Ethereum’s Reign Shaken, But Will It Last?

Solana has achieved a significant victory in the tokenized stock market. Ethereum flipped when the network’s trading volume soared above $800 million. This is significant in a field where Ethereum has long held the top spot. However, for the time being, it’s unclear if Ethereum will recover or if Solana can hold onto its lead.

Ethereum Left Behind as Solana Captures 60% of Tokenized Stock Transfers

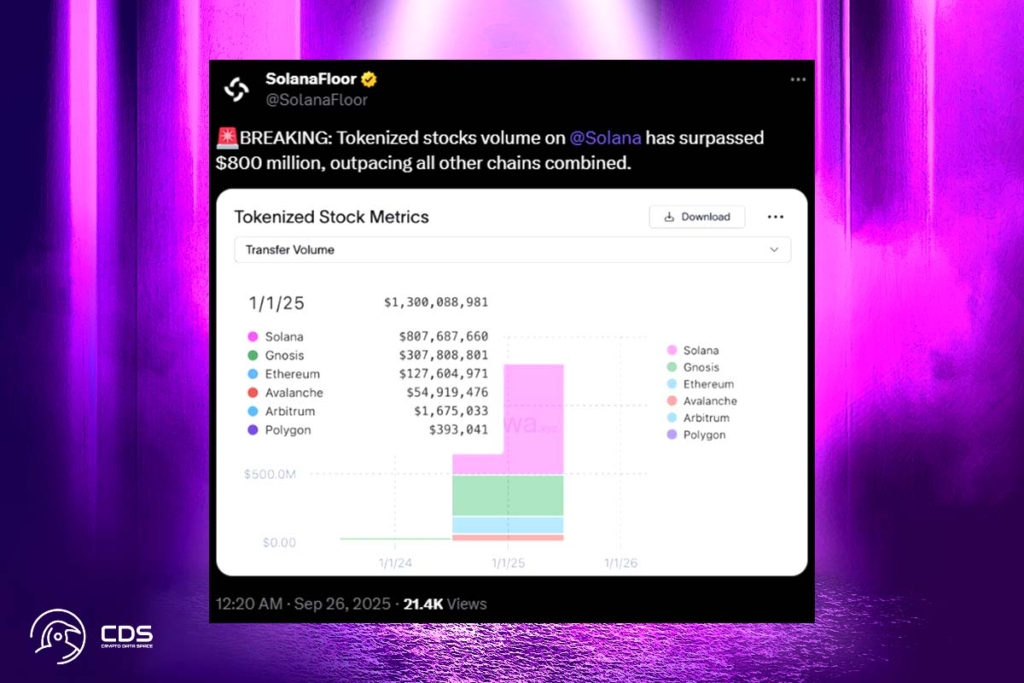

In tokenized stock volumes, Solana gains the majority of the shares. Solana alone was responsible for almost $807 million of the roughly $1.3 billion in tokenized stock transfer volumes. This indicates that the network outperformed all other chains combined, processing more than 60% of the market. Ethereum trailed with just $127 million, while Gnosis came in second with $307 million. In contrast, Polygon, Arbitrum, and Avalanche hardly registered. Once held by Ethereum, this represents a significant change in market leadership.

Solana Dominates Tokenized Stocks but Faces Bearish Price Action

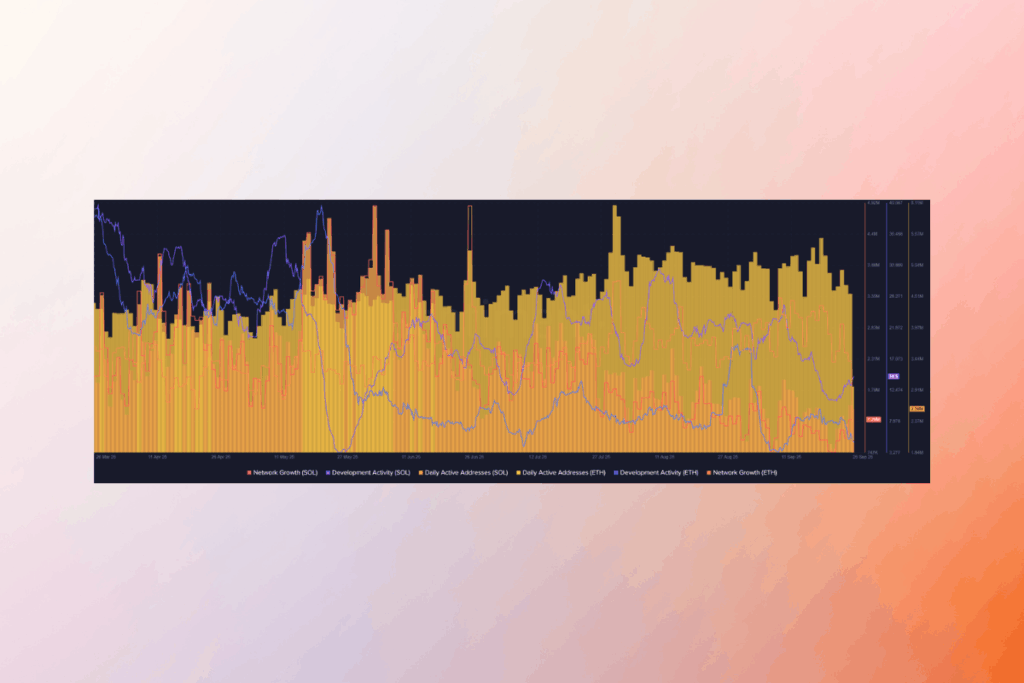

The reason Solana has outperformed Ethereum in tokenized stock volumes is demonstrated by the on-chain data. In contrast to Ethereum‘s 747,000 daily active addresses, Solana had more than 2.5 million at the end of September. Solana also benefited from network growth, adding about 1.3 million additional addresses, surpassing Ethereum’s slower growth. The biggest distinction seems to be Solana’s higher user involvement, even though both blockchains continued to see consistent development activity. However, in the short term, Solana’s price action has become bearish, notwithstanding its supremacy in tokenized stock activity.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.