Ethereum Shows Signs of Life: Smart Investors Are Quietly Accumulating

In the last week, the price of Ethereum (ETH) has increased by roughly 5.03%, suggesting a slight recovery. However, the daily chart still shows the token down more than 2%, indicating that selling pressure hasn’t completely subsided. The failure of Ethereum’s October 27 breakout attempt can be explained by this combination of daily weakness and short-term rebound. Still, a subset of investors is discreetly getting ready for another rebound.

ETH Buyers Hesitate: Accumulation Drops and Exchange Outflows Decline

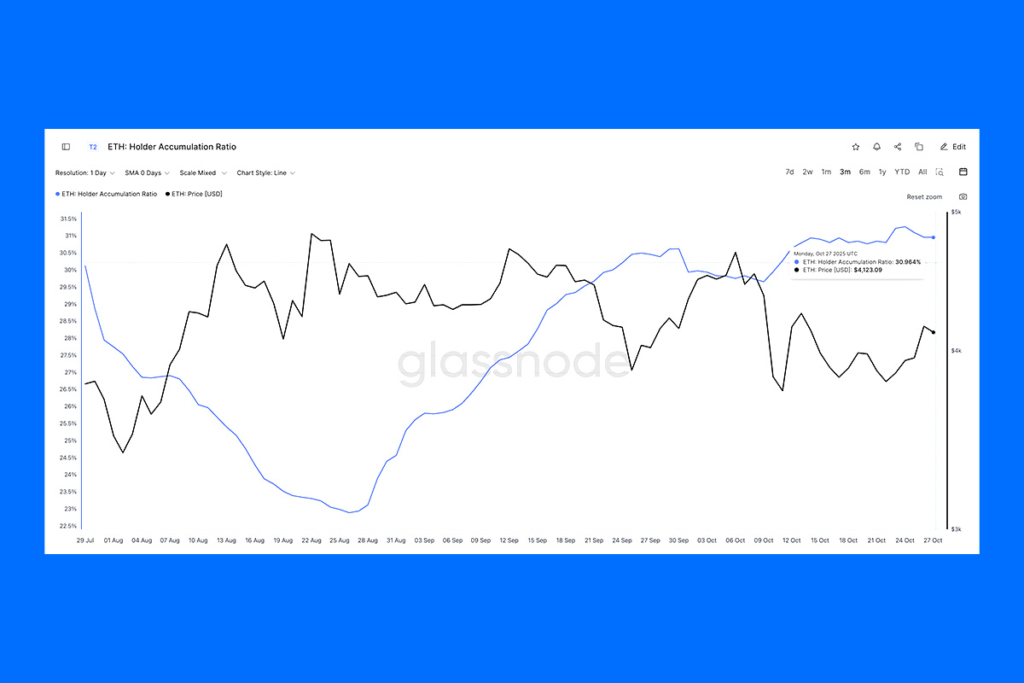

Slowing accumulation among active holders is the core cause of Ethereum‘s most recent rejection. The number of wallets gaining and decreasing their ETH holdings was measured by the accumulation ratio, which decreased from 31,278 to 30,964. Thus, it fell 1% from its peak of three months. This decline indicates that, despite the price increase, fewer addresses are adding ETH. This implies that traders are becoming cautious or holding off for a better opportunity.

This change in sentiment is also confirmed by exchange flows. The amount of ETH that is leaving exchanges is indicated by the exchange net position change, which has decreased. The outflows on October 15 were close to 1.94 million ETH. But by October 27, they had shed 43% of their value, to 1.10 million ETH. Holdings are typically leaving more ETH on exchanges as outflows decrease. This indicates that short-term selling interest is increasing. Together, these two considerations explain why Ethereum’s breakout effort failed to maintain pace.

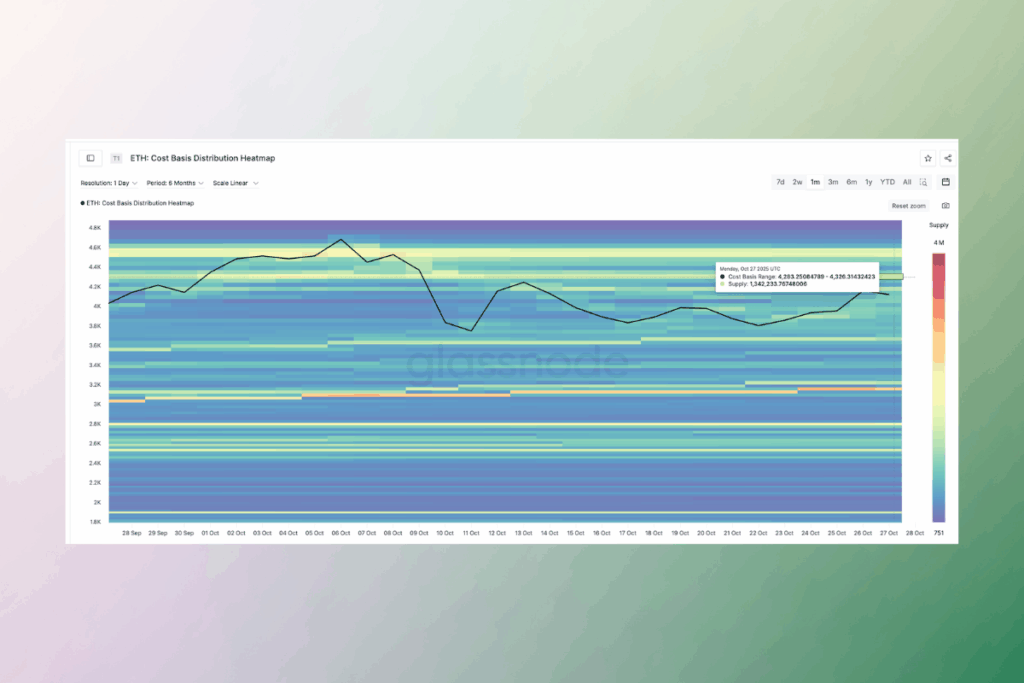

ETH Breakout Stalls as 1.34M Coins Cluster at Key Price Zone

Where big quantities of ETH were last bought is displayed in the cost-basis heatmap. It shows that the strongest supply cluster, which amounts to almost 1.34 million ETH, is between $4,283 and $4,326. The $4,254–$4,395 region on the chart is the same area where Ethereum’s advance paused. Therefore, previous investors may begin selling to lock in profits if ETH approaches this region, increasing pressure. Ethereum’s upward movement is probably going to keep failing unless this barrier is removed.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.