European Banks Ignore Crypto Demand: Investors Think So!

According to a recent poll by the crypto investing platform Bitpanda, less than one in five European banks and financial institutions provide digital asset solutions. This suggests that they may be grossly underestimating the demand for cryptocurrency services.

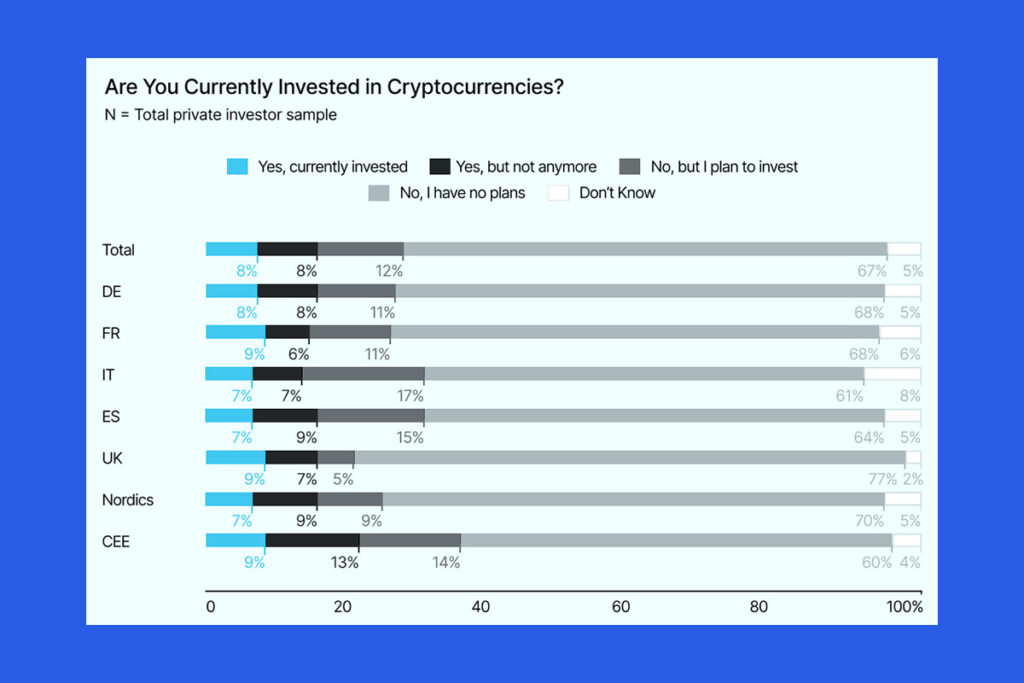

More than 40% of business investors currently own cryptocurrencies, and another 18% intend to do so in the near future, according to a study that polled 10,000 retail and business investors in 13 European nations. However, only 19% of financial institutions polled stated that their customers had a high need for cryptocurrency products. This indicates a 30% discrepancy between perceived and actual investor interest.

80% of Banks See Crypto’s Importance, But Only 19% Offer Services: So Why Are They So Slow to Act?

