Massive Bitcoin ETF Outflow After Trump’s Crypto Move: Investors Spooked?

According to statistics from Farside Investors, investors’ reactions to President Donald Trump’s proposal for a strategic Bitcoin reserve in the United States resulted in net outflows of around $370 million from Bitcoin ETFs on March 7. The outflows show that institutional investors are hesitant to expose themselves to Bitcoin after traders were let down by Trump’s executive order on March 6.

While Trump’s executive order acknowledges crypto’s role in global finance, the lack of fresh purchases disappointed markets,

Alvin Kan, chief operating officer of Bitget Wallet

Trump’s Bitcoin Reserve Plan Triggers Market Jitters: BTC Drops 2%

Trump issued an executive order on March 6 that established a strategic reserve of Bitcoin and, separately, a digital asset stockpile to hold other cryptocurrencies. At first, they will both consist of assets obtained through legal actions and law enforcement. As long as the plans don’t result in any additional expenses for US taxpayers, the order requests that officials create budget-neutral plans for acquiring more Bitcoin.

Google Finance data shows that on March 7, the spot price of Bitcoin fell more than 2%. The majority of Bitcoin‘s forward curve, which consists of futures contracts with staggered expiration dates, has seen falls of more than 2%, according to statistics from the CME, the biggest derivatives market in the US.

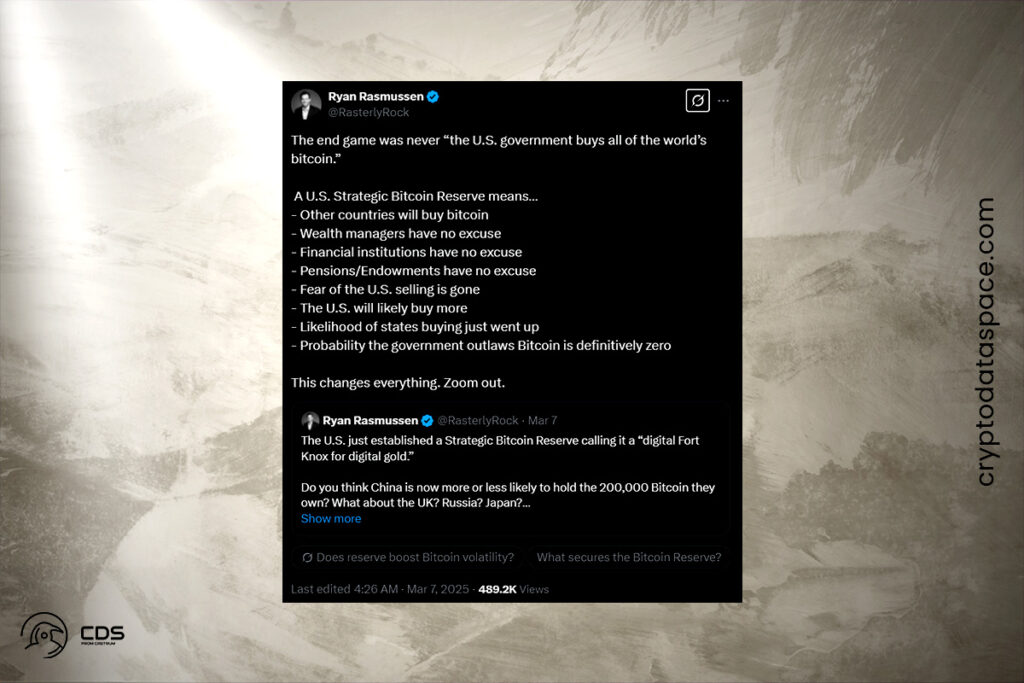

US Strategic Bitcoin Reserve means… Other countries will buy bitcoin… and Financial institutions have no excuse

Ryan Rasmussen, asset manager Bitwise’s head of research

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment