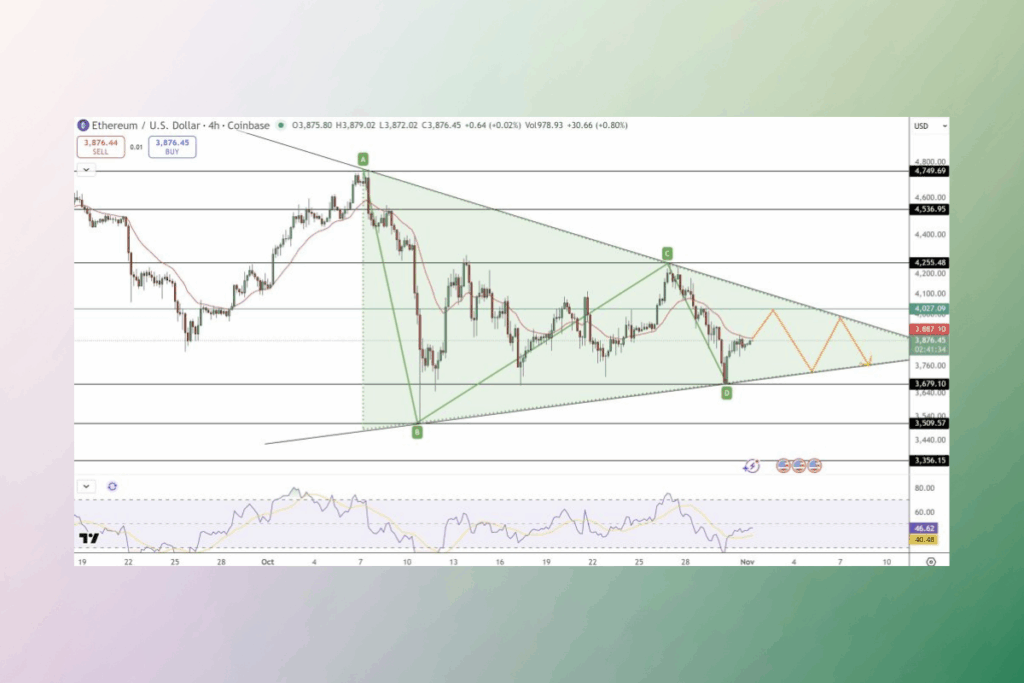

ETH Eyes Symmetrical Triangle Breakout: Market Balance Remains Stagnant

Ethereum (ETH) is currently trading close to $3,887 during the European session. As traders contemplate whether the next move will be a breakout or a pullback, it displays modest increases. ETH remains the second-largest cryptocurrency, with a market capitalization of $467.7 billion. But since mid-October, a symmetrical triangular pattern has been building inside, for which its price action has significantly tightened.

As volatility compresses between crucial resistance at $4,255 and support around $3,680–$3,750, this setup reflects increased indecision. Sellers keep control close to the top, while buyers continue to defend the lower limit. The market is now stagnant. Traders are keeping a careful eye on Ethereum to see if its next big move will cause the balance to shift higher or downward.

Ethereum Traders Hesitant as RSI Rebounds From Oversold Levels

Due to its sideways trading within a symmetrical triangle pattern, the Ethereum price prediction stays neutral. Ethereum’s 20-period EMA has flattened, indicating traders’ hesitation, while the RSI, which is positioned close to 46, is beginning to rebound from oversold circumstances. Doji candles and recent spinning tops indicate short-term uncertainty. Nonetheless, accumulation appears to be ongoing beneath the surface based on the series of higher lows since September.

Ethereum’s Symmetrical Triangle Signals Major November Move

Bullish momentum might be confirmed by a move above $4,030. Prices may move toward $4,255 as a result and then toward $4,536, the next resistance level. A break below $3,680, on the other hand, might signal new selling pressure and reveal downside targets around $3,509 and $3,356, which correspond to the larger ascending channel that is evident on longer timeframes. Moreover, Ethereum’s current structure is viewed by market participants as a coiling spring, poised for a significant move in November. In the past, symmetrical triangles that preceded a breakout frequently resulted in a confirmed 10–15% surge.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.