Solana ETFs See Major Inflows Despite Market Crash Fears

Solana has returned to levels not seen since June. The market sentiment isn’t as negative as the charts indicate, though. Derivatives data is beginning to suggest a tiny shift, although institutional inflows remain consistent. Even as market prices drop to multi-month lows, Solana ETFs continue to get consistent inflows.

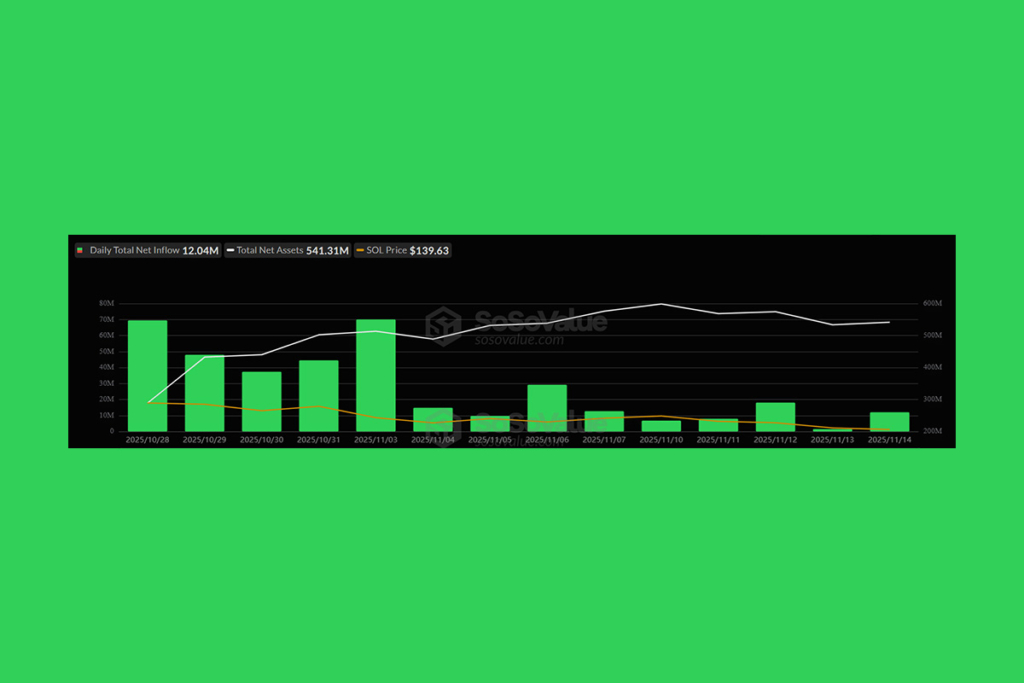

In the majority of sessions, daily net inflows were positive. On October 28 and November 3, they reached their highest points of more than $60 million. At the time of writing, total net assets were around $541 million. A significant investor walkout has not occurred. Although inflows have decreased recently, they have not stopped, and cumulative demand has persisted despite the overall decline in the market.

SOL Tests Critical Support Levels as Weekly Momentum Weakens

The weekly chart for SOL shows that price momentum is still declining, in contrast to the strength from ETF flows. At $176, cryptocurrency dropped below the 50-week EMA. The 100-week EMA was then tested at about $157. June was the last time this amount was observed. For the past two weeks, there has been a rise in trading volume. As a result, the pressure persists.

At the time of writing, the MACD continued its bearish crossover with deeper red bars emerging, and the RSI was getting close to oversold territory. The overall trend is still declining. To stabilize its long-term structure, SOL must return to the $150 average.

Solana Derivatives Show Stability as Open Interest Holds Firm

Derivatives data is stabilizing on top of that. Over the course of the week, total open interest (OI) stayed between $2.94 and $2.95 billion. There were no reductions caused by liquidation, notwithstanding a weakening of spot prices. This consistent OI indicates that leverage was not being unwound quickly. Funding rates returned to above zero after spending the majority of the time in negative territory. At the time of writing, it printed about 0.0084. After being careful for a few days, long-side positioning might be returning. Instead of further reducing risk, traders are starting to re-enter.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.