Massive Crypto Options Expiry: $2.04 Billion in Options Set to Shake the Market!

The cryptocurrency market is awash with excitement as almost $2.04 billion worth of Ethereum (ETH) and Bitcoin (BTC) options are about to expire today. Crypto options that are about to expire frequently see significant price volatility. As a result, traders and investors keep a careful eye on today’s expiration happenings.

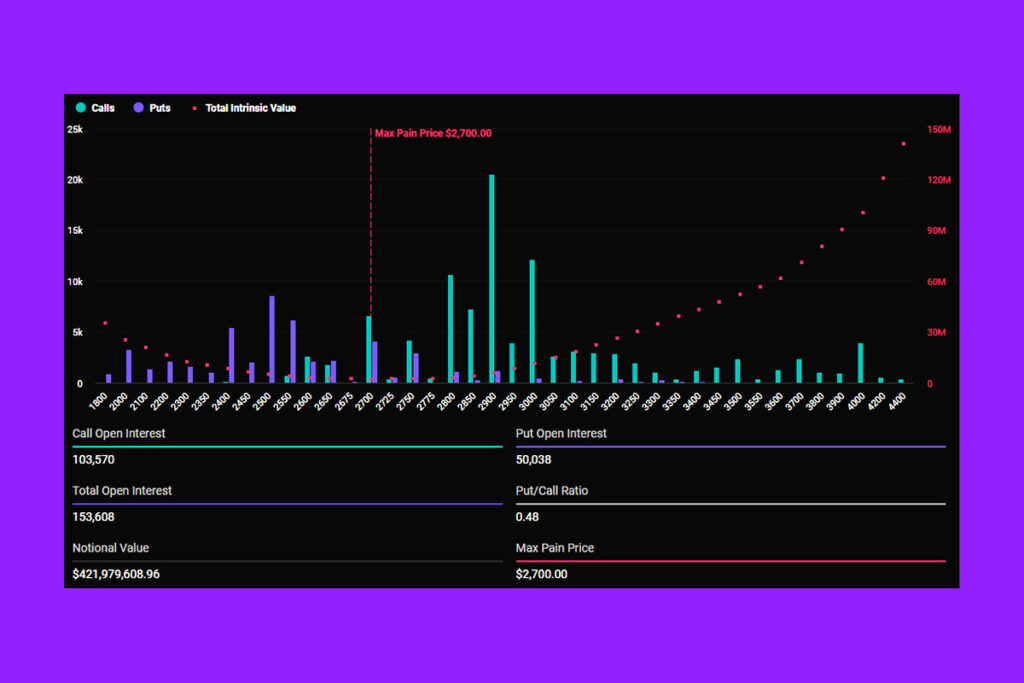

The notional value of the Bitcoin options that are expiring today is $1.62 billion. The put-to-call ratio for these 16,561 expiring contracts is 0.76, and the maximum pain point is $98,000. Ethereum, on the other side, has 153,608 contracts worth $421.97 million in theory. The maximum pain point for these expiring contracts is $2,700, and the put-to-call ratio is 0.48.

Crypto Options Expiry Alert: BTC & ETH Prices May Face a Correction Soon!

As of this writing, Bitcoin is trading at $98,728, up 1.47% since the start of Friday’s session. Ethereum is now trading at $2,794, up 1.93%. The put-to-call ratio for Bitcoin and Ethereum being less than one indicates that buy (call) options are more common than sell (put) options in the context of options trading.

However, when the expiration date draws closer, the max pain theory suggests that the prices of Ethereum and Bitcoin may move closer to their respective strike prices. The majority of the alternatives would expire worthless as a result, causing maximum misery. As the options on the Deribit approach expire at 8:00 AM UTC, this implies that the prices of Bitcoin and Ethereum may experience a slight correction.

Traders Grow Cautious as Bitcoin’s Low Volatility Signals Uncertainty

Low volatility frustrates traders, which is why Greeks.live analysts observed a cautiously pessimistic sentiment in the market. They indicate that investors and traders continue to be concerned, especially with regard to Bitcoin, and that traders are keeping a careful eye on important price points.

The group sentiment is cautiously bearish with low volatility frustrating traders. Participants are watching $96,500 level with skepticism about upward momentum, while discussing possibilities of volatility clustering at low levels around 40%,

the analysts

However, because markets don’t wait around for long, Deribit cautions that although minimal volatility may feel comfortable, this feeling is only temporary.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment