Dogecoin Price Teeters on Rising Wedge Support Amid Market Uncertainty

Dogecoin (DOGE) has had a turbulent week, climbing nearly 7% over the past seven days only to see those gains erased by a similar 7% drop in the last 24 hours. While the broader crypto market is cooling off, Dogecoin’s price setup suggests a more nuanced story is unfolding.

Whale Accumulation vs. Exchange Risk

Behind the scenes, whale wallets holding between 10 million and 100 million DOGE have quietly increased their holdings — from 24.20 billion DOGE on October 2 to 24.33 billion DOGE. That’s an additional 130 million DOGE, worth about $32 million at current prices. Historically, such steady buying from mid-sized whales can act as a price cushion during volatile market phases.

However, this bullish accumulation is met with caution. Data from Glassnode shows 17.7% of DOGE’s total supply is currently held on exchanges — near a multi-year high. Similar levels in the past, like in April 2024 and December 2024, were followed by significant price corrections of 55% and 65%, respectively. High exchange balances suggest a portion of holders may be preparing to sell or take profits, putting pressure on near-term price stability.

Chart Pattern Signals Possible Rebound — But With a Catch

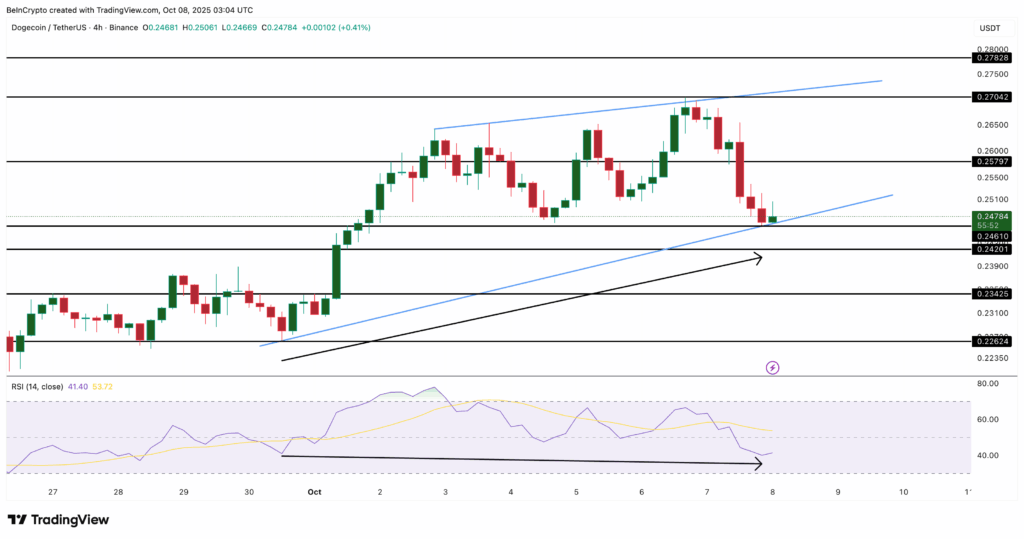

Technically, DOGE is holding above an ascending trendline within a rising wedge on the 4-hour chart. The recent bounce from $0.246 suggests buyers are defending this support. A hidden bullish divergence between price and the Relative Strength Index (RSI) between September 30 and October 7 hints that selling momentum is weakening.

If this support holds, upside targets include $0.257, $0.270, and $0.278. But a breakdown under the trendline could open the door to $0.234 or even $0.226.

For now, Dogecoin’s price action suggests a market that’s cooling — not collapsing. Whether a rebound materializes may depend on whether whale accumulation continues long enough to pull retail sentiment back in.

Comments are closed.