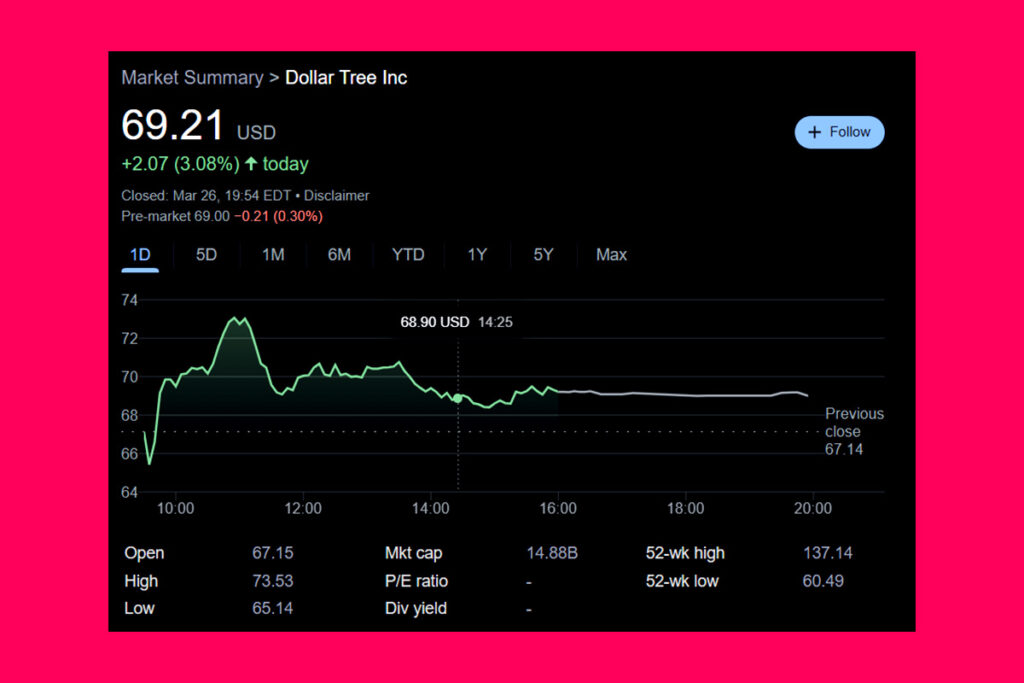

Dollar Tree Shares Surge: A Fresh Start or a Sign of Trouble for Dollar Tree?

Dollar Tree’s (DLTR) sale of the faltering Family Dollar division and the company’s mixed fourth-quarter results, which showed a stressed-out customer, are being viewed favorably by investors. After the discount retailer announced its intention to sell Family Dollar to two private equity companies, Brigade Capital Management and Macellum Capital Management, for $1 billion, Dollar Tree’s stock surged as much as 8% in early trading. After outbidding competitor Dollar General (DG) to secure the company, Dollar Tree purchased the Family Dollar name in 2015 for a whopping $9 billion.

I strongly believe selling Family Dollar and returning to our roots with an expanded assortment at Dollar Tree has created material value. 2025 is going to be a transition year as we pivot to operating Dollar Tree as a standalone entity.

CEO Michael Creedon

Dollar Tree’s Exit from Family Dollar: A Smart Move for Investors?

The company anticipates that the purchase will result in an earnings hit of about $0.30 to $0.35 per share. In general, however, Wall Street was relieved that Dollar Tree was on the verge of discontinuing Family Dollar. The discount retailer’s more than ten-year battle to include Family Dollar in its portfolio has come to a head with this most recent development.

We believe the sale is the right strategic move, as it will allow DLTR to focus on its core Dollar Tree brand, which has historically generated stronger sales, profitability, and cash flow,

CFRA analyst Arun Sundaram

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment