Movement (MOVE) Rallies 13% as Trading Volume Surges

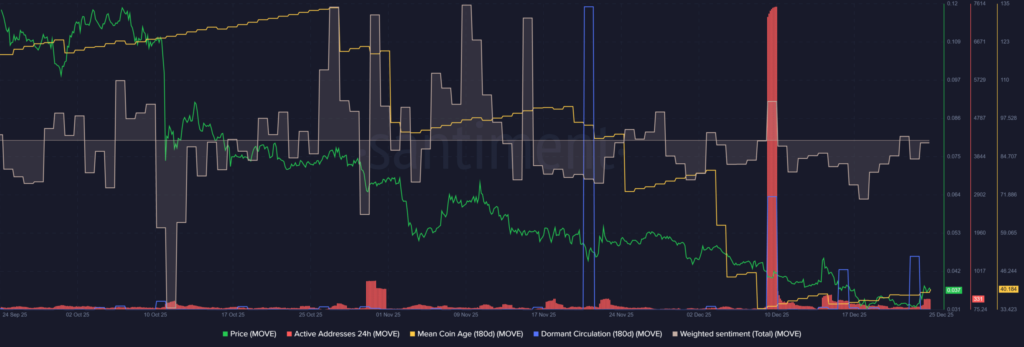

Movement (MOVE) experienced a notable 13% rally on Wednesday, December 24, according to CoinMarketCap data. Daily trading volume surged nearly 400% over the past 24 hours, signaling heightened market activity. Binance data for the MOVE/USDT pair showed a sixfold increase in spot trading volume compared to the 20-day moving average. Despite this surge, daily active addresses remained stable, and weighted sentiment showed no significant change. Dormant circulation spiked on December 23, while the mean coin age continued its gradual increase, indicating holders were not rapidly taking profits.

Long-Term Downtrend Persists

MOVE’s downtrend has persisted since January 2025. The altcoin remained largely unaffected by Bitcoin’s bullish movements in June and late September. Following market-wide sell-offs after the October 10 crash, MOVE holders were incentivized to sell, possibly due to the token’s unlock schedule and limited bullish catalysts. Currently, only 28% of the total supply is in circulation, with monthly unlocks of $5.89M proving difficult for buyers to absorb.

Short-Term Bullish Signals and Cautions

While daily trading volume and open interest increased sharply, suggesting short-term bullish activity, caution remains. The Chaikin Money Flow (CMF) indicator stayed deeply negative, reflecting continued pressure despite the rally. Price action showed successive bearish structure breaks, with short-term rallies quickly retraced. For instance, rallies on November 22 and December 14 gained 55.9% and 54% intraday, respectively, yet both failed to sustain upward momentum and the overall downtrend continued.

Comments are closed.