billion in volume in the past 24 hours, according to data from CoinGecko. This is a significant drop from the peak of $15 billion on March 5, when TradingView data indicated that the total market capitalization of altcoins reached a two-year high of $788 billion. Since then, the market capitalization has stabilized at around $750 billion.

The daily volume on Upbit surged from $2 billion in the two weeks leading up to March 5, driven by bitcoin’s rally to record highs above $70,000 and Ethereum’s Berlin upgrade, which fueled risk-taking in other cryptocurrencies, including meme coins. The trading frenzy was so intense that, at one point, volumes on South Korea-based crypto exchanges surpassed activity on the local stock market.

South Korean crypto enthusiasts seem to have a stronger focus on altcoins compared to bitcoin and ether, the two largest cryptocurrencies by market capitalization. A study by DeSpread Research in October revealed that investors on Upbit are primarily interested in maximizing profits through altcoins and are willing to accept the high risks associated with these coins. Bitcoin and ether trading pairs represent a smaller portion of the total volume on Upbit compared to Nasdaq-listed Coinbase (COIN), where trading activity is predominantly concentrated in BTC and ETH.

1 Comment