Ethereum Momentum Rising: Breakout or Fakeout?

After emerging from its recent consolidation period, Ethereum (ETH) is displaying renewed bullish momentum and is moving toward important resistance levels. Retail and institutional interest in ETH has increased since it regained important exponential moving averages (EMAs) on the daily chart. If macro conditions continue to be favorable, the present rally may continue, as shown by the increase in buying volume and strengthening on-chain metrics. In order to test the psychological barrier of $4,000, traders are currently waiting for a clear rise above $3,900.

ETH Holds Key EMA Support: Bulls Target $4K+ Rally

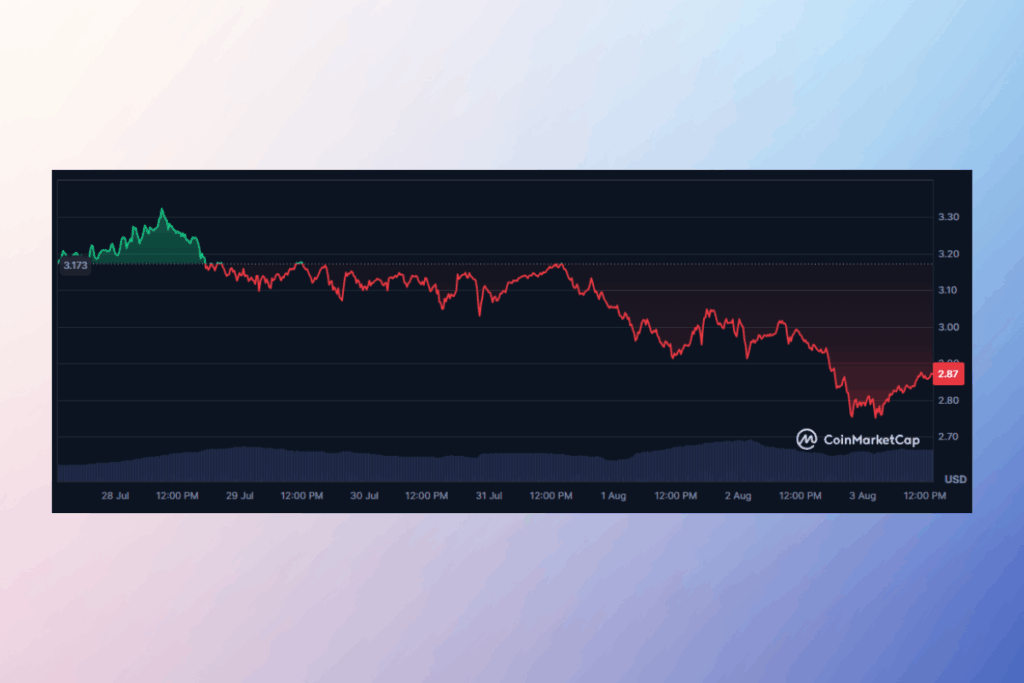

A string of higher lows in ETH’s recent price action indicates further bullish pressure. The token is now functioning as a strong dynamic support between $3,808 and $3,821, having recaptured the 20, 50, 100, and 200 EMA cluster. The momentum toward the $4,050–$4,100 region might be accelerated with a clear breakout over the $3,920–$3,960 supply zone. There is still potential for further rise before the Relative Strength Index (RSI) approaches overbought conditions because it is still in neutral territory.

Institutional Inflows Fuel Ethereum’s Next Potential Rally

Increased open interest in ETH futures is indicative of a growth in leveraged long holdings, according to data from derivatives markets. Consistent inflows into spot Ethereum ETFs have also demonstrated the rise in institutional confidence. Stratified positioning ahead of possible macro-driven catalysts, such as changes in U.S. interest rate policy or impending Ethereum network upgrades, is indicated by whale accumulation patterns. ETH may be preparing for a protracted bull run into Q3 2025 if buying pressure continues.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.