Ether Whales Make Massive Move: What Does This Mean for the Price?

Ethereum whales are causing quite a stir. In just three days, Bitmine, an ETH treasury firm, purchased almost 252,000 ETH, increasing its holdings to an incredible $8.84 billion. Moreover, they are not alone. Other major players are also stacking Ethereum. There could be a short-term decline, analysts warn. There are, nevertheless, grounds to think that this is just the start of something tremendous.

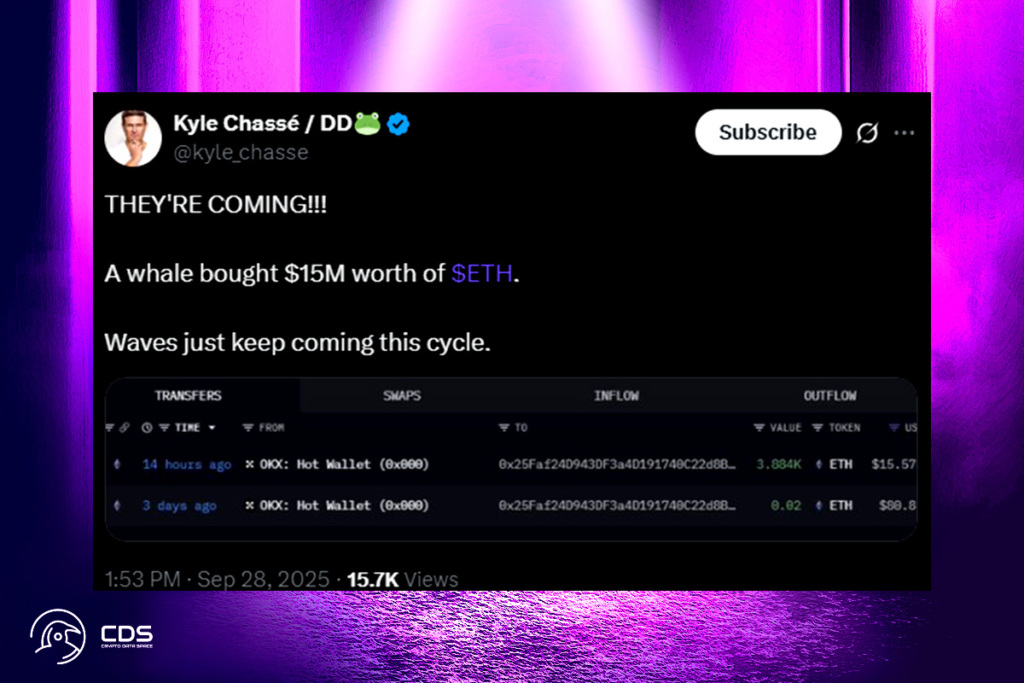

Ether ETFs See Record Outflows as Whales Accumulate Billions in ETH

The recent purchase of $15 million worth of Ethereum by a whale is not unique. In just three days, Bitmine, owned by Tom Lee, went on a shopping binge and purchased 252,441 ETH. It now has approximately 2.2 million ETH, or $8.84 billion, in total. The other major development is the re-entry of whale wallet 0xE37F, which, only five months ago, sold 1,857 ETH for $2,251. It acquired 1,501 ETH earlier today for $6.17 million at $4,114 apiece.

However, Ethereum ETFs are exhibiting the reverse pattern as whales are scooping them up. This week, the products experienced substantial outflows, totaling $795.56 million. Since the beginning, this has been the largest weekly loss. Much of the momentum that had been accumulated in August and early September was destroyed by this abrupt reversal. Inflows had raised overall net assets to above $30 billion during that time.

Analyst Forecast: ETH’s Q4 Performance May Outshine Expectations

Although Ethereum has experienced many ups and downs this year, Q4 may provide clarity. ETH’s Q4 gains more than doubled, and prices reached all-time highs for the first time since the end of Q3, thus strongly. Ted Pillows, an analyst, claims that ETH is in a healthy correction following a nearly 250% recovery from its low, which is typical during large uptrends. After this pullback is complete, ETH may rise comfortably above $10,000 in the following leg if the pattern continues. The upcoming months could be pivotal because seasonal data indicates strong finishes, and the price is still inside its long-term climbing path.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.