Ethereum Price Plunges: What You Need to Know

Ethereum Price– Ethereum (ETH) has taken a significant hit, experiencing an 8% drop in just one day, pushing the price below the $2,500 mark. This marks a challenging period for the world’s second-largest cryptocurrency, as it grapples with one of its worst February performances in history. With a decline of over 23% so far this month, ETH is heading towards potentially recording its worst February in its history.

The cryptocurrency market, in general, is dealing with a correction, with Ethereum being no exception. Alongside broader market struggles, Ethereum’s price has been further dampened by the recent hack on the Bybit exchange, which has sparked a wave of negative sentiment surrounding the coin. Despite these hurdles, market analysts remain cautiously optimistic about Ethereum’s future prospects.

On-chain data from SpotOnChain suggests that Ethereum’s price might end the month on a sour note if it falls below the $2,400 level. Historically, February has been a month where Ethereum performs well, with only a single recorded decline in 2018. However, the current 23% drop presents a real threat to breaking this trend. If ETH’s price falls further, it could mark an unprecedented low for the month.

Several external factors are influencing Ethereum’s price action. The broader market has been dealing with macroeconomic pressures, including new tariffs imposed by the Trump administration, which have added to the uncertainty in the market. This has contributed to Ethereum’s struggles, but analysts believe that Ethereum could still recover, depending on how the rest of the market reacts.

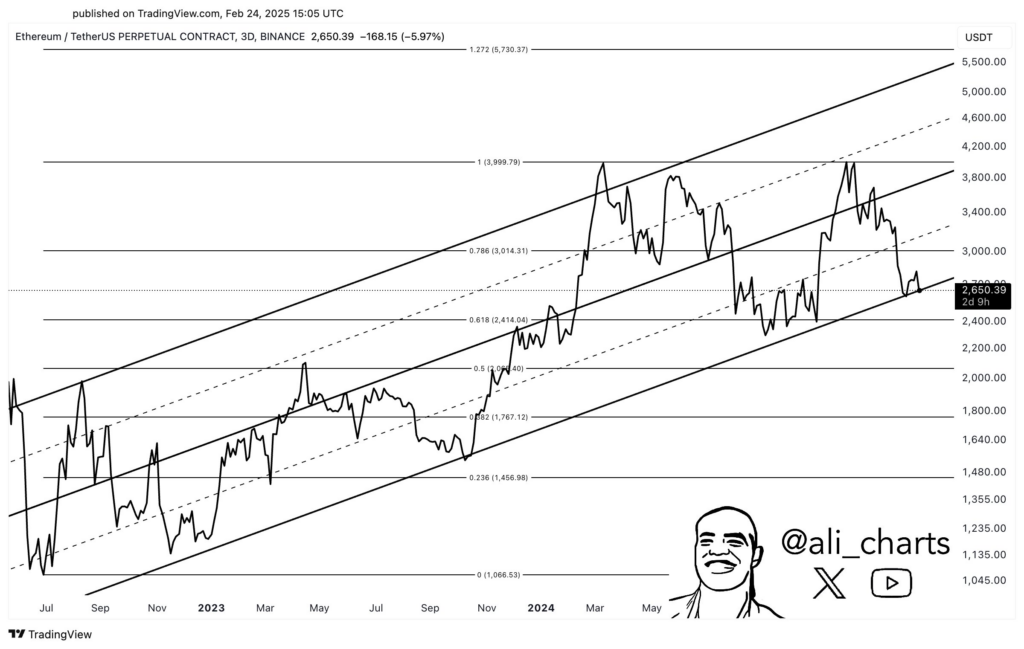

As of the latest update, Ethereum’s price is trading 8.44% down at $2,491, with daily trading volumes spiking by 30%, surpassing $30 billion. According to crypto analyst Ali Martinez, the much-anticipated “altseason” could be in jeopardy if Ethereum fails to maintain key support levels, particularly around $2,600. This level is crucial for preventing a further fall beneath the upward-trending channel that has been guiding ETH’s price action.

