Featured News Headlines

NEIRO Price Drops Amid Exchange Delistings and Market Uncertainty

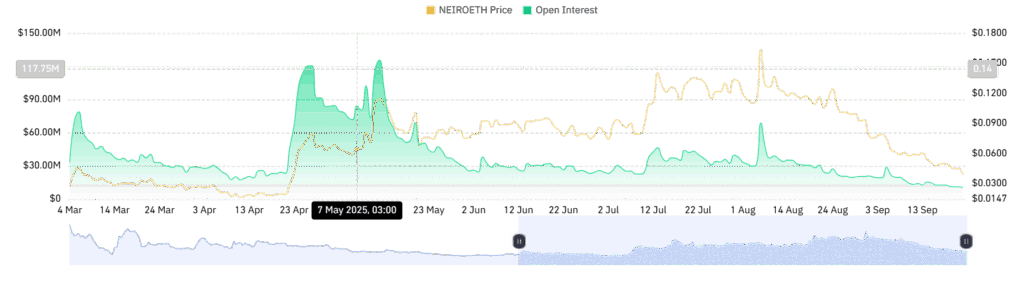

Since peaking at $0.18 two weeks ago, Neiro on Ethereum (NEIRO) has been trapped in a descending channel. As of now, NEIRO trades at $0.0371, reflecting a 7.21% drop in daily charts and a steep 25.57% weekly decline.

Exchange Delistings Weigh Heavily on NEIRO

A major factor behind NEIRO’s price slump is the removal of its trading contracts from prominent exchanges. Bybit initiated this trend two weeks ago by delisting NEIROETH contracts, triggering significant price volatility.

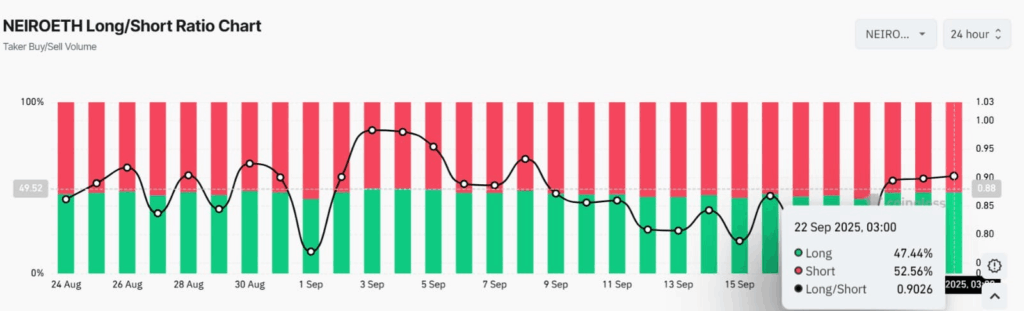

Adding to the pressure, Binance—the world’s largest crypto exchange by trading volume—announced on September 22 the delisting of NEIROETHUSDT contracts. This move has further reduced liquidity, as a key support channel in the market was cut off.

According to AMBCrypto, such delistings signal declining market confidence from exchanges, often resulting in increased bearish momentum in the short term.

Insider Trading Concerns Raised Over Trend Research

Crypto analysts have flagged potential insider activity involving Trend Research. On September 4, the research group transferred 32.4% of NEIROETH tokens—approximately 324.7 million tokens valued at $22 million—to exchanges. Shortly after, Bybit announced its delisting decision.

The pattern repeated on September 21 when Trend Research moved another 34.6% (346 million tokens worth $14.36 million) to exchanges. Binance then announced its NEIROETHUSDT contract delisting on the same day, intensifying market concerns.

On-Chain Activity Shows Mixed Signals

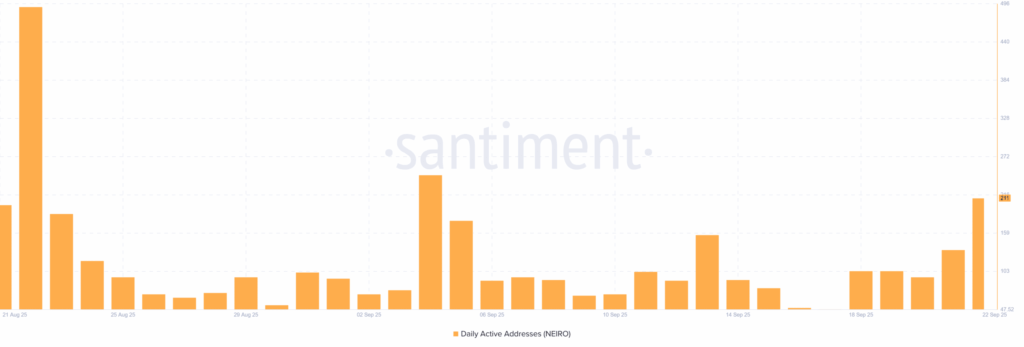

Following these announcements, NEIRO’s on-chain activity spiked. Data from Santiment shows the altcoin’s Daily Active Addresses surged from 95 to 211, signaling heightened user engagement and network interaction.

Additionally, the Price DAA (Daily Active Addresses) Divergence supports this observation, reflecting increased wallet activity despite falling prices.

Comments are closed.