Stunning Analysis from Bernstein: Trump’s Possible Victory, US Elections and Bitcoin Price

The results of the upcoming US presidential election could have a big impact on the cryptocurrency market, especially Bitcoin, according to a recent Bernstein Research analysis. A Donald Trump win, according to the analysis, may trigger a bottom in Bitcoin values and raise the price of the most valuable cryptocurrency.

We believe the Bitcoin price would bottom, only if the crypto market catches a bid on a likely Trump win, given the crypto market continuing to interpret only a Republican win as positive for crypto policy,

the report

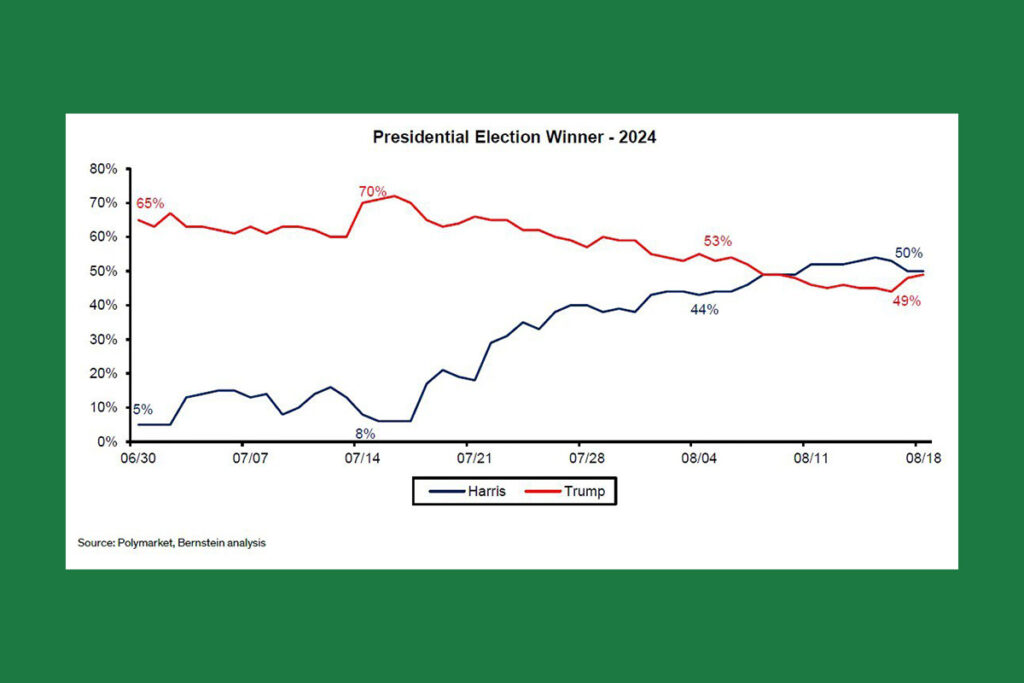

Polymarket Data in the Election Race: Harris and Trump are Head-to-Head

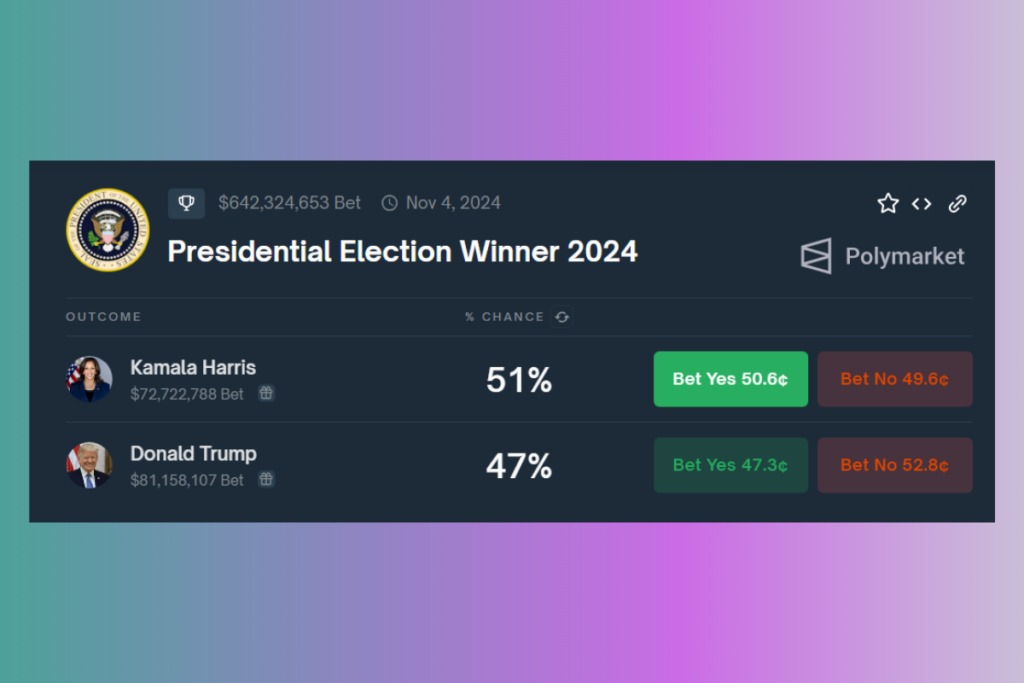

Recent data from Polymarket, the top platform for cryptocurrency prediction markets, indicates that Republican nominee Donald Trump and his anticipated Democratic opponent Kamala Harris are running closely together. Trump’s stock has increased recently as a result of bad responses to Harris’s economic remarks. On Polymarket, Harris has reclaimed the lead over Trump over the past day, with a 51% chance to 47% for Harris.

The article provides insights into the election as well as noteworthy capital-raising efforts by prominent U.S.-listed Bitcoin mining businesses. For example, part of the $300 million in convertible notes that Marathon Digital Holdings (MARA) raised went toward buying Bitcoin for its balance sheet. The company revealed last week that it had bought $249 million worth of the cryptocurrency. Public U.S. miners have an advantage in the business, according to Gautam Chhugani of Bernstein.

U.S. listed Bitcoin miners have a natural advantage vs. private unlisted miners. Whether miners pursue Bitcoin mining or AI data center growth, being able to raise debt/equity in the world’s deepest capital markets presents a natural advantage versus non-U.S. miners, particularly in a capital intensive industry, poised for market consolidation.

Chhugani

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment