Ether Gas Fees Hit Historic Lows: Swap for Just $0.11!

On Sunday, gas prices on the Ethereum layer-1 blockchain fell to a mere 0.067 Gwei. This occurred during a period of calm in the cryptocurrency markets after the catastrophic market meltdown in October. According to Etherscan, Ethereum’s transaction fees are currently as follows:

- A swap costs about $0.11

- NFT sales carry a fee of $0.19

- Bridging assets to another blockchain costs $0.04

- On-chain borrowing costs just $0.09

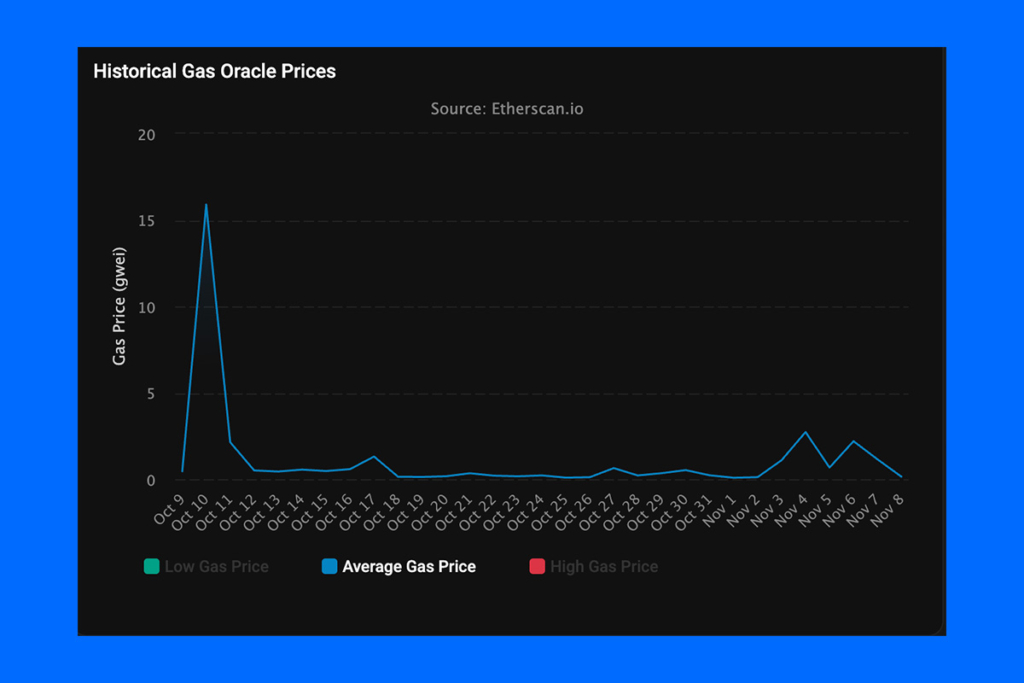

On October 10, the day of the market flash crash that resulted in certain altcoins losing more than 90% of their value in a single day, Ethereum network transaction fees reached a recent high of 15.9 gwei. But on October 12, fees were returned to just 0.5 gwei. For most of October and November, it stayed considerably below 1.

Critics Warn: Ethereum’s Minimal Gas Fees Could Threaten Security

Investors and traders may take advantage of the low transaction fees to execute on-chain transactions on the base layer. However, analysts and crypto industry executives warn that the excessively low fees might spell trouble for the Ethereum ecosystem. For instance, following the Ethereum Dencun upgrade in March 2024, transaction fees for Ethereum’s layer-2 scaling networks dropped sharply. As a result, Ethereum’s overall revenue declined by nearly 99%.

The current low network costs, according to critics, are not sustainable for any blockchain. They caution that by lowering the incentives for validators or miners to process transactions and safeguard the network, low revenue could pose financial and security issues. Low fees may be a sign of lower network activity because fees are based on user demand. In a similar vein, poor sales could indicate that consumers are abandoning a specific blockchain.

Ethereum Faces Internal Competition from Its Own Layer-2 Networks

Specifically, Ethereum has chosen a scaling approach that relies on an ecosystem of distinct layer-2 networks. This strategy is a two-edged sword, according to research from cryptocurrency exchange Binance. Ethereum can scale and compete with more recent, high-throughput chains thanks to layer-2 networks, but they also eat into base layer revenue. Ethereum now faces more competition inside its own ecosystem as a result.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.