European Luxury Stocks Surge: Richemont Reports Record Third-Quarter Sales

Following Cartier parent Richemont’s record quarterly sales on Thursday, European luxury equities surged, giving investors hope that the high-end market is finally rebounding from a downturn brought on by weak Chinese demand. The Swiss business reported that its third-quarter sales, which ended on December 31, increased by 10% year over year to $6.32 billion, or 6.15 billion euros. A drop in watch sales was counterbalanced by strong sales at its jewelry brands, Vhernier, Cartier, Van Cleef & Arpels, and Bucellati.

Richemont Reports Double-Digit Growth in Americas, Europe, and Japan Despite China’s Economic Struggles

Despite still facing difficult demand in China, Richemont reported double-digit growth in the Americas, Europe, the Middle East & Africa, and Japan, as well as a slower fall in Asia Pacific. Hong Kong, Macau, and Mainland China had an 18% decline in sales. Sales of luxury brands have been driven by China in recent years, although domestic customers’ purchasing has been impacted by the country’s economic crisis.

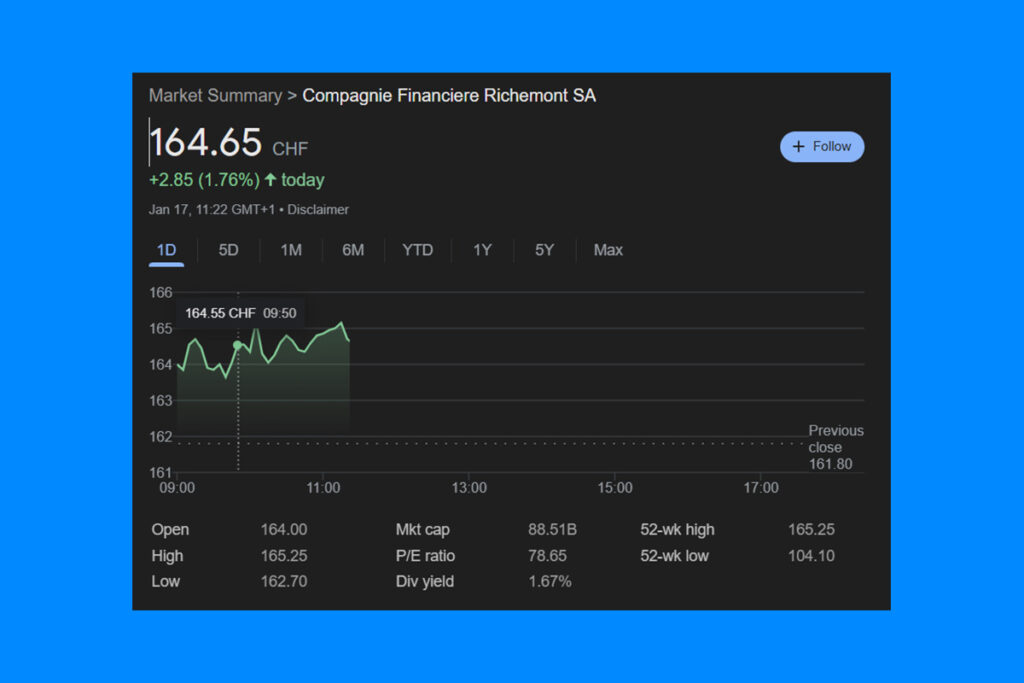

However, shares of Gucci owner Kering, Birkin handbag manufacturer Hermes, LVMH, which produces Louis Vuitton handbags and other luxury items, and Burberry, a British company that makes trench coats, also soared on the news. Burberry was up more than 5% in London, while Richemont’s shares increased 15% in Swiss trading. Hermes, Kering, and LVMH were all up at least 5% in Paris.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment