ENA Explodes in July: Here’s Why This Rally Might Just Be Getting Started

With a closer look, July saw a strong crypto risk-on move. A little over $200 billion went into cryptocurrencies, excluding Ethereum (ETH) and Bitcoin (BTC). With a 130% monthly gain and a position as one of the best momentum plays in the current market cycle, Ethena (ENA) stood out in this respect. But zoom out, ENA’s superior performance is not a short-term move. You shouldn’t ignore the rise since USDe, Ethereum’s native yield-bearing stablecoin, is actively propelling it, according to AMBCrypto.

USDe Becomes the Third Largest Stablecoin with a $2 Billion Inflow

With $2 billion in inflows this month, Ethena’s USDe, a dollar-pegged stablecoin, has increased its market capitalization to $7.3 billion, ranking third in terms of size behind USDT and USDC. Furthermore, its expansion isn’t arbitrary. It is motivated by yield. Ethena is providing one of the highest risk-adjusted returns in DeFi with its 10% APY on sUSDe, its staked version.

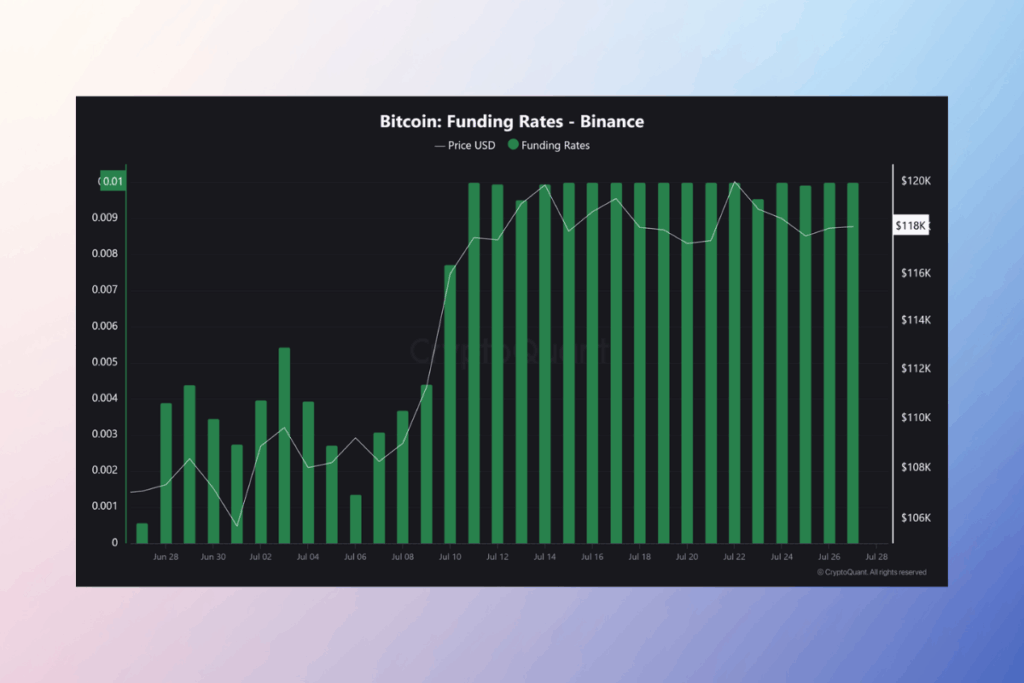

The accompanying figure shows that sUSDe yields recently exceeded 10.29%, which is a direct result of Ethena‘s on-chain revenue production. To put it another way, money is moving into the USDe seeking yield as well as stability. Strong protocol revenue is supporting that momentum.

No T-Bills Needed: Ethena Redefines Stablecoin Strategy with On-Chain Profits

As AMBCrypto noted, as part of its reserve strategy, USDT and USDC rotate the yield they receive from their U.S. Treasury holdings into Bitcoin. Ethena engages in a different activity. It is not dependent on T-bills. Rather, it capitalizes on the volatility of the cryptocurrency market to produce on-chain yield by capturing funding premiums.

Bitcoin traders who trade perpetual futures long while the market is bullish are required to pay a funding charge to those who are shorting the market. Ethena collects that funding as yield, taking the short side. The increase of USDe is thus converted into actual, long-term demand for the native token by recycling that yield into ENA buybacks.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.