Crypto News – Hermetica Synthetic Dollar USDh to Support New Use Cases

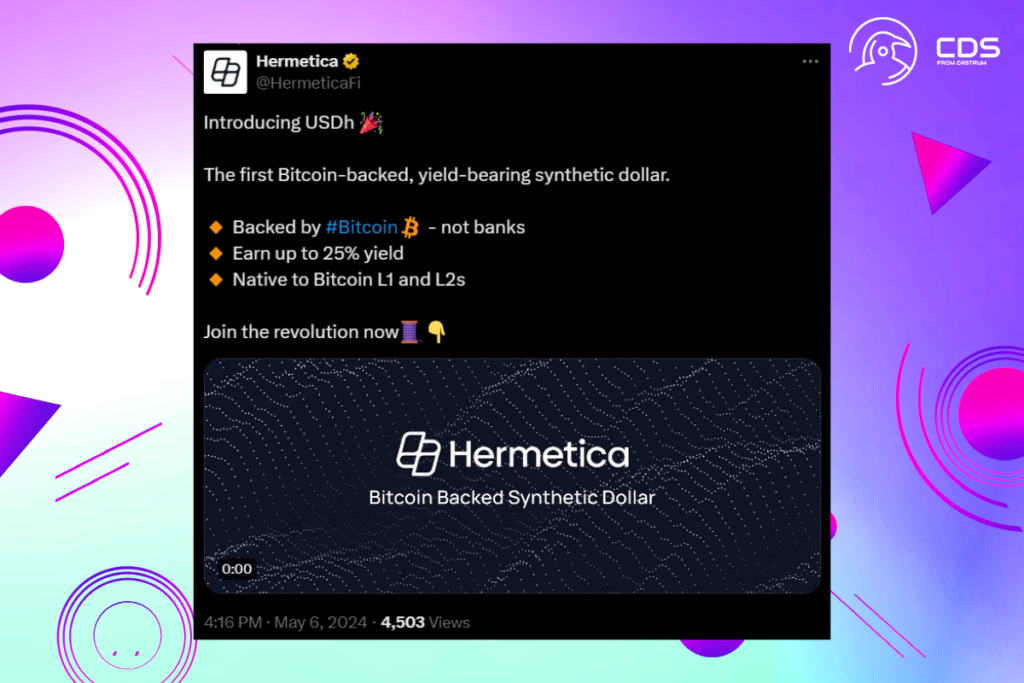

Crypto News – In the most recent advancement for Bitcoin-native DeFi, Hermetica has announced the introduction of the first-ever Bitcoin-backed synthetic US dollar with yield-generating capabilities. According to Hermetica’s statement, the new synthetic dollar, USDh, is scheduled for release in June and would provide consumers with yields of up to 25%. According to Jakob Schillinger, founder, and CEO of Hermetica Labs, the new synthetic dollar will allow Bitcoiners to hold and earn yield on their U.S. dollars without having to rely on the banking system or be exposed to non-Bitcoin-related products.

USDh will play a pivotal role in bringing increased liquidity and new use-cases to Bitcoin DeFi, allowing Bitcoiners to trade, lend, and transact in a dollar asset that is fully backed by Bitcoin.

Schillinger

Concerns about the Long-Term Sustainability of the 25% Yield

The first synthetic dollar backed by Bitcoin was introduced two months after Ethena’s USDe, which raised many questions about the protocol’s viability at the time of its inception with a 27.6% yield for holders. Since the 25% annual percentage yield (APY) on Hermetica’s USDh is significantly higher than the 20% yield provided by Anchor Protocol on TerraUSD (UST) prior to the algorithmic stablecoin issuer Terra collapsing in May 2022, similar worries may surface. The CEO of Hermetica claims that the yield is derived from future funding rates and is sustainable.

This Bitcoin-native yield fluctuates with the market’s demand for long leverage. Our backtest data from January 2021 to March 2024 shows an average APY of 11.71%. In the 2022 bull market, the annual return was 26.11%. The yield is sustainable due to the structural demand for long leverage in the Bitcoin futures markets.

Schillinger

Frequently Asked Questions About Hermetica Synthetic Dollar USDh

What is Hermetica?

A component of the larger BTCFi movement, Hermetica is a Stacks-native DeFi protocol on Bitcoin that seeks to provide DeFi features on the first blockchain network in history.

What Does the Synthetic Dollar Mean?

A digital financial construct or product that imitates the value of the US dollar without being directly backed by reserve dollars is known as a “synthetic dollar.”

Can USDh Sustain the 25% Yield for a Long Time?

Jakob Schillinger claims that the structural demand for long leverage in the Bitcoin futures markets is the reason why the yield is sustainable.

Leave a comment