Crypto Sector Applauds SEC’s Decision to SAB 121 Officially Revoked

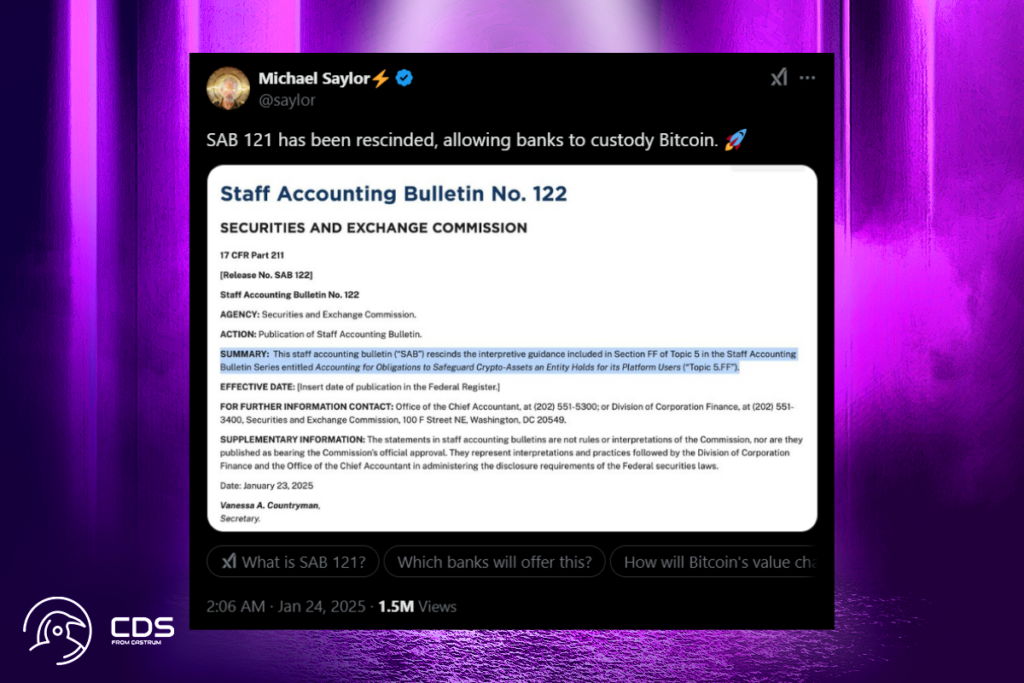

The Securities and Exchange Commission has revoked a contentious rule that required financial organizations holding cryptocurrency to list it as a liability on their balance sheets. The crypto sector has long wanted to repeal SAB 121, an agency rule released in March 2022, and its interpretive guidance was revoked, according to a new Staff Accounting Bulletin issued on January 23.

Bye, bye SAB 121! It’s not been fun.

SAB 121 Repeal Sparks Mixed Reactions: Industry Cheers, Critics Warn Risks

In March 2022, SAB 121 was released by the SEC, requiring financial institutions that hold cryptocurrency on behalf of clients to record the assets as a liability on their balance sheet. The cryptocurrency sector opposed the proposal, claiming it would make managing cryptocurrency more challenging.

French Hill, the chair of the House Financial Services Committee, expressed his satisfaction with the repeal of the flawed SAB 121 rule in a statement on X. The news was also greeted with joy by famous figures in crypto, such as Michael Saylor.

However, Rep. Wiley Nickel and other opponents argued that it would limit the capacity of American banks to hold crypto exchange-traded products on a large scale. This would increase the risk of concentration by giving non-bank companies more influence.

Trump-Era SEC Takes Action: SAB 121 Repeal Marks Key Policy Shift

The SEC’s first major action under President Donald Trump and acting Chair Mark Uyeda is the revocation of SAB 121. On June 1, former President Joe Biden rejected a bill to abolish SAB 121 that had first garnered bipartisan approval in the House and Senate. About five weeks later, the House fell 60 votes shy of overriding Biden’s veto.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment