Featured News Headlines

YZY Token by Kanye West Surges to $3B, Drops After Insider Activity Allegations

Kanye West, also known as Ye, launched his new Solana-based YZY token this week — and it surged to a $3 billion market cap within just 40 minutes. However, alleged insider activity and liquidity concerns quickly triggered a sharp pullback.

Fast Rise, Faster Fall

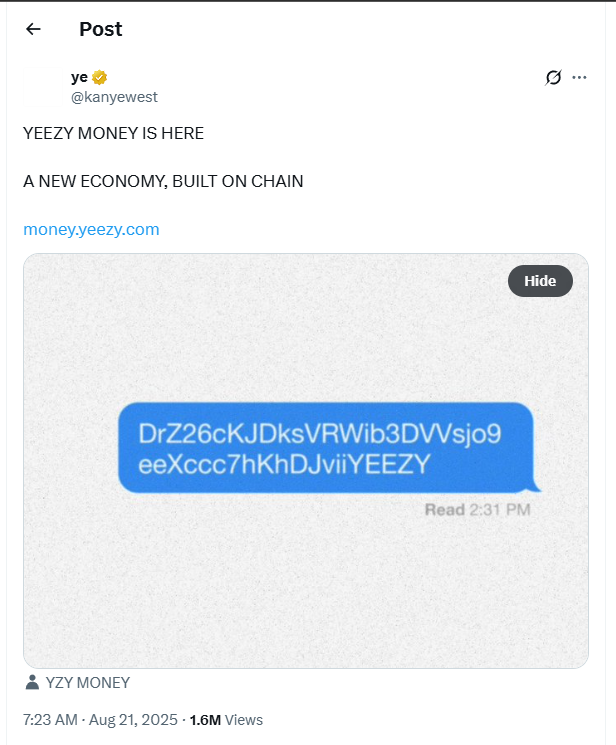

In a post on X, West announced the launch of YZY, calling it part of “a new economy, built on chain.” The token is designed to power the Yeezy Money ecosystem — a decentralized financial system built on blockchain. Shortly after launch, YZY’s market cap soared, but it soon fell back to around $1.05 billion, according to Nansen.

Questions Around Insider Activity

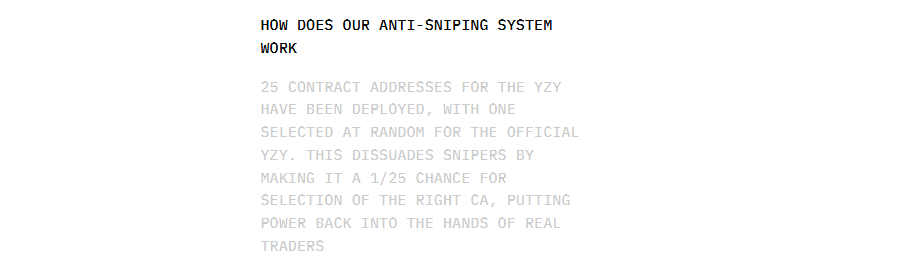

Despite efforts to deter sniping — such as deploying 25 contract addresses and choosing one randomly — on-chain data raised red flags. Analytics firm Lookonchain reported that insiders held up to 94% of the token supply, with one multisig wallet alone controlling 87% before dispersal. Concerns were also raised over limited initial liquidity, giving insiders the flexibility to manipulate price movements.

Traders Still Jumping In

While some traders lost money in early confusion — including one who mistakenly bought a fake version of the token — others made significant profits. One user reportedly earned $3.4 million, while another wallet saw a $6 million gain at the peak.

High-profile traders like James Wynn and Arthur Hayes confirmed they purchased YZY, citing past memecoin runs like Trump’s $TRUMP token, which jumped from $4B to $15B in 28 hours.

Mixed Outlook for Celebrity Tokens

YZY joins a growing list of celebrity-endorsed memecoins. However, as seen with Argentina President Milei’s short-lived LIBRA token, these projects remain controversial — especially amid growing regulatory scrutiny.

Comments are closed.