JELLY Market Turmoil: HyperLiquid Steps In to Protect Traders

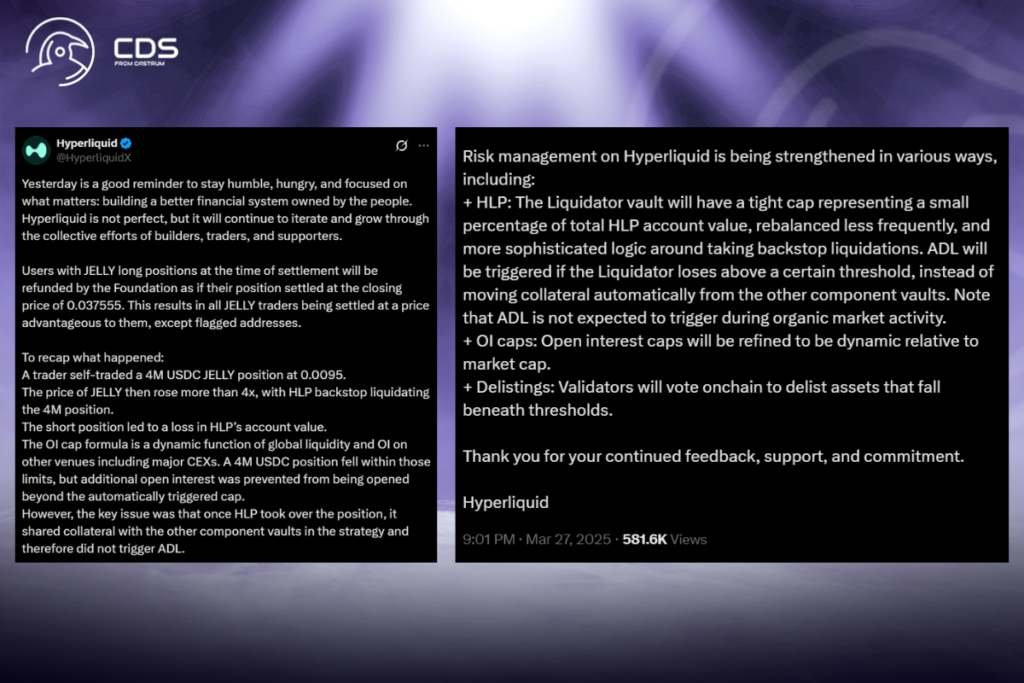

A major event affecting its Hyperliquidity Provider (HLP) vault prompted HyperLiquid to disclose several risk management enhancements. As part of its response, HyperLiquid’s Foundation will use a closing price of $0.037555 to reimburse customers who had long positions in JELLY at the time of settlement.

With the exception of individuals whose addresses have been marked, this action is anticipated to guarantee that every JELLY dealer receives a settlement price that benefits them. After validators discovered questionable market behavior, JELLY perpetual contracts were delisted, which led to the decision.

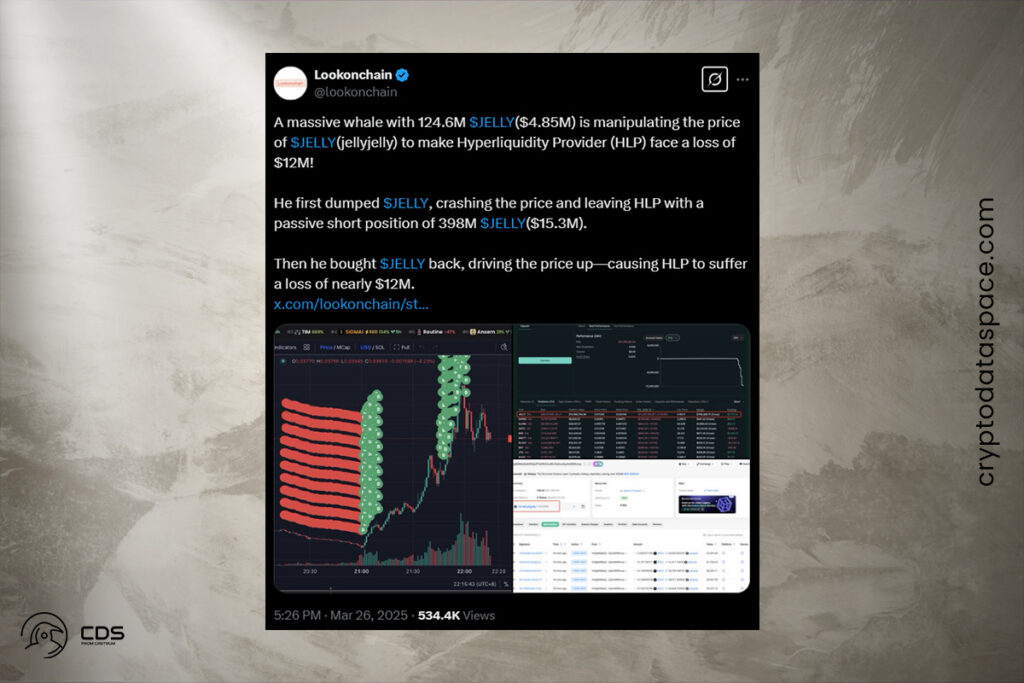

JELLY Price Manipulation Sparks $13.5M Loss for HyperLiquid’s HLP Vault

A trader allegedly manipulated the price of JELLY, causing significant unrealized losses for HLP, a market-making vault within HyperLiquid. The trader’s combination of on-chain spot purchases and a short position on HyperLiquid resulted in a liquidation event that shifted the short position to HLP. The trader owned $4.85 million worth of JELLY.

The trader’s aggressive purchases of JELLY on decentralized exchanges caused its price to soar, momentarily driving HLP’s unrealized losses to $13.5 million. Due to the extremely low liquidity of decentralized exchanges, the price fluctuation was especially apparent. The JELLY market was forced to close by HyperLiquid, and it settled at $0.0095, a substantial decrease from the $0.50 price that decentralized exchange oracles reported.

Bitget CEO Slams HyperLiquid’s JELLY Delisting, Warns of FTX-Like Risks

Bitget CEO Gracy Chen, meanwhile, accused HyperLiquid of handling the JELLY delisting poorly and cautioned that it might follow FTX’s example. The executive contended that decentralization was an issue in the decision, which was decided by a limited group of validators.

Chen also pointed out fundamental problems like a lack of transparency and mixed vault risks. The co-founder of BitMEX, Arthur Hayes, shared her concerns and questioned HyperLiquid’s claims of decentralization. Several significant adjustments to HyperLiquid’s risk management procedures have been made in response to these incidents:

- First, a smaller percentage of the entire HLP account value will be held in the Liquidator vault within HLP due to stricter constraints.

- Second, the Liquidator vault’s losses must surpass a specific threshold in order for the automatic deleveraging (ADL) procedure to begin.

- Third, in order to better reflect the state of the market, the platform will dynamically modify open interest (OI) caps according to market size.

- Finally, validators will be able to determine whether to delete assets that fall below specific levels through an on-chain voting system.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment