The Pump.fun Paradox: Seen Rapid Price Gain but Low Fees Raise Concerns

With a price increase of almost 13% from its previous daily candle closure, Pump.fun saw a significant increase in liquidity over the course of the last day. Revenue and fees fell to their lowest levels in two weeks, indicating a mixed sentiment in the market. The longevity of the rally was called into question by this discrepancy between rising prices and declining consumption.

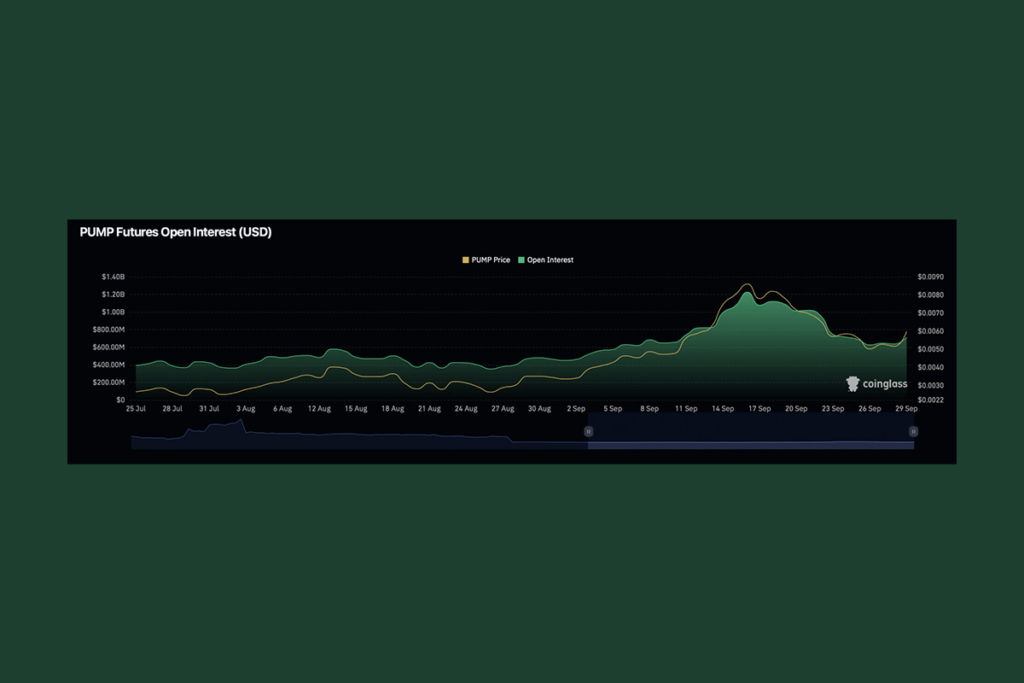

Derivatives Market Dominates PUMP Rally

A significant portion of the recent PUMP rise was fueled by perpetuals market investors who increased their liquidity in the memecoin. Actually, based on recent percentage changes in open interest, analysis revealed that inflows into the derivatives market were $56 million. Additionally, the Open Interest-Weighted Funding Rate was in the positive zone at the time of the spike. This suggested that the majority of the liquidity was coming from long contracts, which were controlling the market.

Spot investors also participated, although to a lesser extent. This group’s $2.94 million PUMP accumulation was their first significant addition since they added $3.52 million on September 25. Considering that on-chain data indicated declining usage and revenue, this purchasing activity across spot and perpetuals might be speculative.

PUMP Revenue and Fees Tank: Is the Rally Losing Steam?

PUMP sentiment has diminished. Revenue and fees earned on the protocol fell to a two-week low at the time of writing. At press time, revenue had dropped from $3.38 million to $945,960, while fees had dropped even more precipitously, from $8.52 million to $1.82 million. Weaker activity on Pumpfun and PumpSwap was indicated by the sharp drop. It suggested that on-chain consumers had less desire for the item. Furthermore, active investors hadn’t surpassed the benchmarks set in earlier months.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.