Crypto News– The U.S. Securities and Exchange Commission (SEC) is soliciting public comments on three proposed Ethereum exchange-traded funds (ETFs), marking the latest development in the regulator’s efforts toward anticipated investment products. Following a series of delays in decision-making on Ethereum spot ETFs, the primary regulatory body of Wall Street announced on Tuesday that Grayscale Investments, Fidelity, and Bitwise will undergo a three-week comment period.

SEC Requests Comments Regarding Three Proposed ETFs for Ethereum

This process is a customary step for fund managers seeking SEC approval for an ETF, similar to what occurred with spot Bitcoin ETF applications. U.S. citizens and organizations have historically submitted their opinions to the SEC regarding proposed investment products. All three fund managers have submitted proposals for a spot ETH ETF to the regulator, intending to hold ETH and issue shares tracking the asset’s price.

In January, the SEC greenlit 11 spot Bitcoin (BTC) ETFs for trading, marking a significant milestone after a decade of denials. These investment vehicles are now actively traded on stock exchanges, offering traditional investors an avenue to purchase shares mirroring the cryptocurrency’s price.

These ETFs have garnered immense popularity, evident in the substantial inflows they’ve attracted. Many of the same fund managers are now seeking regulatory approval to replicate this success with ETH, the second-largest digital asset by market capitalization.

SEC Invites Public Input on Three Ethereum ETF Proposals

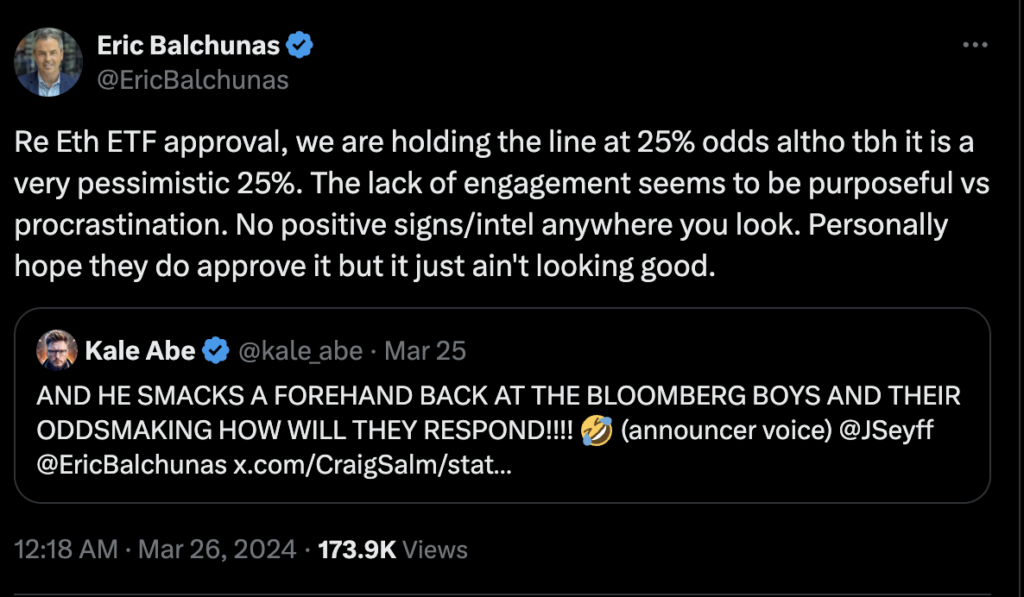

In a January report, the British multinational bank Standard Chartered expressed expectations for ETH ETFs to receive approval from the SEC by the May deadline. However, industry analysts have since suggested that the likelihood of the regulator approving these products is lower. Some have even proposed that a delay, creating a gap between Bitcoin and Ethereum spot ETFs, could be beneficial.

As per CoinGecko data, the current price of ETH is slightly below $3,314. Unlike BTC, which has seen significant growth, ETH remains quite distant from its all-time high of $4,878, reached in 2021.

Leave a comment