MicroStrategy’s Bitcoin Holdings Propel Its Inclusion in Key Global Equity Index

Business intelligence company MicroStrategy, which holds the largest corporate stash of bitcoin, has been included in a significant global equity index following a surge in its stock price.

On Tuesday, MSCI (formerly Morgan Stanley Capital International), a global provider of investment decision support tools including equity indexes, revealed MicroStrategy as one of the three major additions by market capitalization to its MSCI World Index, effective May 31.

After its most recent bitcoin acquisition on April 29, MicroStrategy now possesses 214,400 bitcoins, currently valued at approximately $13.5 billion. The company’s total acquisitions were made at a cost of $7.5 billion, averaging $35,180 per bitcoin. This translates to a paper profit of around $6 billion from its bitcoin purchases.

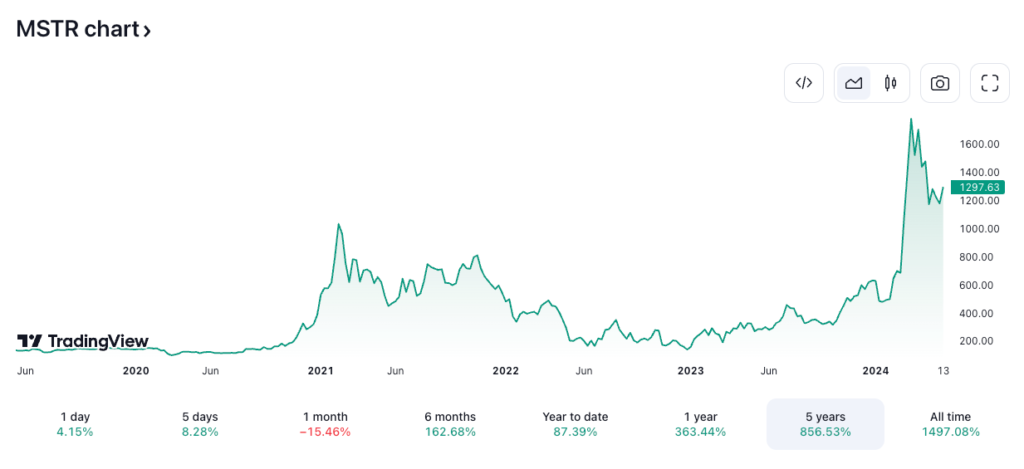

MicroStrategy’s stock price has surged since hitting a low point alongside the cryptocurrency market in December 2022. Its shares have multiplied more than eightfold since then and are up over 87% year-to-date, surpassing bitcoin’s 45% gains in 2024, as reported by TradingView.

In March, investment firm Kerrisdale Capital, which holds a short position on MicroStrategy’s shares, remarked that the stock was trading at an “unjustifiable premium” to bitcoin.

Being the owner of a substantial amount of bitcoin—equivalent to more than 1% of bitcoin’s total supply of 21 million—MicroStrategy has increasingly served as a proxy for bitcoin exposure in the traditional market, particularly before the introduction of spot bitcoin exchange-traded funds in the U.S. in January.

According to Bloomberg, the company’s inclusion in the MSCI World Index also points to how bitcoin exposure could leak into traditional portfolios, given that billions of dollars track or are benchmarked against the index. However, the recent launch of spot bitcoin ETFs is accelerating this trend.

Earlier this month, the company announced plans to introduce a bitcoin-based decentralised identity solution.

Leave a comment