Ether Rockets Past Bitcoin in Q3: Can ETH Hold Momentum Into Q4?

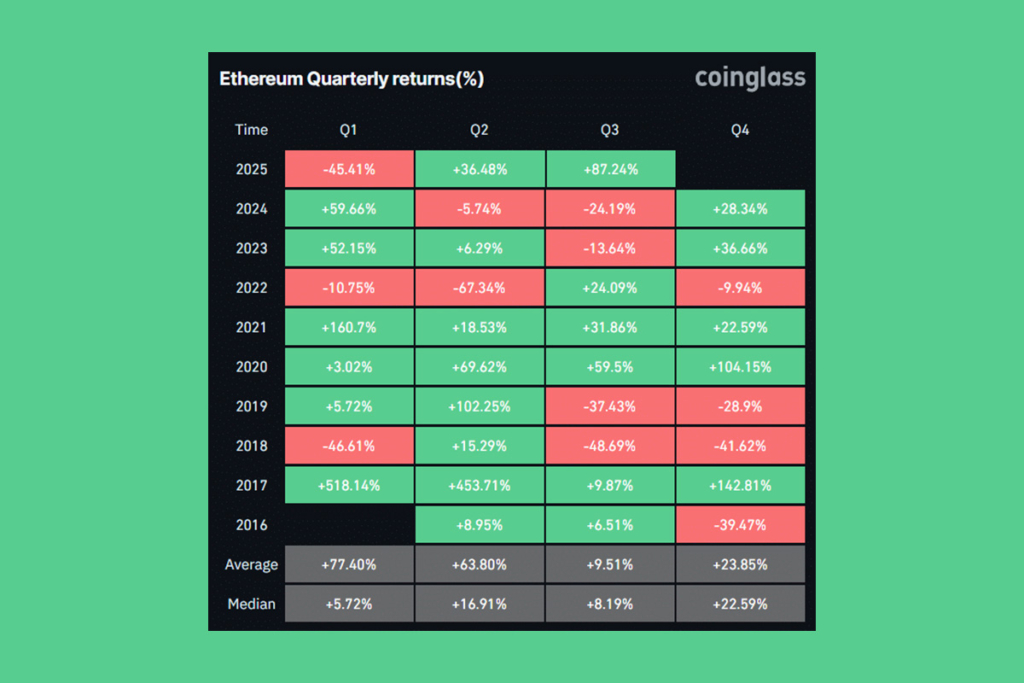

With a third-quarter return on investment (ROI) of 86.41% compared to Bitcoin’s meager 7.87%, Ethereum (ETH) produced a historic third quarter, outperforming BTC by almost 12 times. Due primarily to rotation flows as capital moved from Bitcoin into Ethereum, the ETH/BTC ratio jumped 72%, its largest quarterly rise since April 2021. Q4 poses a historical challenge: Bitcoin-led flows have a tendency to regain the focus, and ETH needs to hold crucial levels to sustain its momentum, even though Q3’s performance demonstrates Ethereum’s dominance.

Ethereum Outpaces Bitcoin With 0.042 ETH/BTC Ratio

The main factor driving Ethereum‘s record-breaking gains in Q3 was rotation, much like in the 2020 cycle when ETH jumped 59.5% and BTC gained 17.97%. During this rotation, Bitcoin dominance (BTC.D) decreased, and about 8 million ETH moved into smart money cohorts. At 0.042, the ETH/BTC ratio is currently testing the crucial 0.045 resistance. Such rotation signals historically show great short-term momentum, but they must defy conventional seasonal tendencies that favor Bitcoin in order to sustain it into Q4.

Ethereum Prepares for Q4 Showdown with Bitcoin

Bitcoin has historically performed better in Q4, frequently delivering returns that are more than three times that of ETH. As a result of flows back into Bitcoin, the ETH/BTC ratio averaged a net loss of 13.05% over the last two Q4 cycles. With a record 20 million ETH, Ethereum’s 10k–100k whale cohort is showing significant accumulation ahead of Q4. While macro swings continue to impact BTC flows, ETH needs to break above the 0.045 resistance on the ETH/BTC pair in order to reverse the seasonal script. Whether Ethereum can sustain its relative strength and produce another exceptional quarter will be eagerly watched by investors.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.