Solana Price Forecast: Can SOL Overcome Bearish Pressure and Reach $300?

Solana Price Breakdown – Solana (SOL) has shown brief signs of upward movement recently, yet it has once again failed to breach the $300 mark. The inability to hit this significant milestone may stem from the growing dominance of Solana sellers, whose presence has overwhelmed that of buyers. With bearish pressure continuing to dominate, traders and investors are left wondering if Solana can avoid another downturn or whether further price declines are inevitable.

Solana’s Bearish Momentum Intensifies

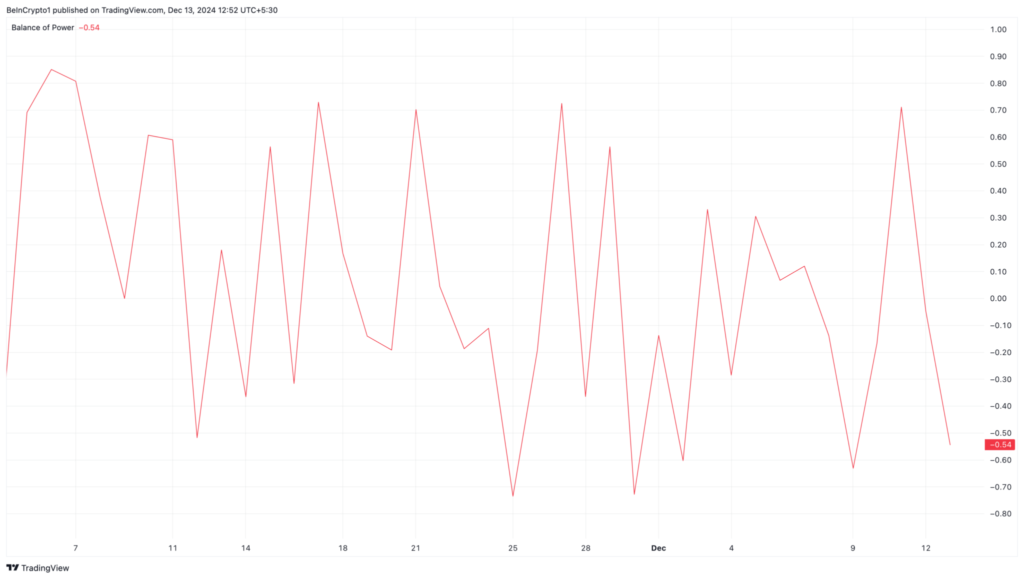

The latest data on the SOL/USD daily chart reveals a troubling trend for Solana holders. The Balance of Power (BoP) indicator has dropped into the negative zone, signaling that sellers have gained significant control of the market. The BoP is a key technical indicator that gauges the balance between buyers and sellers, providing insight into the overall strength of market participants and the likelihood of a trend reversal.

- Positive BoP values suggest that buyers are in control, often signaling price increases.

- Negative BoP values, however, indicate sellers’ dominance, raising the probability of further declines in price.

As of the most recent data, the BoP reading stands at -0.54, further emphasizing the control exerted by Solana sellers. This bearish dominance could continue to exert downward pressure on SOL’s price, making it vulnerable to further drops in value.

Chaikin Money Flow (CMF) Signals Continued Selling Pressure

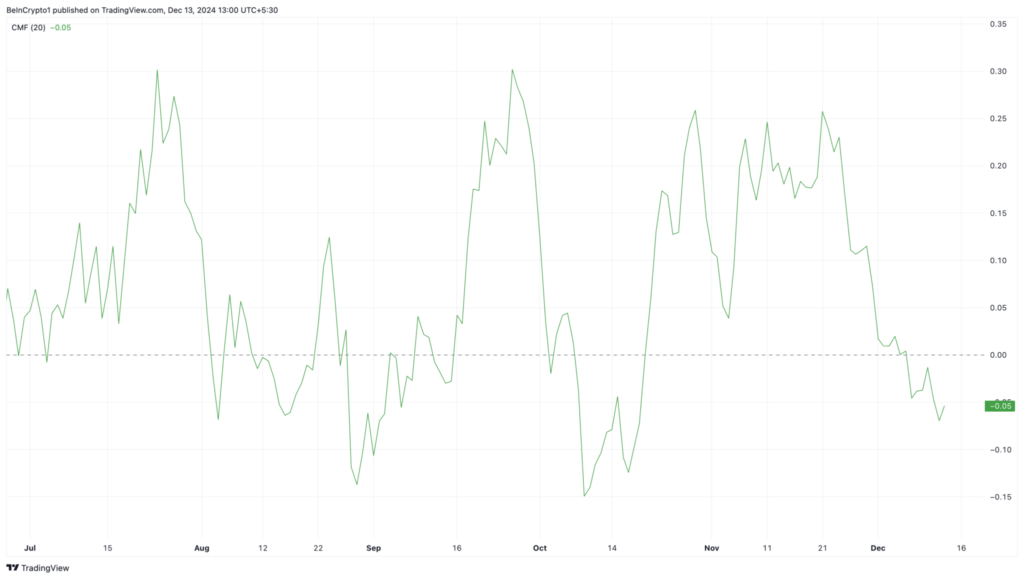

In addition to the BoP indicator, another metric, the Chaikin Money Flow (CMF), is reinforcing the bearish outlook for Solana. The CMF measures the flow of liquidity into or out of a cryptocurrency, providing a clearer picture of accumulation or distribution phases. When the CMF is positive, it suggests accumulation, a signal of buying pressure and potential price increase. Conversely, negative CMF readings suggest distribution or selling pressure, which could lead to a downturn.

Currently, the CMF for Solana has dropped to -0.05, reinforcing the idea that sellers remain firmly in control. As long as this trend persists, SOL’s price is likely to face continued downward pressure, with the potential for further declines.

SOL Price Prediction: A Continued Downturn Below Key Support

Solana’s price has been trading within a descending channel since its all-time high of $267.85 on November 22. The recent breakdown below the $225.74 support level is particularly concerning. Breaking below this key support point signals that Solana could face another significant correction.

If the bearish momentum continues, Solana could see its price fall further, with $203.63 serving as a potential support level. However, this projection hinges on the sellers maintaining their dominance. Should the selling pressure abate and buyers regain control, the outlook for Solana could shift. In this case, SOL’s price could rise to the $264.66 range, with an outside possibility of breaking the $300 mark in a highly bullish scenario.

Can Solana Avoid Further Declines?

The future price trajectory of Solana largely depends on the ongoing struggle between buyers and sellers. The dominance of sellers, as indicated by both the BoP and CMF indicators, suggests that SOL’s price could continue to face downward pressure. However, if bulls manage to reverse the current trend, Solana could see a recovery, with a potential return to the $264.66 level or even a breakout to the $300 region.

In conclusion, while Solana (SOL) has faced considerable bearish momentum in recent weeks, the cryptocurrency market remains highly volatile. Traders and investors will need to closely monitor the Balance of Power and Chaikin Money Flow indicators to assess the likelihood of further price declines or potential recovery. As always, it is crucial to stay informed and cautious in the ever-changing cryptocurrency landscape.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment