Solana Hits 5-Month High Amid Altcoin Revival: Will the Rally Hold?

On Monday, Solana reached a five-month high. Thus, the altcoin is bringing Layer 1 blockchains back into the spotlight and suggesting that the attitude of the cryptocurrency market toward altcoins may be changing.

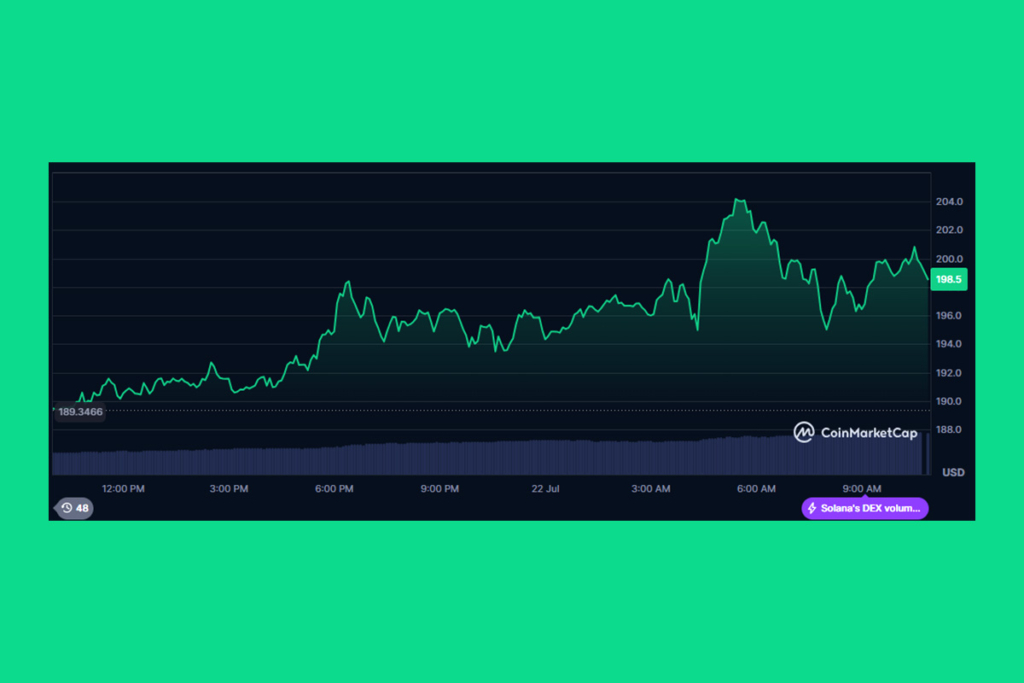

SOL extended a 50% surge over the previous month as it momentarily hit $200 during early Asian trading. According to CoinMarketCap data, it has since dropped to $195.83, below the $200 mark. Some claim that a significant influx of capital is hinted at by the native token’s increasing market power, which is further demonstrated by the $1.5 billion increase in open interest over the last three days.

Solana Options Market Signals Possible Breakout Amid Rising Volatility

According to Sean Dawson, Head of Research at options trading platform Derive, traders in Solana seem to be bracing for a challenging month. He identified the main cause as a widening discrepancy between the 30-day realized and indicated volatilities. From 4% to 14%, the implied volatility—a measure of options traders’ predictions for the future—has more than tripled. Stated differently, traders may have repositioned for a potentially positive breakout based on the recent increase in implied volatility and widening skew.

Dawson Predicts Bright Future for Layer-1s Amid Ethereum and Solana Strength

Dawson envisions a bright future for the larger Layer-1 landscape over the next six months, despite the current short-term focus on Ethereum, a digital currency that has generated a 60% rise in just 30 days. Citing Trump’s GENIUS Act and Ethereum’s rapid institutional adoption as examples, he predicts that L1s will prevail.

Because of its high beta and booming on-chain activity from the comeback in meme coin trading, Dawson anticipates that Solana will be a major beneficiary in that context. However, favorable monetary conditions are still crucial for the long-term outlook and continued bullish trajectory.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.