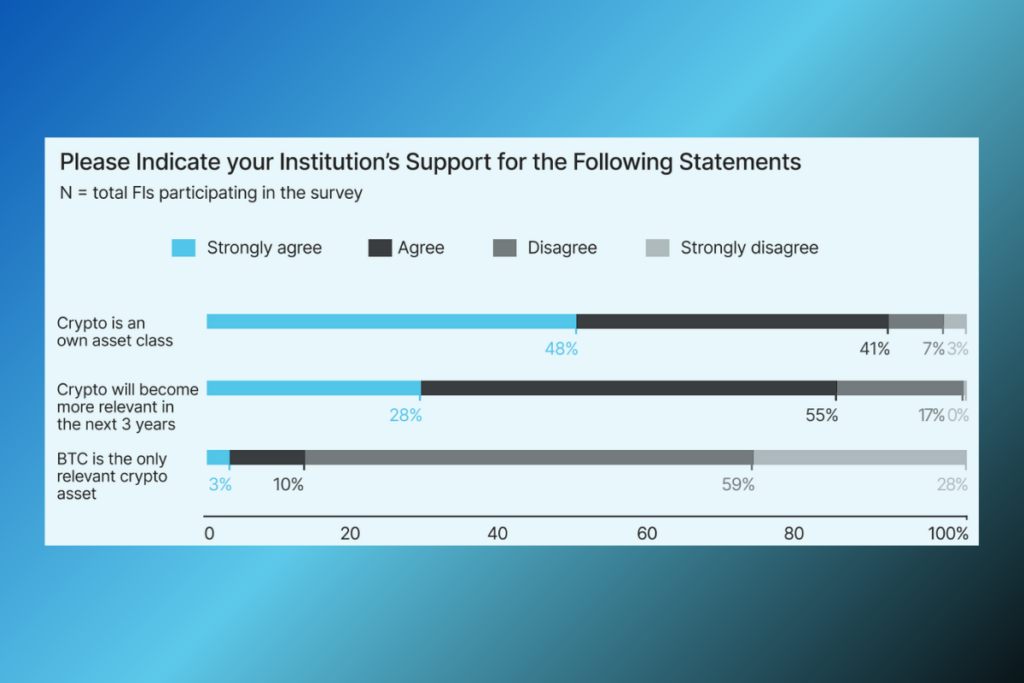

Furthermore, despite the fact that more than 80% of financial institutions in Europe recognize the growing significance of cryptocurrency, only 19% of them already provide crypto services. Nevertheless, 18% of financial institutions questioned said they plan to increase the range of crypto services they offer, especially those about crypto transfers. This indicates that some European banks are acknowledging the rising demand for digital assets.

Financial institutions in Europe know that crypto is here to stay, but most are still not offering services that match investor demand,

Lukas Enzersdorfer-Konrad, deputy CEO of Bitpanda

He stated that the primary obstacles to adoption are internal, such as a lack of resources or knowledge, rather than external, such as regulations.

These can be overcome, and the challenge to financial institutions is clear: go and check your revenue outflows. You can see where customers are moving their money; you can see just how real the demand for crypto is.

Enzersdorfer-Konrad

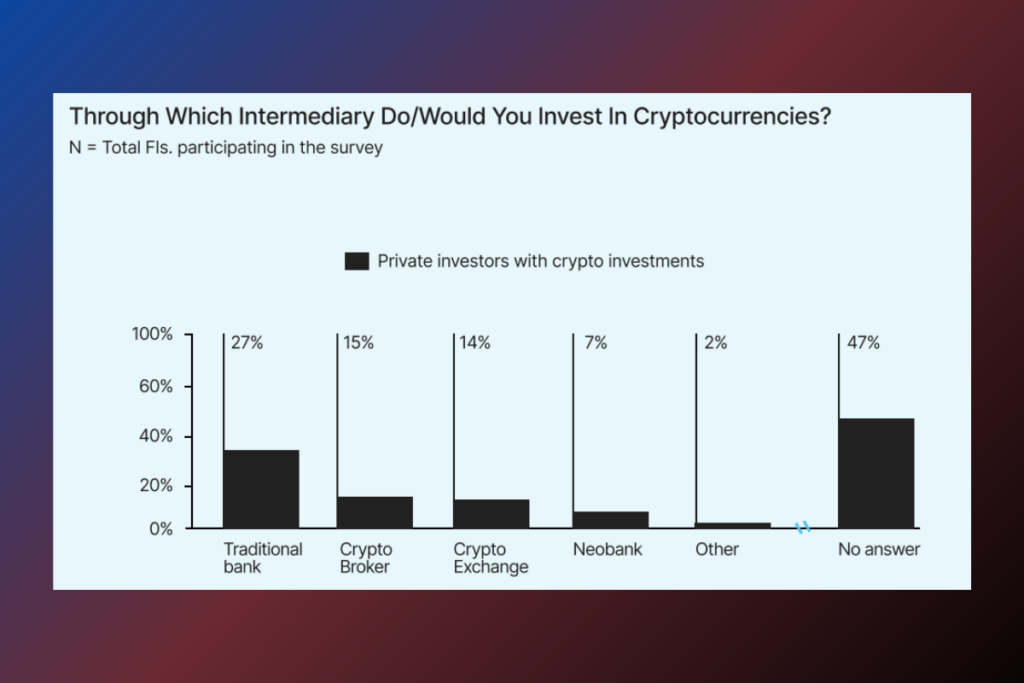

Traditional Banks Risk Losing Investors by Ignoring Crypto

Given that 27% of survey participants would rather invest in cryptocurrencies through a regular bank and only 14% would pick a crypto exchange, more bank-sponsored cryptocurrency products could boost the adoption of cryptocurrencies in Europe. By contrast, traditional banks were only the third most popular alternative (27%), with 36% of business investors choosing to invest through an exchange. According to Enzersdorfer-Konrad, banks and other financial institutions that do not integrate cryptocurrencies run the danger of losing a sizable portion of their revenue from both corporate and individual investors.

Financial institutions that delay integrating crypto services risk losing revenue to their competition or crypto native companies. With the EU’s Markets in Crypto-Assets Regulation (MiCA) providing regulatory clarity, the time to act is now,

Enzersdorfer-Konrad

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment