Bittensor’s Next Move Hinges on Key Resistance Level

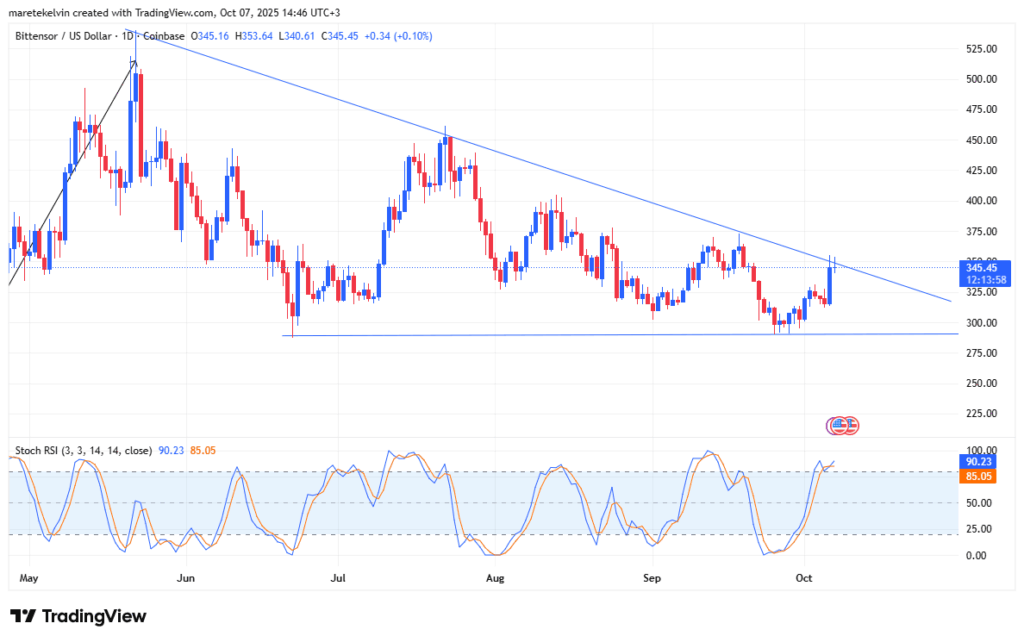

Bittensor (TAO) gained over 10% on October 7, briefly touching the $345 resistance level before pulling back. The move reignited trader discussions over whether this signals the start of a breakout or just another pause in TAO’s long-standing consolidation range.

At the time of writing, TAO remains just below descending wedge resistance—a technical formation that has shaped its mid-term price trajectory since April.

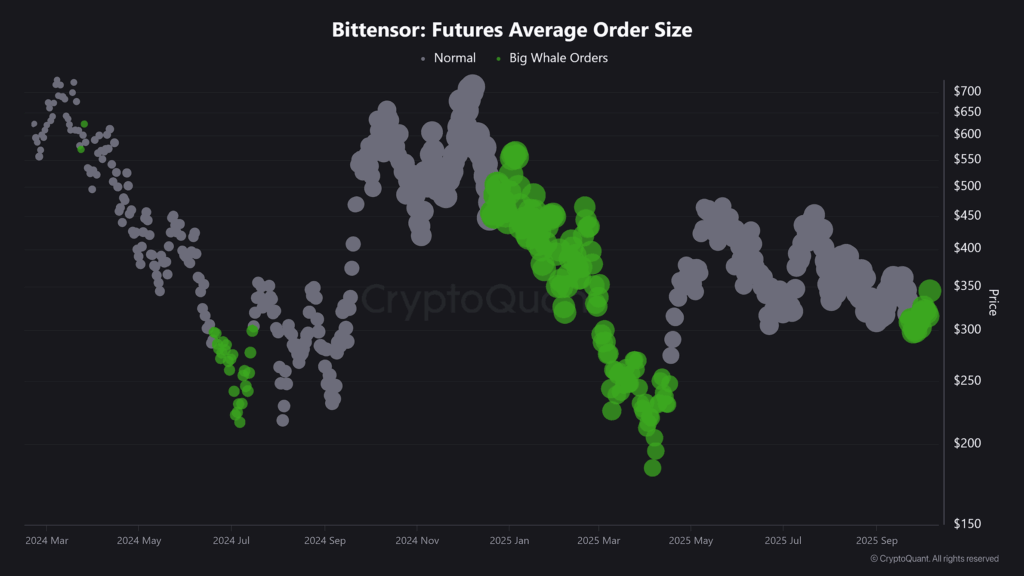

Whale Activity Builds Ahead of Resistance Test

According to CryptoQuant, whale participation in the Futures market has increased steadily over the past two trading sessions. The Average Order Size metric reflects larger positions being accumulated, indicating a buildup of bullish pressure just below resistance.

Historically, similar patterns of whale clustering have preceded breakout phases. This growing confidence among large holders contrasts with cooling momentum seen in both Futures and spot markets. Data from Volume Bubble Mapsindicates that short-term traders are likely taking profits while watching TAO’s next move.

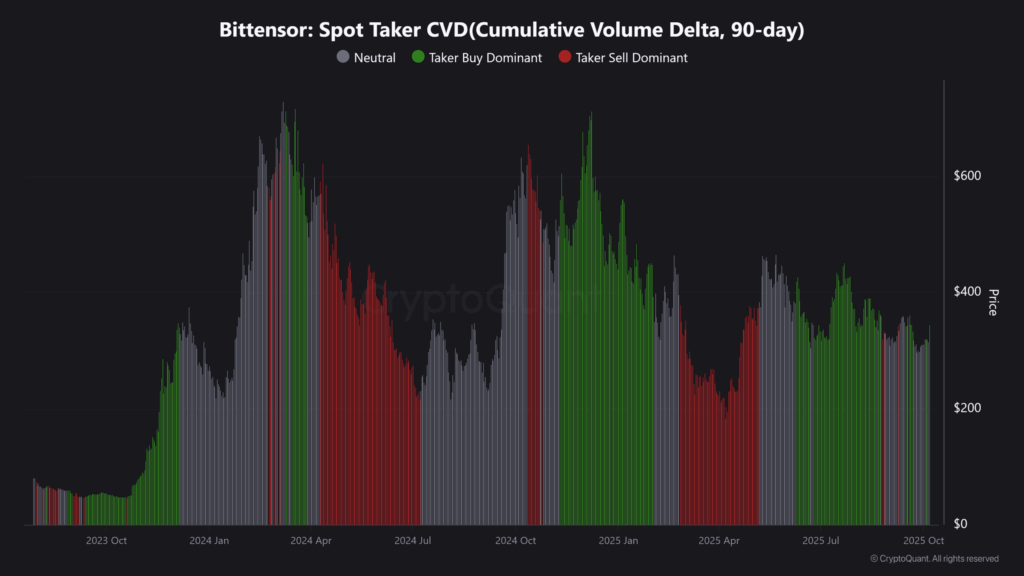

Yet, the Spot Taker Cumulative Volume Delta (CVD) suggests that buyers still have control in the short term, potentially paving the way for longer-term market participants to step in.

$345: The Breakout or Rejection Level?

TAO’s daily chart shows it nearing the upper boundary of a wedge pattern, which has capped gains since April. Most analysts identify $345 as a key breakout point. A confirmed close above could shift the mid-term trend bullish.

However, failure to break above this level may trigger a pullback toward the $325 support zone. Overbought signals from Stochastic RSI also hint at possible short-term weakness before any sustained move.

[…] TAO’s short-term structure will remain bullish-inclined as long as the price holds above nearby support levels. Momentum indicators also support this scenario. […]