Tether Pumps Liquidity as Crypto Fear Index Hits 2-Month Low

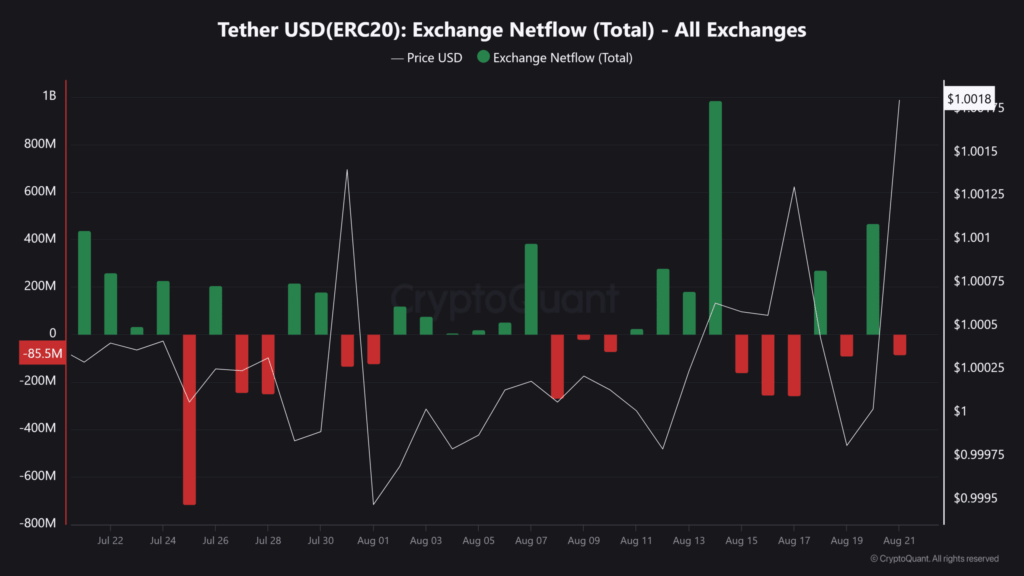

Tether [USDT] has minted $2 billion in new supply within just five days—an unusual move that’s caught the attention of analysts. The first $1 billion tranche was issued on August 15, coinciding with Bitcoin’s all-time high near $124,000. The second followed on August 20, right as BTC slid back to $112,000, entering the “fear” territory on sentiment indexes.

Market Enters “Fear” Phase, But Not Capitulation

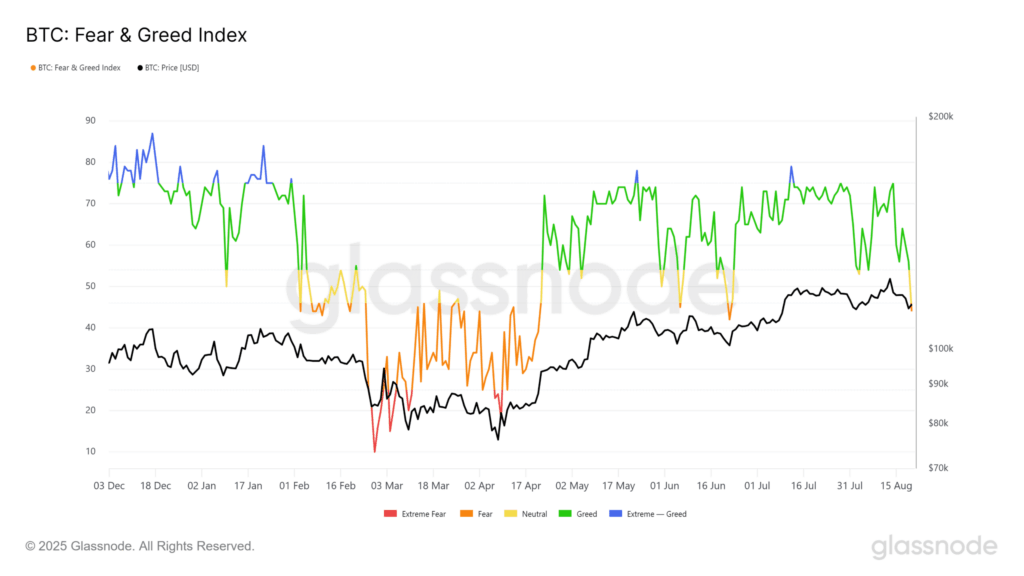

Bitcoin has now closed two consecutive weeks in the red, correcting nearly 10% from its August peak. As a result, the Crypto Fear & Greed Index dropped over 20 points to 44, its lowest reading in two months.

Historically, similar dips into the “fear” range have been followed by short-term rebounds. For instance, mid-June saw BTC fall 11% before surging to $123K within weeks. That said, a deeper decline remains possible—especially when looking back to Q1 2025, where “extreme fear” preceded Bitcoin’s drop to $74K, its lowest point of the year.

USDT Liquidity Could Influence Bitcoin’s Next Move

The minting of $2 billion in USDT may be signaling upcoming volatility. On-chain data shows positive USDT net flows, with 470 million USDT moving into exchanges after the latest mint. This correlated with a minor 1.27% recovery in BTC, hinting at potential accumulation near $112K.

Although the market remains cautious, there’s no strong “flight to safety” signal yet. In fact, sentiment is already starting to shift—the Fear & Greed Index bounced back to neutral (50), suggesting that confidence may be rebuilding.

Comments are closed.