Analysts Remain Optimistic Despite Declining Price

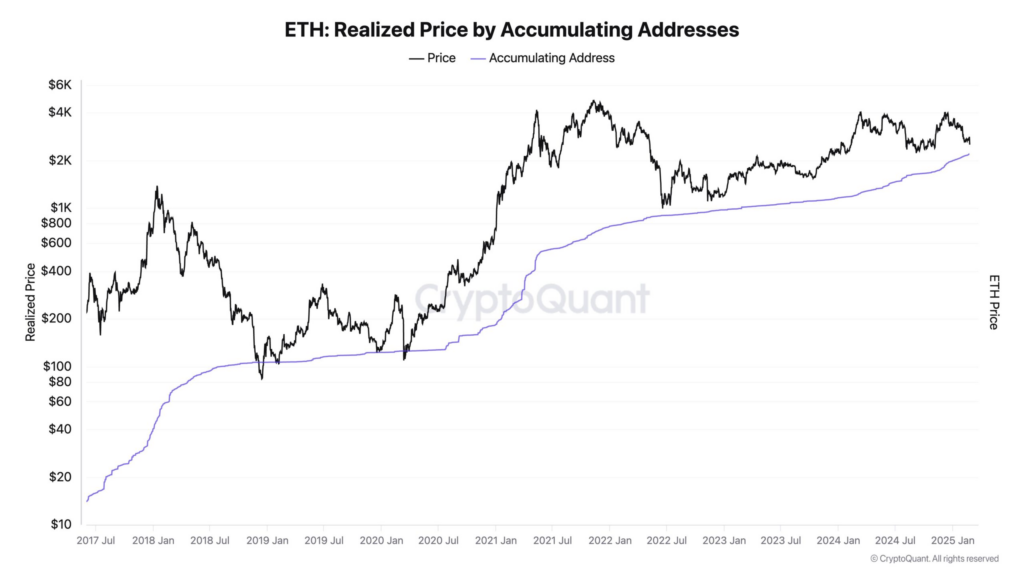

Despite the significant drop in Ethereum’s price, on-chain data reveals that investor interest in Ethereum remains strong. Large Ethereum holders, or “whales,” have been steadily accumulating more ETH. Data from CryptoQuant shows that addresses holding between 10,000 and 100,000 ETH have increased their balances by 24% over the past year. The cost basis for these addresses stands at $2,199, while Ethereum’s current price is around $2,505.

This increase in whale activity indicates that large investors are continuing to accumulate, even amid market downturns. The inflow of funds from smaller wallets holding less than 1,000 ETH suggests a redistribution of supply within the Ethereum ecosystem. The steady accumulation by whales could act as a stabilizing force, providing some optimism for Ethereum’s price moving forward.

Moreover, Ki Young Ju, CEO of CryptoQuant, emphasized that the recent Bybit hack has not resulted in significant selling pressure on Ethereum. According to Ju, the hack has not caused enough panic selling to negatively affect the long-term outlook for Ethereum. Ethereum continues to dominate the stablecoin market, controlling 56% of the total stablecoin market capitalization, and analysts believe this dominance will help support its price in the future.

Ethereum’s Potential for Future Growth

Looking ahead, there are several factors that could lead to a rebound for Ethereum. The approval of Ethereum-based spot ETFs has provided a regulatory tailwind for the asset, and this could pave the way for a “Large Cap ETF altseason,” potentially sparking a period of significant gains for ETH. Additionally, Ethereum’s upcoming Pectra upgrade, currently being tested on the Holesky testnet, could be a catalyst for further growth.

Ki Young Ju also predicts that the easing of crypto regulations by the Trump administration could lead to more firms adopting Ethereum-based stablecoins and smart contracts in 2025, further driving demand for ETH.

Bybit Makes Moves to Stabilize After Hack

In addition to the developments with Ethereum, the Bybit exchange is taking swift action to stabilize after the hack that occurred over the weekend. Bybit has repaid a 40,000 ETH loan, valued at $100 million, to fellow exchange Bitget. This repayment, completed in just three days, showcases Bybit’s commitment to handling its financial obligations promptly after the hack.

Meanwhile, the hackers behind the Bybit attack have laundered a significant portion of the stolen Ethereum. Approximately 89,500 ETH, worth around $224 million, has been laundered in the past 2.5 days, representing 18% of the total 499,000 ETH stolen. The hackers are reportedly planning to exchange the remaining ETH for other assets like Bitcoin (BTC) and DAI within the next two weeks. The primary tool for their cross-chain asset exchanges appears to be THORChain.

Ethereum’s Resilience Amidst Market Challenges

While Ethereum faces numerous challenges, including a potential worst-ever February and a broader market correction, there are reasons to remain optimistic. The accumulation of ETH by large investors, the approval of Ethereum spot ETFs, and the upcoming Pectra upgrade all provide a strong foundation for future growth. Additionally, despite the recent hack and its impact on sentiment, Ethereum continues to maintain its dominance in the stablecoin market, signaling its resilience.

As the market continues to evolve, Ethereum’s potential for recovery and long-term growth remains intact. However, it’s important for investors to stay vigilant and monitor critical price levels to navigate through this volatile period.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment