Crypto News – Following the recent approval of cryptocurrency ETF products within the region, Victory Securities, an investment firm based in Hong Kong, has reportedly disclosed to investors its proposed fees for Bitcoin and Ethereum ETFs.

Victory Securities ETF Fees: Hong Kong Investment Firm Reveals ETF Fees Ahead of SCF Announcement

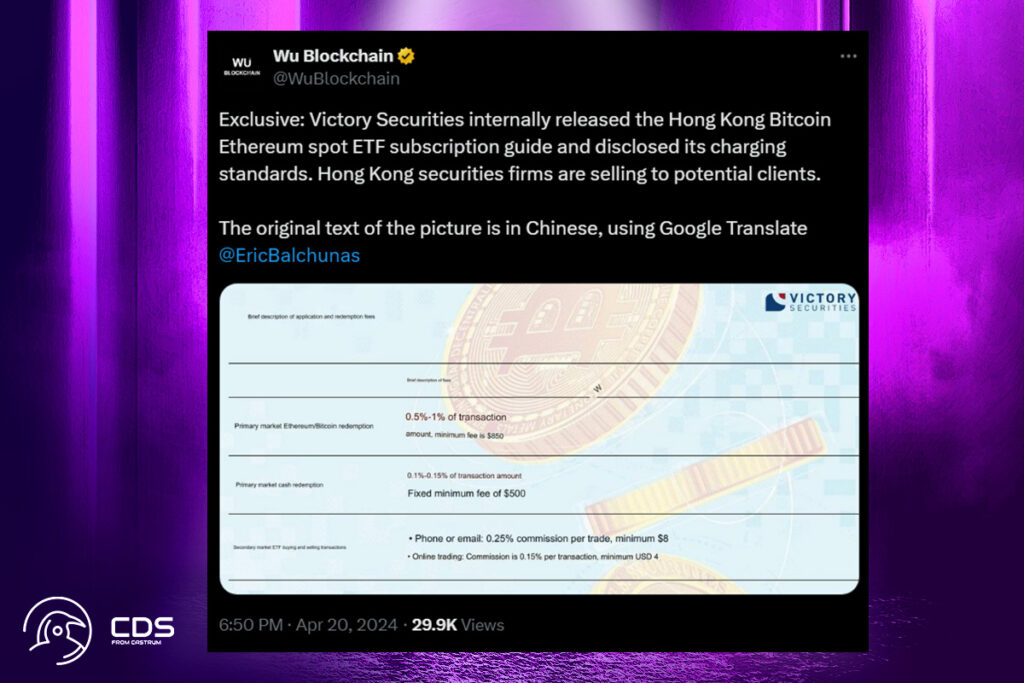

The announcement is made despite the fact that the list of authorized ETF issuers has not yet been released by the Hong Kong Securities and Futures Commission (SFC). According to an excerpt of a translated report published by Wu Blockchain on April 20, Victory Securities‘ clients would be subject to proposed fees for Ethereum and Bitcoin ETF shares in the primary market, set at 0.5% to 1% of the entire transaction, with a minimum fee of $850, if approved by SFC. Fees will be 0.15% for online transactions and 0.25% for phone transactions for investors who wish to purchase and sell existing ETF shares on the secondary market.

The fees are similar to those specified by US asset managers that provide spot Bitcoin ETFs. Franklin Templeton, an asset manager, has set its charge at 0.19%, while other ETFs range in price from 0.20% to 0.90%. On the other hand, 1.5% is a noticeably higher fee charged by the Grayscale Bitcoin Trust (GBTC).

Leave a comment